Answers to HW3 - Academic Csuohio

Answers to HW3 - Academic Csuohio

Answers to HW3 - Academic Csuohio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

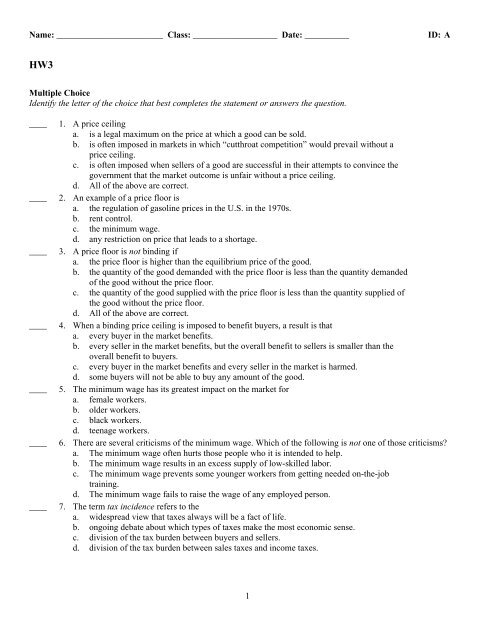

Name: ________________________ Class: ___________________ Date: __________ ID: A<br />

<strong>HW3</strong><br />

Multiple Choice<br />

Identify the letter of the choice that best completes the statement or answers the question.<br />

____ 1. A price ceiling<br />

a. is a legal maximum on the price at which a good can be sold.<br />

b. is often imposed in markets in which “cutthroat competition” would prevail without a<br />

price ceiling.<br />

c. is often imposed when sellers of a good are successful in their attempts <strong>to</strong> convince the<br />

government that the market outcome is unfair without a price ceiling.<br />

d. All of the above are correct.<br />

____ 2. An example of a price floor is<br />

a. the regulation of gasoline prices in the U.S. in the 1970s.<br />

b. rent control.<br />

c. the minimum wage.<br />

d. any restriction on price that leads <strong>to</strong> a shortage.<br />

____ 3. A price floor is not binding if<br />

a. the price floor is higher than the equilibrium price of the good.<br />

b. the quantity of the good demanded with the price floor is less than the quantity demanded<br />

of the good without the price floor.<br />

c. the quantity of the good supplied with the price floor is less than the quantity supplied of<br />

the good without the price floor.<br />

d. All of the above are correct.<br />

____ 4. When a binding price ceiling is imposed <strong>to</strong> benefit buyers, a result is that<br />

a. every buyer in the market benefits.<br />

b. every seller in the market benefits, but the overall benefit <strong>to</strong> sellers is smaller than the<br />

overall benefit <strong>to</strong> buyers.<br />

c. every buyer in the market benefits and every seller in the market is harmed.<br />

d. some buyers will not be able <strong>to</strong> buy any amount of the good.<br />

____ 5. The minimum wage has its greatest impact on the market for<br />

a. female workers.<br />

b. older workers.<br />

c. black workers.<br />

d. teenage workers.<br />

____ 6. There are several criticisms of the minimum wage. Which of the following is not one of those criticisms?<br />

a. The minimum wage often hurts those people who it is intended <strong>to</strong> help.<br />

b. The minimum wage results in an excess supply of low-skilled labor.<br />

c. The minimum wage prevents some younger workers from getting needed on-the-job<br />

training.<br />

d. The minimum wage fails <strong>to</strong> raise the wage of any employed person.<br />

____ 7. The term tax incidence refers <strong>to</strong> the<br />

a. widespread view that taxes always will be a fact of life.<br />

b. ongoing debate about which types of taxes make the most economic sense.<br />

c. division of the tax burden between buyers and sellers.<br />

d. division of the tax burden between sales taxes and income taxes.<br />

1

Name: ________________________ ID: A<br />

____ 8. When a tax is imposed on tea and buyers of tea are required <strong>to</strong> send in the tax payments <strong>to</strong> the government,<br />

a. buyers of tea and sellers of tea both are made worse off.<br />

b. buyers of tea are made worse off and the well-being of sellers is unaffected.<br />

c. buyers of tea are made worse off and sellers of tea are made better-off.<br />

d. the well-being of both buyers of tea and sellers of tea is unaffected.<br />

____ 9. If a tax is imposed on a market with inelastic demand and elastic supply,<br />

a. buyers will bear most of the burden of the tax.<br />

b. sellers will bear most of the burden of the tax.<br />

c. the burden of the tax will be shared equally between buyers and sellers.<br />

d. it is impossible <strong>to</strong> determine how the burden of the tax will be shared.<br />

____ 10. Which of the following is the most correct statement about tax burdens?<br />

a. A tax burden falls most heavily on the side of the market that is more elastic.<br />

b. A tax burden falls most heavily on the side of the market that is less elastic.<br />

c. A tax burden falls most heavily on the side of the market that is closer <strong>to</strong> unit elastic.<br />

d. A tax burden is distributed independently of relative elasticities of supply and demand.<br />

____ 11. In 1990, Congress passed a new luxury tax on items such as yachts, private airplanes, furs, jewelry, and<br />

expensive cars. The goal of the tax was <strong>to</strong><br />

a. raise revenue from the wealthy.<br />

b. prevent wealthy people from buying luxuries.<br />

c. force producers of luxury goods <strong>to</strong> reduce employment.<br />

d. limit exports of luxury goods <strong>to</strong> other countries.<br />

____ 12. Which of the Ten Principles of Economics does welfare economics explain more fully?<br />

a. The cost of something is what you give up <strong>to</strong> get it.<br />

b. Markets are usually a good way <strong>to</strong> organize economic activity.<br />

c. Trade can make everyone better off.<br />

d. A country’s standard of living depends on its ability <strong>to</strong> produce goods and services.<br />

____ 13. The area below a demand curve and above the price measures<br />

a. producer surplus.<br />

b. consumer surplus.<br />

c. excess supply.<br />

d. willingness <strong>to</strong> pay.<br />

____ 14. What happens <strong>to</strong> consumer surplus if the price of a good increases?<br />

a. It increases.<br />

b. It decreases.<br />

c. It is unchanged.<br />

d. It may increase, decrease, or remain unchanged.<br />

2

Name: ________________________ ID: A<br />

Figure 7-1<br />

____ 15. Refer <strong>to</strong> Figure 7-1. When the price is P2, consumer surplus is<br />

a. A.<br />

b. B.<br />

c. A + B.<br />

d. A + B + C.<br />

____ 16. Refer <strong>to</strong> Figure 7-1. When the price rises from P1 <strong>to</strong> P2, consumer surplus<br />

a. increases by an amount equal <strong>to</strong> A.<br />

b. decreases by an amount equal <strong>to</strong> B + C.<br />

c. increases by an amount equal <strong>to</strong> B + C.<br />

d. decreases by an amount equal <strong>to</strong> C.<br />

____ 17. Refer <strong>to</strong> Figure 7-1. Area C represents<br />

a. the decrease in consumer surplus that results from a downward-sloping demand curve.<br />

b. consumer surplus <strong>to</strong> new consumers who enter the market when the price falls from P2 <strong>to</strong><br />

P1.<br />

c. the increase in producer surplus when quantity sold increases from Q2 <strong>to</strong> Q1.<br />

d. the decrease in consumer surplus <strong>to</strong> each consumer in the market when the price<br />

increases from P1 <strong>to</strong> P2.<br />

3

Name: ________________________ ID: A<br />

Figure 7-9<br />

____ 18. Refer <strong>to</strong> Figure 7-9. At the equilibrium price, consumer surplus is<br />

a. $480.<br />

b. $640.<br />

c. $1,120.<br />

d. $1,280.<br />

____ 19. Refer <strong>to</strong> Figure 7-9. At the equilibrium price, producer surplus is<br />

a. $480.<br />

b. $640.<br />

c. $1,120.<br />

d. $1,280.<br />

____ 20. Refer <strong>to</strong> Figure 7-9. At the equilibrium price, <strong>to</strong>tal surplus is<br />

a. $480.<br />

b. $640.<br />

c. $1,120.<br />

d. $1,280.<br />

____ 21. Refer <strong>to</strong> Figure 7-9. Assume demand increases and as a result, equilibrium price increases <strong>to</strong> $22 and<br />

equilibrium quantity increases <strong>to</strong> 110. The increase in producer surplus due <strong>to</strong> new producers entering the<br />

market would be equal <strong>to</strong><br />

a. $90.<br />

b. $210.<br />

c. $360.<br />

d. $480.<br />

4

Name: ________________________ ID: A<br />

____ 22. The distinction between efficiency and equity can be described as follows:<br />

a. Efficiency refers <strong>to</strong> maximizing the number of trades among buyers and sellers; equity<br />

refers <strong>to</strong> maximizing the gains from trade among buyers and sellers.<br />

b. Efficiency refers <strong>to</strong> minimizing the price paid by buyers; equity refers <strong>to</strong> maximizing the<br />

gains from trade among buyers and sellers.<br />

c. Efficiency refers <strong>to</strong> maximizing the size of the pie; equity refers <strong>to</strong> producing a pie of a<br />

given size at the least possible cost.<br />

d. Efficiency refers <strong>to</strong> maximizing the size of the pie; equity refers <strong>to</strong> distributing the pie<br />

fairly among members of society.<br />

____ 23. If an allocation of resources is efficient, then<br />

a. consumer surplus is maximized.<br />

b. producer surplus is maximized.<br />

c. all potential gains from trade among buyers are sellers are being realized.<br />

d. the allocation is necessarily equitable as well.<br />

____ 24. At present, the maximum legal price for a human kidney is $0. The price of $0 maximizes<br />

a. consumer surplus, but not producer surplus.<br />

b. producer surplus, but not consumer surplus.<br />

c. both consumer and producer surplus.<br />

d. neither consumer nor producer surplus.<br />

____ 25. Inefficiency can be caused in a market by the presence of<br />

a. market power.<br />

b. externalities.<br />

c. imperfectly competitive markets.<br />

d. All of the above are correct.<br />

____ 26. Suppose the equilibrium quantity in the market for widgets is 200 per month when there is no tax. Then a tax<br />

of $5 per widget is imposed. As a result, the government is able <strong>to</strong> raise $750 per month in tax revenue. We<br />

can conclude that the equilibrium quantity of widgets has fallen by<br />

a. 25 per month.<br />

b. 50 per month.<br />

c. 75 per month.<br />

d. 100 per month.<br />

5

Name: ________________________ ID: A<br />

Figure 8-4<br />

____ 27. Refer <strong>to</strong> Figure 8-4. The price that buyers effectively pay after the tax is imposed is<br />

a. P1.<br />

b. P2.<br />

c. P3.<br />

d. impossible <strong>to</strong> determine from the figure.<br />

____ 28. Refer <strong>to</strong> Figure 8-4. The tax is levied on<br />

a. buyers only.<br />

b. sellers only.<br />

c. both buyers and sellers.<br />

d. This is impossible <strong>to</strong> determine from the figure.<br />

____ 29. Refer <strong>to</strong> Figure 8-4. After the tax is levied, producer surplus is represented by area<br />

a. A.<br />

b. A + B + C.<br />

c. D + E + F.<br />

d. F.<br />

____ 30. Refer <strong>to</strong> Figure 8-4. The benefit <strong>to</strong> the government is<br />

a. measured by tax revenue and is represented by area A + B.<br />

b. measured by tax revenue and is represented by area B + D.<br />

c. measured by the net gain in <strong>to</strong>tal surplus and is represented by area B + D.<br />

d. measured by the net gain in <strong>to</strong>tal surplus and is represented by area D + E.<br />

____ 31. Refer <strong>to</strong> Figure 8-4. The <strong>to</strong>tal surplus (consumer, producer, and government) with the tax is represented by<br />

area<br />

a. C + E.<br />

b. A + B + C.<br />

c. D + E + F.<br />

d. A + B + D + F.<br />

____ 32. The deadweight loss from a tax<br />

a. does not vary in amount when the price elasticity of demand changes.<br />

b. does not vary in amount when the amount of the tax per unit changes.<br />

c. is larger, the larger is the amount of the tax per unit.<br />

d. is smaller, the larger is the amount of the tax per unit.<br />

6

Name: ________________________ ID: A<br />

____ 33. The Laffer curve relates<br />

a. the tax rate <strong>to</strong> tax revenue raised by the tax.<br />

b. the tax rate <strong>to</strong> the deadweight loss of the tax.<br />

c. the price elasticity of supply <strong>to</strong> the deadweight loss of the tax.<br />

d. government welfare payments <strong>to</strong> the birth rate.<br />

____ 34. The view held by Arthur Laffer and Ronald Reagan -- that cuts in tax rates would encourage people <strong>to</strong><br />

increase the quantity of labor they supplied -- became known as<br />

a. California economics.<br />

b. welfare economics.<br />

c. supply-side economics.<br />

d. elasticity economics.<br />

____ 35. Which of the following scenarios is not consistent with the Laffer curve?<br />

a. The tax rate is very low and tax revenue is very low.<br />

b. The tax rate is very high and tax revenue is very low.<br />

c. The tax rate is very high and tax revenue is very high.<br />

d. The tax rate is moderate (between very high and very low) and tax revenue is relatively<br />

high.<br />

____ 36. The higher a country's tax rates, the more likely that country will be<br />

a. at the <strong>to</strong>p of the Laffer curve.<br />

b. on the positively sloped part of the Laffer curve.<br />

c. on the negatively sloped part of the Laffer curve.<br />

d. experiencing small deadweight losses.<br />

____ 37. With which of the Ten Principles of Economics is the study of international trade most closely connected?<br />

a. People face tradeoffs.<br />

b. Trade can make everyone better off.<br />

c. Governments can sometimes improve market outcomes.<br />

d. Prices rise when the government prints <strong>to</strong>o much money.<br />

7

Name: ________________________ ID: A<br />

Figure 9-1<br />

____ 38. Refer <strong>to</strong> Figure 9-1. Without trade, consumer surplus is<br />

a. $210.<br />

b. $245.<br />

c. $455.<br />

d. $490.<br />

____ 39. Refer <strong>to</strong> Figure 9-1. With free trade, this country will<br />

a. import 40 baskets.<br />

b. import 70 baskets.<br />

c. export 35 baskets.<br />

d. export 65 baskets.<br />

____ 40. Refer <strong>to</strong> Figure 9-1. With free trade, consumer surplus is<br />

a. $45.<br />

b. $80.<br />

c. $210.<br />

d. $245.<br />

____ 41. Refer <strong>to</strong> Figure 9-1. With free trade, producer surplus is<br />

a. $80.00.<br />

b. $210.00.<br />

c. $245.50.<br />

d. $472.50.<br />

____ 42. Refer <strong>to</strong> Figure 9-1. As a result of trade, <strong>to</strong>tal surplus increases by<br />

a. $80.<br />

b. $97.50.<br />

c. $162.50.<br />

d. $495.50.<br />

8

Name: ________________________ ID: A<br />

Figure 9-5<br />

____ 43. Refer <strong>to</strong> Figure 9-5. Without trade, the equilibrium price of carnations is<br />

a. $8 and the equilibrium quantity is 300.<br />

b. $6 and the equilibrium quantity is 200.<br />

c. $6 and the equilibrium quantity is 400.<br />

d. $4 and the equilibrium quantity is 500.<br />

____ 44. Refer <strong>to</strong> Figure 9-5. With trade and without a tariff,<br />

a. the domestic price is equal <strong>to</strong> the world price.<br />

b. carnations are sold at $8 in this market.<br />

c. there is a shortage of 400 carnations in this market.<br />

d. this country imports 200 carnations.<br />

____ 45. Refer <strong>to</strong> Figure 9-5. The size of the tariff on carnations is<br />

a. $8 per dozen.<br />

b. $6 per dozen.<br />

c. $4 per dozen.<br />

d. $2 per dozen.<br />

____ 46. Refer <strong>to</strong> Figure 9-5. The imposition of a tariff on carnations<br />

a. increases the number of carnations imported by 100.<br />

b. increases the number of carnations imported by 200.<br />

c. decreases the number of carnations imported by 200.<br />

d. decreases the number of carnations imported by 400.<br />

____ 47. Refer <strong>to</strong> Figure 9-5. The amount of revenue collected by the government from the tariff is<br />

a. $200.<br />

b. $400.<br />

c. $500.<br />

d. $600.<br />

9

Name: ________________________ ID: A<br />

____ 48. Refer <strong>to</strong> Figure 9-5. When a tariff is imposed in the market, domestic producers<br />

a. gain by $100.<br />

b. gain by $200.<br />

c. gain by $300.<br />

d. lose by $100.<br />

____ 49. Refer <strong>to</strong> Figure 9-5. The amount of deadweight loss caused by the tariff equals<br />

a. $100.<br />

b. $200.<br />

c. $400.<br />

d. $500.<br />

____ 50. Refer <strong>to</strong> Figure 9-5. When the tariff is imposed, domestic consumers<br />

a. lose by $500.<br />

b. lose by $900.<br />

c. gain by $500.<br />

d. gain by $900.<br />

10

<strong>HW3</strong><br />

Answer Section<br />

MULTIPLE CHOICE<br />

1<br />

ID: A<br />

1. ANS: A DIF: 2 REF: 6-1 TOP: Price ceilings<br />

MSC: Interpretive<br />

2. ANS: C DIF: 1 REF: 6-1 TOP: Price ceilings, Price floors<br />

MSC: Definitional<br />

3. ANS: C DIF: 3 REF: 6-1<br />

TOP: Price floors, Quantity demanded, Quantity supplied MSC: Analytical<br />

4. ANS: D DIF: 2 REF: 6-1 TOP: Price ceilings<br />

MSC: Interpretive<br />

5. ANS: D DIF: 1 REF: 6-1 TOP: Minimum wage, Labor force<br />

MSC: Interpretive<br />

6. ANS: D DIF: 2 REF: 6-1 TOP: Minimum wage<br />

MSC: Interpretive<br />

7. ANS: C DIF: 1 REF: 6-2 TOP: Tax incidence<br />

MSC: Definitional<br />

8. ANS: A DIF: 2 REF: 6-2 TOP: Tax incidence<br />

MSC: Interpretive<br />

9. ANS: A DIF: 3 REF: 6-2<br />

TOP: Inelastic demand, Elastic supply, Tax incidence MSC: Applicative<br />

10. ANS: B DIF: 2 REF: 6-2 TOP: Elasticity, Tax incidence<br />

MSC: Applicative<br />

11. ANS: A DIF: 1 REF: 6-2 TOP: Luxury tax<br />

MSC: Definitional<br />

12. ANS: B DIF: 2 REF: 7-0 TOP: Economic welfare<br />

MSC: Interpretive<br />

13. ANS: B DIF: 1 REF: 7-1 TOP: Consumer surplus, Demand curve<br />

MSC: Interpretive<br />

14. ANS: B DIF: 2 REF: 7-1 TOP: Consumer surplus<br />

MSC: Interpretive<br />

15. ANS: A DIF: 2 REF: 7-1 TOP: Consumer surplus<br />

MSC: Interpretive<br />

16. ANS: B DIF: 2 REF: 7-1 TOP: Consumer surplus<br />

MSC: Interpretive<br />

17. ANS: B DIF: 3 REF: 7-1 TOP: Consumer surplus<br />

MSC: Applicative<br />

18. ANS: A DIF: 3 REF: 7-3 TOP: Consumer surplus<br />

MSC: Applicative<br />

19. ANS: B DIF: 3 REF: 7-3 TOP: Producer surplus<br />

MSC: Applicative<br />

20. ANS: C DIF: 3 REF: 7-3 TOP: Total surplus<br />

MSC: Applicative<br />

21. ANS: A DIF: 3 REF: 7-3 TOP: Producer surplus<br />

MSC: Applicative

22. ANS: D DIF: 2 REF: 7-3<br />

TOP: Efficiency, Equity, Gains from trade MSC: Interpretive<br />

23. ANS: C DIF: 2 REF: 7-3 TOP: Efficiency<br />

MSC: Interpretive<br />

24. ANS: D DIF: 2 REF: 7-3<br />

TOP: Price ceilings, Consumer surplus, Producer surplus MSC: Applicative<br />

25. ANS: D DIF: 2 REF: 7-4 TOP: Market failures<br />

MSC: Interpretive<br />

26. ANS: B DIF: 3 REF: 8-1 TOP: Tax, Quantity demanded<br />

MSC: Applicative<br />

27. ANS: C DIF: 2 REF: 8-1 TOP: Tax, Equilibrium price<br />

MSC: Applicative<br />

28. ANS: D DIF: 2 REF: 8-1 TOP: Tax<br />

MSC: Interpretive<br />

29. ANS: D DIF: 2 REF: 8-1 TOP: Tax, Producer surplus<br />

MSC: Applicative<br />

30. ANS: B DIF: 2 REF: 8-1 TOP: Tax, Government<br />

MSC: Applicative<br />

31. ANS: D DIF: 2 REF: 8-1 TOP: Total surplus<br />

MSC: Applicative<br />

32. ANS: C DIF: 2 REF: 8-2 TOP: Deadweight losses<br />

MSC: Interpretive<br />

33. ANS: A DIF: 2 REF: 8-3 TOP: Laffer curve<br />

MSC: Definitional<br />

34. ANS: C DIF: 1 REF: 8-3 TOP: Supply-side economics<br />

MSC: Definitional<br />

35. ANS: C DIF: 2 REF: 8-3 TOP: Laffer curve<br />

MSC: Interpretive<br />

36. ANS: C DIF: 2 REF: 8-3 TOP: Laffer curve<br />

MSC: Interpretive<br />

37. ANS: B DIF: 1 REF: 9-0 TOP: International trade<br />

MSC: Interpretive<br />

38. ANS: B DIF: 2 REF: 9-2 TOP: Consumer surplus<br />

MSC: Applicative<br />

39. ANS: D DIF: 2 REF: 9-2 TOP: Exports<br />

MSC: Applicative<br />

40. ANS: B DIF: 2 REF: 9-2 TOP: Trade, Consumer surplus<br />

MSC: Applicative<br />

41. ANS: D DIF: 2 REF: 9-2 TOP: Trade, Producer surplus<br />

MSC: Applicative<br />

42. ANS: B DIF: 3 REF: 9-2 TOP: Trade, Total surplus<br />

MSC: Applicative<br />

43. ANS: A DIF: 1 REF: 9-2<br />

TOP: Equilibrium price, Equilibrium quantity MSC: Interpretive<br />

44. ANS: A DIF: 2 REF: 9-2 TOP: Trade, Prices<br />

MSC: Interpretive<br />

45. ANS: D DIF: 1 REF: 9-2 TOP: Tariffs<br />

MSC: Interpretive<br />

2<br />

ID: A

46. ANS: C DIF: 2 REF: 9-2 TOP: Tariffs, Imports<br />

MSC: Applicative<br />

47. ANS: B DIF: 2 REF: 9-2 TOP: Tariffs, Government<br />

MSC: Applicative<br />

48. ANS: C DIF: 2 REF: 9-2 TOP: Tariffs, Producer surplus<br />

MSC: Applicative<br />

49. ANS: B DIF: 3 REF: 9-2 TOP: Tariffs, Deadweight losses<br />

MSC: Applicative<br />

50. ANS: B DIF: 2 REF: 9-2 TOP: Tariffs, Consumer surplus<br />

MSC: Applicative<br />

3<br />

ID: A

<strong>HW3</strong> [Answer Strip]<br />

_____ A 1.<br />

_____ C 2.<br />

_____ C 3.<br />

_____ D 4.<br />

_____ D 5.<br />

_____ D 6.<br />

_____ C 7.<br />

_____ A 8.<br />

_____ A 9.<br />

_____ B 10.<br />

_____ A 11.<br />

_____ B 12.<br />

_____ B 13.<br />

_____ B 14.<br />

_____ A 15.<br />

_____ B 16.<br />

_____ B 17.<br />

_____ A 18.<br />

_____ B 19.<br />

_____ C 20.<br />

_____ A 21.<br />

_____ D 22.<br />

_____ C 23.<br />

_____ D 24.<br />

_____ D 25.<br />

_____ B<br />

26.<br />

ID: A

<strong>HW3</strong> [Answer Strip]<br />

_____ C 27.<br />

_____ D 28.<br />

_____ D 29.<br />

_____ B 30.<br />

_____ D 31.<br />

_____ C 32.<br />

_____ A 33.<br />

_____ C 34.<br />

_____ C 35.<br />

_____ C 36.<br />

_____ B 37.<br />

_____ B 38.<br />

_____ D 39.<br />

_____ B 40.<br />

_____ D 41.<br />

_____ B 42.<br />

_____ A 43.<br />

_____ A 44.<br />

_____ D 45.<br />

_____ C 46.<br />

_____ B 47.<br />

_____ C 48.<br />

_____ B 49.<br />

_____ B<br />

50.<br />

ID: A

Name: ________________________ Class: ___________________ Date: __________<br />

MULTIPLE CHOICE<br />

1. A B C D E<br />

2. A B C D E<br />

3. A B C D E<br />

4. A B C D E<br />

5. A B C D E<br />

6. A B C D E<br />

7. A B C D E<br />

8. A B C D E<br />

9. A B C D E<br />

10. A B C D E<br />

11. A B C D E<br />

12. A B C D E<br />

13. A B C D E<br />

14. A B C D E<br />

15. A B C D E<br />

16. A B C D E<br />

17. A B C D E<br />

18. A B C D E<br />

19. A B C D E<br />

20. A B C D E<br />

21. A B C D E<br />

22. A B C D E<br />

23. A B C D E<br />

24. A B C D E<br />

25. A B C D E<br />

26. A B C D E<br />

27. A B C D E<br />

28. A B C D E<br />

29. A B C D E<br />

30. A B C D E<br />

31. A B C D E<br />

32. A B C D E<br />

33. A B C D E<br />

34. A B C D E<br />

35. A B C D E<br />

36. A B C D E<br />

37. A B C D E<br />

38. A B C D E<br />

39. A B C D E<br />

40. A B C D E<br />

41. A B C D E<br />

42. A B C D E<br />

43. A B C D E<br />

44. A B C D E<br />

45. A B C D E<br />

46. A B C D E<br />

47. A B C D E<br />

48. A B C D E<br />

49. A B C D E<br />

50. A B C D E<br />

1<br />

ID: A