Drucken GB - MME moviement

Drucken GB - MME moviement

Drucken GB - MME moviement

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

corporation tax for 2004 in the amount of 25%, the solidarity surcharge of 5.5% -<br />

taken on the corporation tax to be paid - and an average trade earnings tax rate of<br />

19.4%. In comparison with the previous year there were various trade tax rates that<br />

affected the 2004 financial year.<br />

The corporation tax is the income-dependent tax for legal entities. The amount of<br />

corporation tax is determined by the income of the company, taking into account any<br />

deductions and additions. Trade earnings tax can be deducted from the basis of<br />

assessment for corporation tax (income tax).<br />

The trade earnings tax is levied on the taxable income of a company with the deduction<br />

of income not subject to trade earnings tax and the addition of expenses not<br />

deductible for the purpose of trade earnings tax.The effective trade earnings tax rate<br />

depends on which municipality the company maintains a site for exercise of its trade<br />

operations.<br />

As per IAS 12, the tax rate existing on the date that the statement of our company<br />

was prepared is applied in the computation of deferred taxes according to the "liability<br />

method", reflecting the temporary differences between taxable values and book<br />

values of assets and debt in accordance with IFRS as well as its value as used for income<br />

tax purposes and taxable losses carried forward, if a positive earnings forecast<br />

was in place.<br />

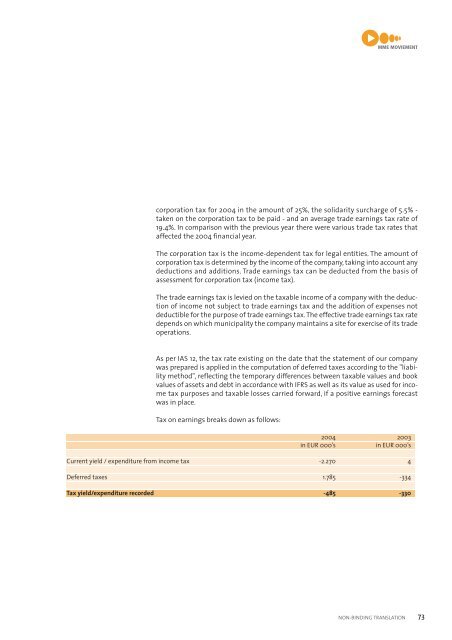

Tax on earnings breaks down as follows:<br />

2004 2003<br />

in EUR 000’s in EUR 000’s<br />

Current yield / expenditure from income tax -2.270 4<br />

Deferred taxes 1.785 -334<br />

Tax yield/expenditure recorded -485 -330<br />

NON-BINDING TRANSLATION<br />

73