Consolidated Reports of Condition and Income for A Bank ... - ffiec

Consolidated Reports of Condition and Income for A Bank ... - ffiec

Consolidated Reports of Condition and Income for A Bank ... - ffiec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

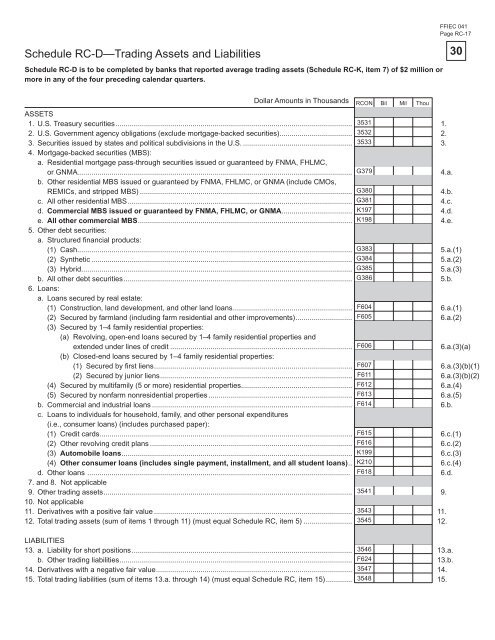

Schedule RC-D—Trading Assets <strong>and</strong> Liabilities<br />

Schedule RC-D is to be completed by banks that reported average trading assets (Schedule RC-K, item 7) <strong>of</strong> $2 million or<br />

more in any <strong>of</strong> the four preceding calendar quarters.<br />

Dollar Amounts in Thous<strong>and</strong>s RCON Bil Mil Thou<br />

ASSETS<br />

1. U.S. Treasury securities ..................................................................................................................... 3531<br />

1.<br />

2. U.S. Government agency obligations (exclude mortgage-backed securities).................................... 3532<br />

2.<br />

3. Securities issued by states <strong>and</strong> political subdivisions in the U.S. ...................................................... 3533<br />

4. Mortgage-backed securities (MBS):<br />

a. Residential mortgage pass-through securities issued or guaranteed by FNMA, FHLMC,<br />

3.<br />

or GNMA ........................................................................................................................................ G379<br />

b. Other residential MBS issued or guaranteed by FNMA, FHLMC, or GNMA (include CMOs,<br />

4.a.<br />

REMICs, <strong>and</strong> stripped MBS) ......................................................................................................... G380<br />

4.b.<br />

c. All other residential MBS ............................................................................................................... G381<br />

4.c.<br />

d. Commercial MBS issued or guaranteed by FNMA, FHLMC, or GNMA ................................... K197<br />

4.d.<br />

e. All other commercial MBS .......................................................................................................... K198<br />

5. Other debt securities:<br />

a. Structured fi nancial products:<br />

4.e.<br />

(1) Cash ........................................................................................................................................ G383<br />

5.a.(1)<br />

(2) Synthetic ................................................................................................................................. G384<br />

5.a.(2)<br />

(3) Hybrid ...................................................................................................................................... G385<br />

5.a.(3)<br />

b. All other debt securities ................................................................................................................. G386<br />

6. Loans:<br />

a. Loans secured by real estate:<br />

5.b.<br />

(1) Construction, l<strong>and</strong> development, <strong>and</strong> other l<strong>and</strong> loans ........................................................... F604<br />

6.a.(1)<br />

(2) Secured by farml<strong>and</strong> (including farm residential <strong>and</strong> other improvements) ............................ F605<br />

(3) Secured by 1–4 family residential properties:<br />

(a) Revolving, open-end loans secured by 1–4 family residential properties <strong>and</strong><br />

6.a.(2)<br />

extended under lines <strong>of</strong> credit .......................................................................................... F606<br />

(b) Closed-end loans secured by 1–4 family residential properties:<br />

6.a.(3)(a)<br />

(1) Secured by fi rst liens .................................................................................................. F607<br />

6.a.(3)(b)(1)<br />

(2) Secured by junior liens ............................................................................................... F611<br />

6.a.(3)(b)(2)<br />

(4) Secured by multifamily (5 or more) residential properties....................................................... F612<br />

6.a.(4)<br />

(5) Secured by nonfarm nonresidential properties ....................................................................... F613<br />

6.a.(5)<br />

b. Commercial <strong>and</strong> industrial loans ................................................................................................... F614<br />

c. Loans to individuals <strong>for</strong> household, family, <strong>and</strong> other personal expenditures<br />

(i.e., consumer loans) (includes purchased paper):<br />

6.b.<br />

(1) Credit cards ............................................................................................................................. F615<br />

6.c.(1)<br />

(2) Other revolving credit plans .................................................................................................... F616<br />

6.c.(2)<br />

(3) Automobile loans .................................................................................................................. K199<br />

6.c.(3)<br />

(4) Other consumer loans (includes single payment, installment, <strong>and</strong> all student loans) .. K210<br />

6.c.(4)<br />

d. Other loans .................................................................................................................................. F618<br />

7. <strong>and</strong> 8. Not applicable<br />

6.d.<br />

9. Other trading assets ........................................................................................................................... 3541<br />

10. Not applicable<br />

9.<br />

11. Derivatives with a positive fair value .................................................................................................. 3543<br />

11.<br />

12. Total trading assets (sum <strong>of</strong> items 1 through 11) (must equal Schedule RC, item 5) ........................ 3545<br />

12.<br />

LIABILITIES<br />

13. a. Liability <strong>for</strong> short positions ............................................................................................................. 3546<br />

13.a.<br />

b. Other trading liabilities ................................................................................................................... F624<br />

13.b.<br />

14. Derivatives with a negative fair value ................................................................................................. 3547<br />

14.<br />

15. Total trading liabilities (sum <strong>of</strong> items 13.a. through 14) (must equal Schedule RC, item 15) ............. 3548<br />

15.<br />

FFIEC 041<br />

Page RC-17<br />

30