VAL/1/Add.17 - World Trade Organization

VAL/1/Add.17 - World Trade Organization

VAL/1/Add.17 - World Trade Organization

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

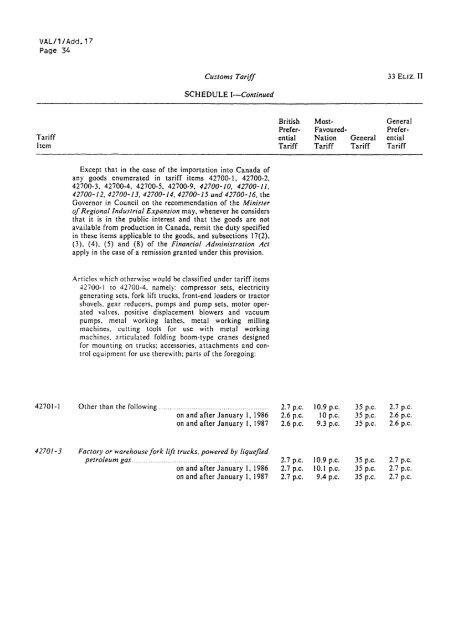

<strong>VAL</strong>/1/Add. 17<br />

Page 34<br />

Customs Tariff 33 ELIZ. Il<br />

SCHEDULE I-Continued<br />

British Most- General<br />

Prefer- Favoured- Prefer-<br />

Tariff ential Nation General ential<br />

Item Tariff Tariff Tariff Tariff<br />

Except that in the case of the importation into Canada of<br />

any goods enumerated in tariff items 42700-1, 42700-2,<br />

42700-3, 42700-4, 42700-5, 42700-9, 42700-10, 42700-11,<br />

42700-12, 42700-13, 42700-14, 42700-15 and 42700-16, the<br />

Governor in Council on the recommendation of the Minister<br />

of Regional Industrial Expansion may, whenever he considers<br />

that it is in the public interest and that the goods are not<br />

available from production in Canada, remit the duty specified<br />

in these items applicable to the goods, and subsections 17(2),<br />

(3), (4), (5) and (8) of the Financial Administration Act<br />

apply in the case of a remission granted under this provision.<br />

Articles which otherwise would be classified under tariff items<br />

42700-l to 42700-4. namely: compressor sets, electricity<br />

generating sets, fork lift trucks, front-end loaders or tractor<br />

shovels. gear reducers, pumps and pump sets, motor operated<br />

valves, positive displacement blowers and vacuum<br />

pumps, metal working lathes, metal working milling<br />

machines. cutting tools for use with metal working<br />

machines. articulated folding boom-type cranes designed<br />

for mounting on trucks; accessories, attachments and control<br />

equipment for use therewith; parts of the foregoing:<br />

42701-1 Other than the following........................................... 2.7 p.c. 10.935 p.c. p.c. 2.7 p.c.<br />

on and after January 1, 1986 2.6 p.c. 10 p.c. 35 p.c. 2.6 p.c.<br />

on and after January 1, 1987 2.6 p.c. 9.3 p.c. 35 p.c. 2.6 p.c.<br />

42701-3 Facrory or warehouse fork lift trucks, powered by liquefied<br />

petroleum gas .2.7 p.c. 10.9 p.c. 35 p.c. 2.7 p.c.<br />

on and after January 1, 1986 2.7 p.c. 10.1 p.c. 35 p.c. 2.7 p.c.<br />

on and after January 1, 1987 2.7 p.c. 9.4 p.c. 35 p.c. 2.7 p.c.