Answers to HW3 - Academic Csuohio

Answers to HW3 - Academic Csuohio

Answers to HW3 - Academic Csuohio

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Name: ________________________ ID: A<br />

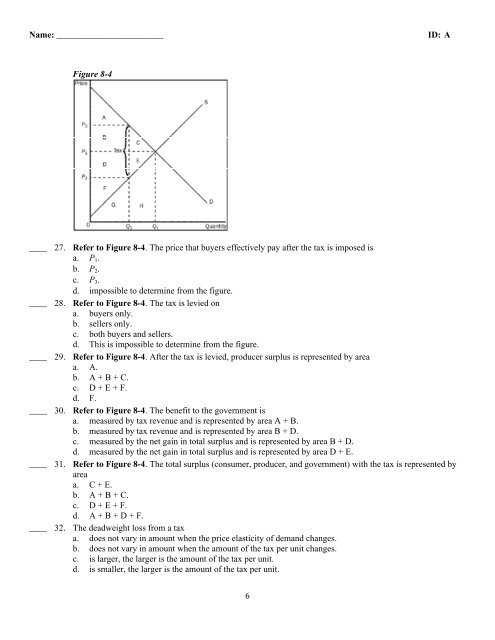

Figure 8-4<br />

____ 27. Refer <strong>to</strong> Figure 8-4. The price that buyers effectively pay after the tax is imposed is<br />

a. P1.<br />

b. P2.<br />

c. P3.<br />

d. impossible <strong>to</strong> determine from the figure.<br />

____ 28. Refer <strong>to</strong> Figure 8-4. The tax is levied on<br />

a. buyers only.<br />

b. sellers only.<br />

c. both buyers and sellers.<br />

d. This is impossible <strong>to</strong> determine from the figure.<br />

____ 29. Refer <strong>to</strong> Figure 8-4. After the tax is levied, producer surplus is represented by area<br />

a. A.<br />

b. A + B + C.<br />

c. D + E + F.<br />

d. F.<br />

____ 30. Refer <strong>to</strong> Figure 8-4. The benefit <strong>to</strong> the government is<br />

a. measured by tax revenue and is represented by area A + B.<br />

b. measured by tax revenue and is represented by area B + D.<br />

c. measured by the net gain in <strong>to</strong>tal surplus and is represented by area B + D.<br />

d. measured by the net gain in <strong>to</strong>tal surplus and is represented by area D + E.<br />

____ 31. Refer <strong>to</strong> Figure 8-4. The <strong>to</strong>tal surplus (consumer, producer, and government) with the tax is represented by<br />

area<br />

a. C + E.<br />

b. A + B + C.<br />

c. D + E + F.<br />

d. A + B + D + F.<br />

____ 32. The deadweight loss from a tax<br />

a. does not vary in amount when the price elasticity of demand changes.<br />

b. does not vary in amount when the amount of the tax per unit changes.<br />

c. is larger, the larger is the amount of the tax per unit.<br />

d. is smaller, the larger is the amount of the tax per unit.<br />

6