Apata Limited and Group

Apata Limited and Group

Apata Limited and Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the financial statements (year ended 31 March 2008)<br />

apata (annual report 2007/08)<br />

38<br />

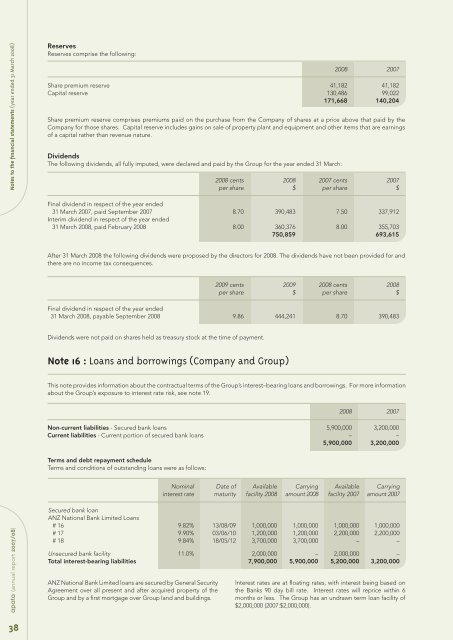

Reserves<br />

Reserves comprise the following:<br />

Dividends<br />

The following dividends, all fully imputed, were declared <strong>and</strong> paid by the <strong>Group</strong> for the year ended 31 March:<br />

After 31 March 2008 the following dividends were proposed by the directors for 2008. The dividends have not been provided for <strong>and</strong><br />

there are no income tax consequences.<br />

Dividends were not paid on shares held as treasury stock at the time of payment.<br />

Note 16 : Loans <strong>and</strong> borrowings (Company <strong>and</strong> <strong>Group</strong>)<br />

This note provides information about the contractual terms of the <strong>Group</strong>’s interest–bearing loans <strong>and</strong> borrowings. For more information<br />

about the <strong>Group</strong>’s exposure to interest rate risk, see note 19.<br />

Terms <strong>and</strong> debt repayment schedule<br />

Terms <strong>and</strong> conditions of outst<strong>and</strong>ing loans were as follows:<br />

ANZ National Bank <strong>Limited</strong> loans are secured by General Security<br />

Agreement over all present <strong>and</strong> after acquired property of the<br />

<strong>Group</strong> <strong>and</strong> by a first mortgage over <strong>Group</strong> l<strong>and</strong> <strong>and</strong> buildings.<br />

2008 2007<br />

Share premium reserve 41,182 41,182<br />

Capital reserve 130,486 99,022<br />

171,668 140,204<br />

Share premium reserve comprises premiums paid on the purchase from the Company of shares at a price above that paid by the<br />

Company for those shares. Capital reserve includes gains on sale of property plant <strong>and</strong> equipment <strong>and</strong> other items that are earnings<br />

of a capital rather than revenue nature.<br />

2008 cents 2008 2007 cents 2007<br />

per share $ per share $<br />

Final dividend in respect of the year ended<br />

31 March 2007, paid September 2007 8.70 390,483 7.50 337,912<br />

Interim dividend in respect of the year ended<br />

31 March 2008, paid February 2008 8.00 360,376 8.00 355,703<br />

750,859 693,615<br />

2009 cents 2009 2008 cents 2008<br />

per share $ per share $<br />

Final dividend in respect of the year ended<br />

31 March 2008, payable September 2008 9.86 444,241 8.70 390,483<br />

2008 2007<br />

Non-current liabilities - Secured bank loans 5,900,000 3,200,000<br />

Current liabilities - Current portion of secured bank loans – –<br />

5,900,000 3,200,000<br />

Nominal Date of Available Carrying Available Carrying<br />

interest rate maturity facility 2008 amount 2008 facility 2007 amount 2007<br />

Secured bank loan<br />

ANZ National Bank <strong>Limited</strong> Loans<br />

# 16 9.82% 13/08/09 1,000,000 1,000,000 1,000,000 1,000,000<br />

# 17 9.90% 03/06/10 1,200,000 1,200,000 2,200,000 2,200,000<br />

# 18 9.84% 18/05/12 3,700,000 3,700,000 – –<br />

Unsecured bank facility 11.0% 2,000,000 – 2,000,000 –<br />

Total interest-bearing liabilities 7,900,000 5,900,000 5,200,000 3,200,000<br />

Interest rates are at floating rates, with interest being based on<br />

the Banks 90 day bill rate. Interest rates will reprice within 6<br />

months or less. The <strong>Group</strong> has an undrawn term loan facility of<br />

$2,000,000 (2007:$2,000,000).