Gravity Magazine_Final - Great Lakes

Gravity Magazine_Final - Great Lakes

Gravity Magazine_Final - Great Lakes

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GUEST LECTURES<br />

31<br />

Many a Slip<br />

Between the Cup and the Lip…<br />

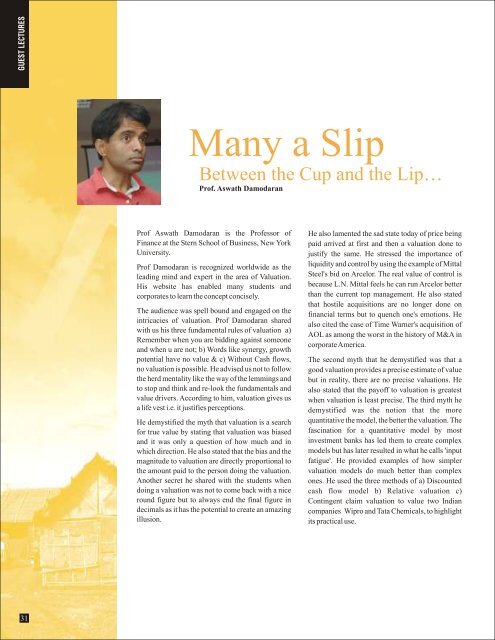

Prof. Aswath Damodaran<br />

Prof Aswath Damodaran is the Professor of<br />

Finance at the Stern School of Business, New York<br />

University.<br />

Prof Damodaran is recognized worldwide as the<br />

leading mind and expert in the area of Valuation.<br />

His website has enabled many students and<br />

corporates to learn the concept concisely.<br />

The audience was spell bound and engaged on the<br />

intricacies of valuation. Prof Damodaran shared<br />

with us his three fundamental rules of valuation a)<br />

Remember when you are bidding against someone<br />

and when u are not; b) Words like synergy, growth<br />

potential have no value & c) Without Cash flows,<br />

no valuation is possible. He advised us not to follow<br />

the herd mentality like the way of the lemmings and<br />

to stop and think and re-look the fundamentals and<br />

value drivers. According to him, valuation gives us<br />

a life vest i.e. it justifies perceptions.<br />

He demystified the myth that valuation is a search<br />

for true value by stating that valuation was biased<br />

and it was only a question of how much and in<br />

which direction. He also stated that the bias and the<br />

magnitude to valuation are directly proportional to<br />

the amount paid to the person doing the valuation.<br />

Another secret he shared with the students when<br />

doing a valuation was not to come back with a nice<br />

round figure but to always end the final figure in<br />

decimals as it has the potential to create an amazing<br />

illusion.<br />

He also lamented the sad state today of price being<br />

paid arrived at first and then a valuation done to<br />

justify the same. He stressed the importance of<br />

liquidity and control by using the example of Mittal<br />

Steel's bid on Arcelor. The real value of control is<br />

because L.N. Mittal feels he can run Arcelor better<br />

than the current top management. He also stated<br />

that hostile acquisitions are no longer done on<br />

financial terms but to quench one's emotions. He<br />

also cited the case of Time Warner's acquisition of<br />

AOL as among the worst in the history of M&A in<br />

corporate America.<br />

The second myth that he demystified was that a<br />

good valuation provides a precise estimate of value<br />

but in reality, there are no precise valuations. He<br />

also stated that the payoff to valuation is greatest<br />

when valuation is least precise. The third myth he<br />

demystified was the notion that the more<br />

quantitative the model, the better the valuation. The<br />

fascination for a quantitative model by most<br />

investment banks has led them to create complex<br />

models but has later resulted in what he calls 'input<br />

fatigue'. He provided examples of how simpler<br />

valuation models do much better than complex<br />

ones. He used the three methods of a) Discounted<br />

cash flow model b) Relative valuation c)<br />

Contingent claim valuation to value two Indian<br />

companies Wipro and Tata Chemicals, to highlight<br />

its practical use.