Consolidated Reports of Condition and Income for A Bank ... - ffiec

Consolidated Reports of Condition and Income for A Bank ... - ffiec

Consolidated Reports of Condition and Income for A Bank ... - ffiec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

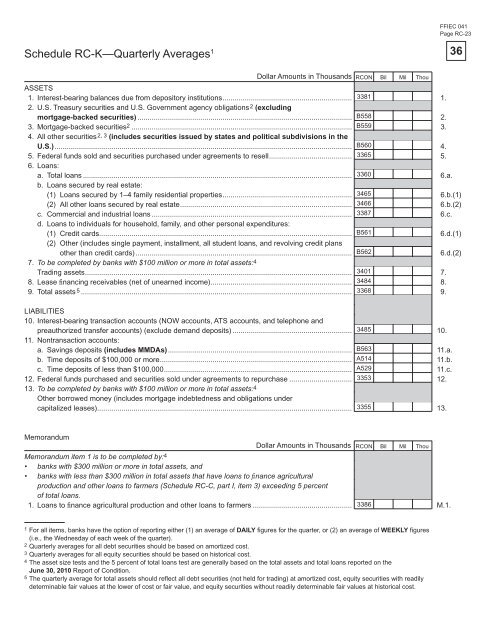

Schedule RC-K—Quarterly Averages 1<br />

Dollar Amounts in Thous<strong>and</strong>s<br />

RCON Bil Mil Thou<br />

ASSETS<br />

1. Interest-bearing balances due from depository institutions ................................................................<br />

2. U.S. Treasury securities <strong>and</strong> U.S. Government agency obligations<br />

1.<br />

2 (excluding<br />

mortgage-backed securities) .......................................................................................................... 2.<br />

3. Mortgage-backed securities2 .............................................................................................................<br />

4. All other securities<br />

3.<br />

2, 3 (includes securities issued by states <strong>and</strong> political subdivisions in the<br />

U.S.) ................................................................................................................................................... 4.<br />

5. Federal funds sold <strong>and</strong> securities purchased under agreements to resell .........................................<br />

6. Loans:<br />

5.<br />

a. Total loans .....................................................................................................................................<br />

b. Loans secured by real estate:<br />

6.a.<br />

(1) Loans secured by 1–4 family residential properties ................................................................ 6.b.(1)<br />

(2) All other loans secured by real estate ..................................................................................... 6.b.(2)<br />

c. Commercial <strong>and</strong> industrial loans ...................................................................................................<br />

d. Loans to individuals <strong>for</strong> household, family, <strong>and</strong> other personal expenditures:<br />

6.c.<br />

(1) Credit cards .............................................................................................................................<br />

(2) Other (includes single payment, installment, all student loans, <strong>and</strong> revolving credit plans<br />

6.d.(1)<br />

other than credit cards) ...........................................................................................................<br />

7. To be completed by banks with $100 million or more in total assets:<br />

6.d.(2)<br />

4<br />

Trading assets .................................................................................................................................... 7.<br />

8. Lease fi nancing receivables (net <strong>of</strong> unearned income)...................................................................... 8.<br />

9. Total assets 5 3381<br />

B558<br />

B559<br />

B560<br />

3365<br />

3360<br />

3465<br />

3466<br />

3387<br />

B561<br />

B562<br />

3401<br />

3484<br />

...................................................................................................................................... 3368<br />

9.<br />

LIABILITIES<br />

10. Interest-bearing transaction accounts (NOW accounts, ATS accounts, <strong>and</strong> telephone <strong>and</strong><br />

preauthorized transfer accounts) (exclude dem<strong>and</strong> deposits) ........................................................... 10.<br />

11. Nontransaction accounts:<br />

a. Savings deposits (includes MMDAs) ........................................................................................... 11.a.<br />

b. Time deposits <strong>of</strong> $100,000 or more ............................................................................................... 11.b.<br />

c. Time deposits <strong>of</strong> less than $100,000 ............................................................................................. 11.c.<br />

12. Federal funds purchased <strong>and</strong> securities sold under agreements to repurchase ............................... 12.<br />

13. To be completed by banks with $100 million or more in total assets: 4<br />

3485<br />

B563<br />

A514<br />

A529<br />

3353<br />

Other borrowed money (includes mortgage indebtedness <strong>and</strong> obligations under<br />

capitalized leases).............................................................................................................................. 3355<br />

13.<br />

Memor<strong>and</strong>um<br />

Dollar Amounts in Thous<strong>and</strong>s<br />

Memor<strong>and</strong>um item 1 is to be completed by:<br />

3386<br />

4<br />

RCON Bil Mil Thou<br />

• banks with $300 million or more in total assets, <strong>and</strong><br />

• banks with less than $300 million in total assets that have loans to fi nance agricultural<br />

production <strong>and</strong> other loans to farmers (Schedule RC-C, part I, item 3) exceeding 5 percent<br />

<strong>of</strong> total loans.<br />

1. Loans to fi nance agricultural production <strong>and</strong> other loans to farmers ................................................. M.1.<br />

1 For all items, banks have the option <strong>of</strong> reporting either (1) an average <strong>of</strong> DAILY figures <strong>for</strong> the quarter, or (2) an average <strong>of</strong> WEEKLY figures<br />

(i.e., the Wednesday <strong>of</strong> each week <strong>of</strong> the quarter).<br />

2 Quarterly averages <strong>for</strong> all debt securities should be based on amortized cost.<br />

3 Quarterly averages <strong>for</strong> all equity securities should be based on historical cost.<br />

4 The asset size tests <strong>and</strong> the 5 percent <strong>of</strong> total loans test are generally based on the total assets <strong>and</strong> total loans reported on the<br />

June 30, 2010 Report <strong>of</strong> <strong>Condition</strong>.<br />

5 The quarterly average <strong>for</strong> total assets should reflect all debt securities (not held <strong>for</strong> trading) at amortized cost, equity securities with readily<br />

determinable fair values at the lower <strong>of</strong> cost or fair value, <strong>and</strong> equity securities without readily determinable fair values at historical cost.<br />

FFIEC 041<br />

Page RC-23<br />

36