Consolidated Reports of Condition and Income for A Bank ... - ffiec

Consolidated Reports of Condition and Income for A Bank ... - ffiec

Consolidated Reports of Condition and Income for A Bank ... - ffiec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

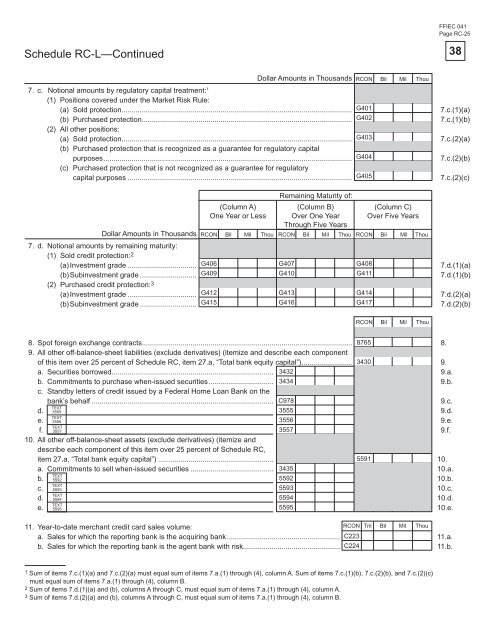

Schedule RC-L—Continued<br />

7. c. Notional amounts by regulatory capital treatment: 1<br />

(1) Positions covered under the Market Risk Rule:<br />

(a) Sold protection.................................................................................................................. G401<br />

7.c.(1)(a)<br />

(b) Purchased protection........................................................................................................ G402<br />

7.c.(1)(b)<br />

(2) All other positions:<br />

(a) Sold protection.................................................................................................................. G403<br />

7.c.(2)(a)<br />

(b) Purchased protection that is recognized as a guarantee <strong>for</strong> regulatory capital<br />

purposes ........................................................................................................................... G404<br />

7.c.(2)(b)<br />

(c) Purchased protection that is not recognized as a guarantee <strong>for</strong> regulatory<br />

capital purposes ............................................................................................................... G405<br />

7.c.(2)(c)<br />

Dollar Amounts in Thous<strong>and</strong>s<br />

(Column A)<br />

One Year or Less<br />

Dollar Amounts in Thous<strong>and</strong>s<br />

RCON Bil Mil Thou<br />

Remaining Maturity <strong>of</strong>:<br />

(Column B)<br />

Over One Year<br />

Through Five Years<br />

(Column C)<br />

Over Five Years<br />

RCON Bil Mil Thou RCON Bil Mil Thou RCON Bil Mil Thou<br />

7. d. Notional amounts by remaining maturity:<br />

(1) Sold credit protection: 2<br />

(a) Investment grade .................................. 7.d.(1)(a)<br />

(b) Subinvestment grade ............................<br />

(2) Purchased credit protection:<br />

7.d.(1)(b)<br />

3<br />

G406 G407 G408<br />

G409 G410 G411<br />

(a) Investment grade .................................. G412 G413 G414<br />

7.d.(2)(a)<br />

(b) Subinvestment grade ............................ G415 G416 G417<br />

7.d.(2)(b)<br />

RCON Bil Mil Thou<br />

8. Spot <strong>for</strong>eign exchange contracts........................................................................................................ 8765<br />

9. All other <strong>of</strong>f-balance-sheet liabilities (exclude derivatives) (itemize <strong>and</strong> describe each component<br />

8.<br />

<strong>of</strong> this item over 25 percent <strong>of</strong> Schedule RC, item 27.a, “Total bank equity capital”) ......................... 3430<br />

9.<br />

a. Securities borrowed................................................................................ 3432<br />

9.a.<br />

b. Commitments to purchase when-issued securities ................................ 3434<br />

c. St<strong>and</strong>by letters <strong>of</strong> credit issued by a Federal Home Loan <strong>Bank</strong> on the<br />

9.b.<br />

bank’s behalf .......................................................................................... C978<br />

9.c.<br />

TEXT<br />

d. 3555<br />

3555<br />

9.d.<br />

TEXT<br />

e. 3556<br />

3556<br />

9.e.<br />

TEXT<br />

f. 3557<br />

10. All other <strong>of</strong>f-balance-sheet assets (exclude derivatives) (itemize <strong>and</strong><br />

describe each component <strong>of</strong> this item over 25 percent <strong>of</strong> Schedule RC,<br />

3557<br />

9.f.<br />

item 27.a, “Total bank equity capital”) ......................................................... 5591<br />

10.<br />

a. Commitments to sell when-issued securities ......................................... 3435<br />

10.a.<br />

TEXT<br />

b. 5592<br />

5592<br />

10.b.<br />

TEXT<br />

c. 5593<br />

5593<br />

10.c.<br />

TEXT<br />

d. 5594<br />

5594<br />

10.d.<br />

TEXT<br />

e. 5595<br />

5595<br />

10.e.<br />

11. Year-to-date merchant credit card sales volume:<br />

RCON Tril Bil Mil Thou<br />

a. Sales <strong>for</strong> which the reporting bank is the acquiring bank ........................................................ C223<br />

11.a.<br />

b. Sales <strong>for</strong> which the reporting bank is the agent bank with risk................................................ C224<br />

11.b.<br />

1 Sum <strong>of</strong> items 7.c.(1)(a) <strong>and</strong> 7.c.(2)(a) must equal sum <strong>of</strong> items 7.a.(1) through (4), column A. Sum <strong>of</strong> items 7.c.(1)(b), 7.c.(2)(b), <strong>and</strong> 7.c.(2)(c)<br />

must equal sum <strong>of</strong> items 7.a.(1) through (4), column B.<br />

2 Sum <strong>of</strong> items 7.d.(1)(a) <strong>and</strong> (b), columns A through C, must equal sum <strong>of</strong> items 7.a.(1) through (4), column A.<br />

3 Sum <strong>of</strong> items 7.d.(2)(a) <strong>and</strong> (b), columns A through C, must equal sum <strong>of</strong> items 7.a.(1) through (4), column B.<br />

FFIEC 041<br />

Page RC-25<br />

38