Chapter 18 International Managerial Finance

Chapter 18 International Managerial Finance

Chapter 18 International Managerial Finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

792 PART SIX Special Topics in <strong>Managerial</strong> <strong>Finance</strong><br />

LG1<br />

multinational companies<br />

(MNCs)<br />

Firms that have international<br />

assets and operations in foreign<br />

markets and draw part<br />

of their total revenue and<br />

profits from such markets.<br />

Hint One of the reasons<br />

why firms have operations in<br />

foreign markets is the portfolio<br />

concept that was discussed in<br />

<strong>Chapter</strong> 5. Just as it is not wise<br />

for the individual investor to<br />

put all of his or her investment<br />

into the stock of one firm, it is<br />

not wise for a firm to invest<br />

in only one market. By having<br />

operations in many markets,<br />

firms can smooth out some of<br />

the cyclic changes that occur<br />

in each market.<br />

<strong>18</strong>.1 The Multinational Company<br />

and Its Environment<br />

In recent years, as world markets have become significantly more interdependent,<br />

international finance has become an increasingly important element in the management<br />

of multinational companies (MNCs). These firms, based anywhere in<br />

the world, have international assets and operations in foreign markets and draw<br />

part of their total revenue and profits from such markets. The principles of managerial<br />

finance presented in this text are applicable to the management of MNCs.<br />

However, certain factors unique to the international setting tend to complicate<br />

the financial management of multinational companies. A simple comparison<br />

between a domestic U.S. firm (firm A) and a U.S.-based MNC (firm B), as illustrated<br />

in Table <strong>18</strong>.1, indicates the influence of some of the international factors<br />

on MNCs’ operations.<br />

In the present international environment, multinationals face a variety of<br />

laws and restrictions when operating in different nation-states. The legal and economic<br />

complexities existing in this environment are significantly different from<br />

those a domestic firm would face. Here we take a brief look at the newly emerging<br />

trading blocs in North America, western Europe, and South America; GATT<br />

and the WTO; legal forms of business organization; taxation of MNCs; and<br />

financial markets.<br />

Emerging Trading Blocs<br />

During the early 1990s, three important trading blocs emerged, centered in the<br />

Americas and western Europe. Chile, Mexico, and several other Latin American<br />

countries began to adopt market-oriented economic policies in the late 1980s,<br />

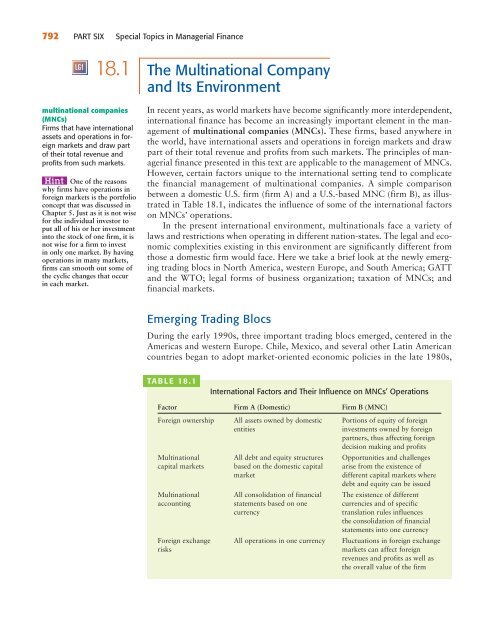

TABLE <strong>18</strong>.1<br />

<strong>International</strong> Factors and Their Influence on MNCs’ Operations<br />

Factor Firm A (Domestic) Firm B (MNC)<br />

Foreign ownership All assets owned by domestic Portions of equity of foreign<br />

entities investments owned by foreign<br />

partners, thus affecting foreign<br />

decision making and profits<br />

Multinational All debt and equity structures Opportunities and challenges<br />

capital markets based on the domestic capital arise from the existence of<br />

market different capital markets where<br />

debt and equity can be issued<br />

Multinational All consolidation of financial The existence of different<br />

accounting statements based on one currencies and of specific<br />

currency translation rules influences<br />

the consolidation of financial<br />

statements into one currency<br />

Foreign exchange All operations in one currency Fluctuations in foreign exchange<br />

risks markets can affect foreign<br />

revenues and profits as well as<br />

the overall value of the firm