Answers to HW3 - Academic Csuohio

Answers to HW3 - Academic Csuohio

Answers to HW3 - Academic Csuohio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

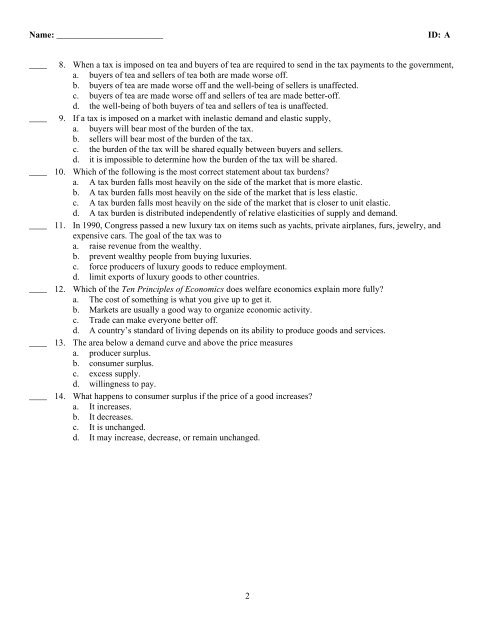

Name: ________________________ ID: A<br />

____ 8. When a tax is imposed on tea and buyers of tea are required <strong>to</strong> send in the tax payments <strong>to</strong> the government,<br />

a. buyers of tea and sellers of tea both are made worse off.<br />

b. buyers of tea are made worse off and the well-being of sellers is unaffected.<br />

c. buyers of tea are made worse off and sellers of tea are made better-off.<br />

d. the well-being of both buyers of tea and sellers of tea is unaffected.<br />

____ 9. If a tax is imposed on a market with inelastic demand and elastic supply,<br />

a. buyers will bear most of the burden of the tax.<br />

b. sellers will bear most of the burden of the tax.<br />

c. the burden of the tax will be shared equally between buyers and sellers.<br />

d. it is impossible <strong>to</strong> determine how the burden of the tax will be shared.<br />

____ 10. Which of the following is the most correct statement about tax burdens?<br />

a. A tax burden falls most heavily on the side of the market that is more elastic.<br />

b. A tax burden falls most heavily on the side of the market that is less elastic.<br />

c. A tax burden falls most heavily on the side of the market that is closer <strong>to</strong> unit elastic.<br />

d. A tax burden is distributed independently of relative elasticities of supply and demand.<br />

____ 11. In 1990, Congress passed a new luxury tax on items such as yachts, private airplanes, furs, jewelry, and<br />

expensive cars. The goal of the tax was <strong>to</strong><br />

a. raise revenue from the wealthy.<br />

b. prevent wealthy people from buying luxuries.<br />

c. force producers of luxury goods <strong>to</strong> reduce employment.<br />

d. limit exports of luxury goods <strong>to</strong> other countries.<br />

____ 12. Which of the Ten Principles of Economics does welfare economics explain more fully?<br />

a. The cost of something is what you give up <strong>to</strong> get it.<br />

b. Markets are usually a good way <strong>to</strong> organize economic activity.<br />

c. Trade can make everyone better off.<br />

d. A country’s standard of living depends on its ability <strong>to</strong> produce goods and services.<br />

____ 13. The area below a demand curve and above the price measures<br />

a. producer surplus.<br />

b. consumer surplus.<br />

c. excess supply.<br />

d. willingness <strong>to</strong> pay.<br />

____ 14. What happens <strong>to</strong> consumer surplus if the price of a good increases?<br />

a. It increases.<br />

b. It decreases.<br />

c. It is unchanged.<br />

d. It may increase, decrease, or remain unchanged.<br />

2