MITRAJAYA HOLDINGS BERHAD - Announcements

MITRAJAYA HOLDINGS BERHAD - Announcements

MITRAJAYA HOLDINGS BERHAD - Announcements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Independent Advice Letter to the Shareholders<br />

of Mitrajaya Holdings Berhad<br />

1.3 The purpose of this Independent Advice Letter (“IAL”) is to provide the<br />

shareholders of MHB with an independent evaluation, from the financial point of<br />

view, of the terms and conditions of the Proposed Acquisitions, and HMP’s<br />

recommendation thereon.<br />

2. DETAILS OF THE PROPOSED ACQUISITIONS<br />

2.1 Details of the Proposed GPIL Acquisition<br />

Samitra is a property development company incorporated in South Africa with an<br />

authorised share capital of Rand1,010 comprising 1,000 ordinary shares of<br />

Rand1.00 each and 1,000 redeemable preference shares of Rand0.01 each, all of<br />

which have been issued and fully paid.<br />

The purchase consideration Rand30,000,000 has been arrived at on a willing<br />

buyer-willing seller basis after taking into consideration the potential earnings of<br />

Samitra. Upon execution of the Memorandum of Agreement, GPIL has paid<br />

Samrand Rand1,000,000 and another Rand1,800,000 on 31 January 2001. On the<br />

date of execution of the Comprehensive Agreement, GPIL has paid to Samitra an<br />

amount of Rand4,400,000 as partial discharge of the amount owing by Samrand to<br />

Samitra. This amount will be set-off against the balance of the purchase<br />

consideration. The balance of Rand22,800,000 will be paid on completion.<br />

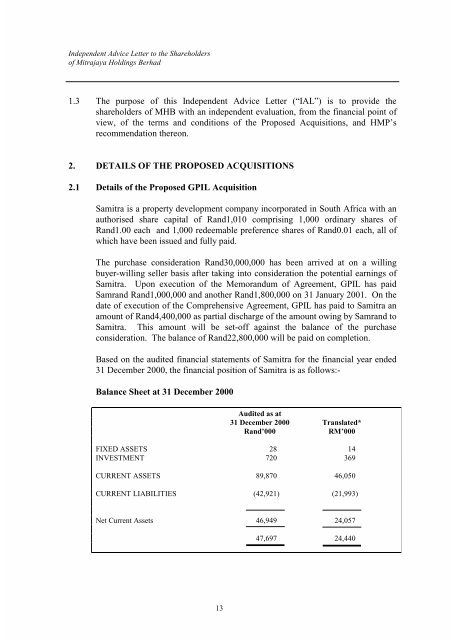

Based on the audited financial statements of Samitra for the financial year ended<br />

31 December 2000, the financial position of Samitra is as follows:-<br />

Balance Sheet at 31 December 2000<br />

13<br />

Audited as at<br />

31 December 2000 Translated*<br />

Rand’000 RM’000<br />

FIXED ASSETS 28 14<br />

INVESTMENT 720 369<br />

CURRENT ASSETS 89,870 46,050<br />

CURRENT LIABILITIES (42,921) (21,993)<br />

Net Current Assets 46,949 24,057<br />

47,697 24,440