Apata Limited and Group

Apata Limited and Group

Apata Limited and Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

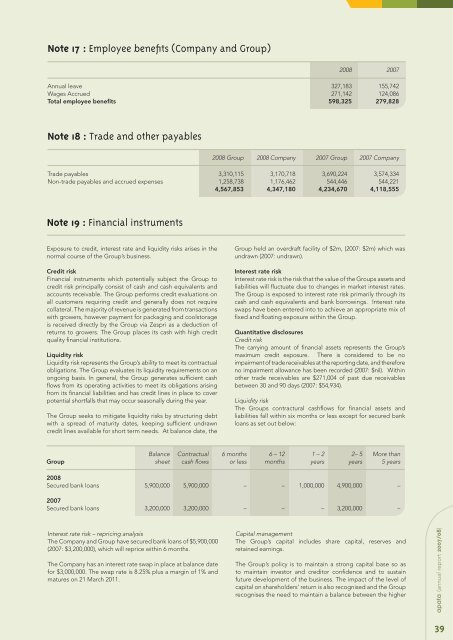

Note 17 : Employee benefits (Company <strong>and</strong> <strong>Group</strong>)<br />

2008 2007<br />

Annual leave 327,183 155,742<br />

Wages Accrued 271,142 124,086<br />

Total employee benefits 598,325 279,828<br />

Note 18 : Trade <strong>and</strong> other payables<br />

2008 <strong>Group</strong> 2008 Company 2007 <strong>Group</strong> 2007 Company<br />

Trade payables 3,310,115 3,170,718 3,690,224 3,574,334<br />

Non-trade payables <strong>and</strong> accrued expenses 1,258,738 1,176,462 544,446 544,221<br />

4,567,853 4,347,180 4,234,670 4,118,555<br />

Note 19 : Financial instruments<br />

Exposure to credit, interest rate <strong>and</strong> liquidity risks arises in the<br />

normal course of the <strong>Group</strong>’s business.<br />

Credit risk<br />

Financial instruments which potentially subject the <strong>Group</strong> to<br />

credit risk principally consist of cash <strong>and</strong> cash equivalents <strong>and</strong><br />

accounts receivable. The <strong>Group</strong> performs credit evaluations on<br />

all customers requiring credit <strong>and</strong> generally does not require<br />

collateral. The majority of revenue is generated from transactions<br />

with growers, however payment for packaging <strong>and</strong> coolstorage<br />

is received directly by the <strong>Group</strong> via Zespri as a deduction of<br />

returns to growers. The <strong>Group</strong> places its cash with high credit<br />

quality financial institutions.<br />

Liquidity risk<br />

Liquidity risk represents the <strong>Group</strong>’s ability to meet its contractual<br />

obligations. The <strong>Group</strong> evaluates its liquidity requirements on an<br />

ongoing basis. In general, the <strong>Group</strong> generates sufficient cash<br />

flows from its operating activities to meet its obligations arising<br />

from its financial liabilities <strong>and</strong> has credit lines in place to cover<br />

potential shortfalls that may occur seasonally during the year.<br />

The <strong>Group</strong> seeks to mitigate liquidity risks by structuring debt<br />

with a spread of maturity dates, keeping sufficient undrawn<br />

credit lines available for short term needs. At balance date, the<br />

<strong>Group</strong> held an overdraft facility of $2m, (2007: $2m) which was<br />

undrawn (2007: undrawn).<br />

Interest rate risk<br />

Interest rate risk is the risk that the value of the <strong>Group</strong>s assets <strong>and</strong><br />

liabilities will fluctuate due to changes in market interest rates.<br />

The <strong>Group</strong> is exposed to interest rate risk primarily through its<br />

cash <strong>and</strong> cash equivalents <strong>and</strong> bank borrowings. Interest rate<br />

swaps have been entered into to achieve an appropriate mix of<br />

fixed <strong>and</strong> floating exposure within the <strong>Group</strong>.<br />

Quantitative disclosures<br />

Credit risk<br />

The carrying amount of financial assets represents the <strong>Group</strong>’s<br />

maximum credit exposure. There is considered to be no<br />

impairment of trade receivables at the reporting date, <strong>and</strong> therefore<br />

no impairment allowance has been recorded (2007: $nil). Within<br />

other trade receivables are $271,004 of past due receivables<br />

between 30 <strong>and</strong> 90 days (2007: $54,934).<br />

Liquidity risk<br />

The <strong>Group</strong>s contractural cashflows for financial assets <strong>and</strong><br />

liabilities fall within six months or less except for secured bank<br />

loans as set out below:<br />

Balance Contractual 6 months 6 – 12 1 – 2 2– 5 More than<br />

<strong>Group</strong> sheet cash flows or less months years years 5 years<br />

2008<br />

Secured bank loans 5,900,000 5,900,000 – – 1,000,000 4,900,000 –<br />

2007<br />

Secured bank loans 3,200,000 3,200,000 – – – 3,200,000 –<br />

Interest rate risk – repricing analysis<br />

The Company <strong>and</strong> <strong>Group</strong> have secured bank loans of $5,900,000<br />

(2007: $3,200,000), which will reprice within 6 months.<br />

The Company has an interest rate swap in place at balance date<br />

for $3,000,000. The swap rate is 8.25% plus a margin of 1% <strong>and</strong><br />

matures on 21 March 2011.<br />

Capital management<br />

The <strong>Group</strong>’s capital includes share capital, reserves <strong>and</strong><br />

retained earnings.<br />

The <strong>Group</strong>’s policy is to maintain a strong capital base so as<br />

to maintain investor <strong>and</strong> creditor confidence <strong>and</strong> to sustain<br />

future development of the business. The impact of the level of<br />

capital on shareholders’ return is also recognised <strong>and</strong> the <strong>Group</strong><br />

recognises the need to maintain a balance between the higher<br />

apata (annual report 2007/08)<br />

39