2007 - Etman Distribusjon

2007 - Etman Distribusjon

2007 - Etman Distribusjon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Etman</strong> International Group<br />

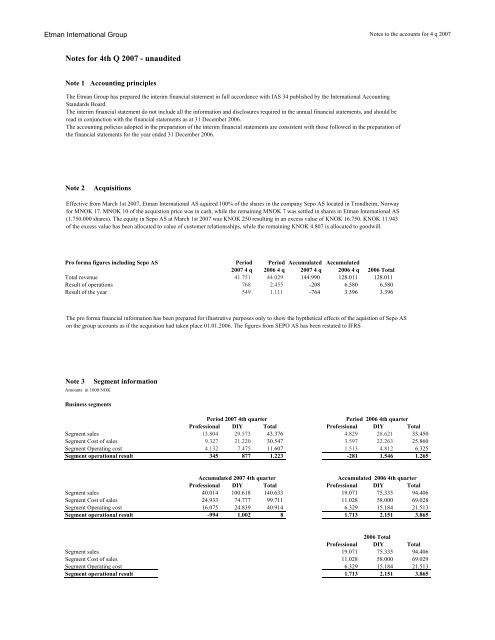

Notes for 4th Q <strong>2007</strong> - unaudited<br />

Note 1 Accounting principles<br />

The <strong>Etman</strong> Group has prepared the interim financial statement in full accordance with IAS 34 published by the International Accounting<br />

Standards Board.<br />

The interim financial statement do not include all the information and disclosures required in the annual financial statements, and should be<br />

read in conjunction with the financial statements as at 31 December 2006.<br />

The accounting policies adopted in the preparation of the interim financial statements are consistent with those followed in the preparation of<br />

the financial statements for the year ended 31 December 2006.<br />

Note 2 Acquisitions<br />

Effective from March 1st <strong>2007</strong>, <strong>Etman</strong> International AS aquired 100% of the shares in the company Sepo AS located in Trondheim, Norway<br />

for MNOK 17. MNOK 10 of the acquistion price was in cash, while the remaining MNOK 7 was settled in shares in <strong>Etman</strong> International AS<br />

(1.750.000 shares). The equity in Sepo AS at March 1st <strong>2007</strong> was KNOK 250 resulting in an excess value of KNOK 16.750. KNOK 11.943<br />

of the excess value has been allocated to value of customer relationsships, while the remaining KNOK 4.807 is allocated to goodwill.<br />

Pro forma figures including Sepo AS Period Period Accumulated Accumulated<br />

<strong>2007</strong> 4 q 2006 4 q <strong>2007</strong> 4 q 2006 4 q 2006 Total<br />

Total revenue 41.751 44.029 144.990 128.011 128.011<br />

Result of operations 768 2.455 -208 6.580 6.580<br />

Result of the year 549 1.111 -764 3.396 3.396<br />

The pro forma financial information has been prepared for illustrative purposes only to show the hypthetical effects of the aquistion of Sepo AS<br />

on the group accounts as if the acquistion had taken place 01.01.2006. The figures from SEPO AS has been restated to IFRS<br />

Note 3 Segment information<br />

Amounts in 1000 NOK<br />

Business segments<br />

Notes to the accounts for 4 q <strong>2007</strong><br />

Period <strong>2007</strong> 4th quarter Period 2006 4th quarter<br />

Professional DIY Total Professional DIY Total<br />

Segment sales 13.804 29.573 43.376<br />

4.829 28.621 33.450<br />

Segment Cost of sales 9.327 21.220 30.547<br />

3.597 22.263 25.860<br />

Segment Operating cost 4.132 7.475 11.607<br />

1.513 4.812 6.325<br />

Segment operational result 345 877 1.223<br />

-281 1.546 1.265<br />

Accumulated <strong>2007</strong> 4th quarter<br />

Accumulated 2006 4th quarter<br />

Professional DIY Total Professional DIY Total<br />

Segment sales 40.014 100.618 140.633<br />

19.071 75.335 94.406<br />

Segment Cost of sales 24.933 74.777 99.711<br />

11.028 58.000 69.028<br />

Segment Operating cost 16.075 24.839 40.914<br />

6.329 15.184 21.513<br />

Segment operational result -994 1.002<br />

8<br />

1.713 2.151 3.865<br />

Professional<br />

2006 Total<br />

DIY Total<br />

Segment sales 19.071 75.335 94.406<br />

Segment Cost of sales 11.028 58.000 69.029<br />

Segment Operating cost 6.329 15.184 21.513<br />

Segment operational result 1.713 2.151 3.865