Chapter 18 International Managerial Finance

Chapter 18 International Managerial Finance

Chapter 18 International Managerial Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Euromarket<br />

The international financial<br />

market that provides for<br />

borrowing and lending<br />

currencies outside their<br />

country of origin.<br />

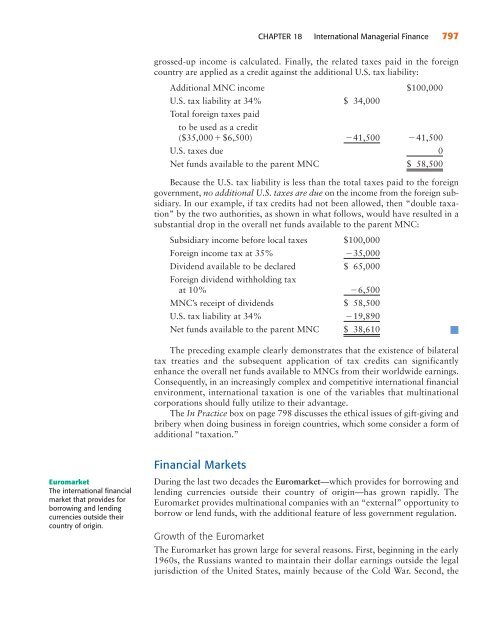

grossed-up income is calculated. Finally, the related taxes paid in the foreign<br />

country are applied as a credit against the additional U.S. tax liability:<br />

Additional MNC income $100,000<br />

U.S. tax liability at 34%<br />

Total foreign taxes paid<br />

to be used as a credit<br />

$ 34,000<br />

($35,000$6,500) 241,500 41,500<br />

U.S. taxes due<br />

0<br />

Net funds available to the parent MNC<br />

$ 58,500<br />

Because the U.S. tax liability is less than the total taxes paid to the foreign<br />

government, no additional U.S. taxes are due on the income from the foreign subsidiary.<br />

In our example, if tax credits had not been allowed, then “double taxation”<br />

by the two authorities, as shown in what follows, would have resulted in a<br />

substantial drop in the overall net funds available to the parent MNC:<br />

Subsidiary income before local taxes $100,000<br />

Foreign income tax at 35%<br />

235,000<br />

Dividend available to be declared<br />

Foreign dividend withholding tax<br />

$ 65,000<br />

at 10%<br />

26,500<br />

MNC’s receipt of dividends $ 58,500<br />

U.S. tax liability at 34%<br />

219,890<br />

Net funds available to the parent MNC $ 38,610<br />

■<br />

The preceding example clearly demonstrates that the existence of bilateral<br />

tax treaties and the subsequent application of tax credits can significantly<br />

enhance the overall net funds available to MNCs from their worldwide earnings.<br />

Consequently, in an increasingly complex and competitive international financial<br />

environment, international taxation is one of the variables that multinational<br />

corporations should fully utilize to their advantage.<br />

The In Practice box on page 798 discusses the ethical issues of gift-giving and<br />

bribery when doing business in foreign countries, which some consider a form of<br />

additional “taxation.”<br />

Financial Markets<br />

CHAPTER <strong>18</strong> <strong>International</strong> <strong>Managerial</strong> <strong>Finance</strong> 797<br />

During the last two decades the Euromarket—which provides for borrowing and<br />

lending currencies outside their country of origin—has grown rapidly. The<br />

Euromarket provides multinational companies with an “external” opportunity to<br />

borrow or lend funds, with the additional feature of less government regulation.<br />

Growth of the Euromarket<br />

The Euromarket has grown large for several reasons. First, beginning in the early<br />

1960s, the Russians wanted to maintain their dollar earnings outside the legal<br />

jurisdiction of the United States, mainly because of the Cold War. Second, the