Consolidated Reports of Condition and Income for A Bank ... - ffiec

Consolidated Reports of Condition and Income for A Bank ... - ffiec

Consolidated Reports of Condition and Income for A Bank ... - ffiec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

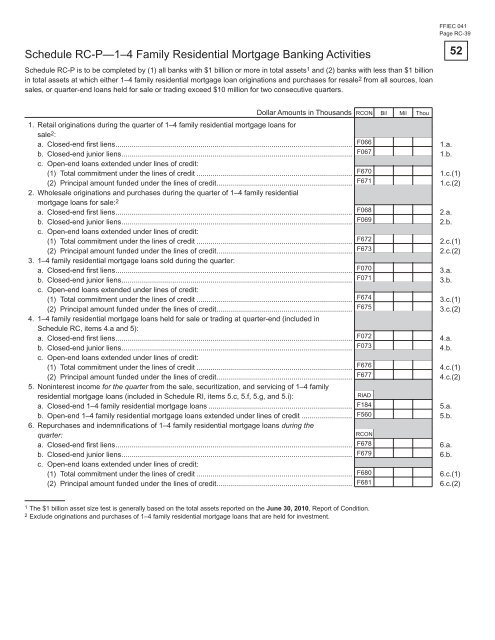

Schedule RC-P—1–4 Family Residential Mortgage <strong>Bank</strong>ing Activities<br />

Schedule RC-P is to be completed by (1) all banks with $1 billion or more in total assets 1 <strong>and</strong> (2) banks with less than $1 billion<br />

in total assets at which either 1–4 family residential mortgage loan originations <strong>and</strong> purchases <strong>for</strong> resale 2 from all sources, loan<br />

sales, or quarter-end loans held <strong>for</strong> sale or trading exceed $10 million <strong>for</strong> two consecutive quarters.<br />

FFIEC 041<br />

Page RC-39<br />

Dollar Amounts in Thous<strong>and</strong>s RCON<br />

1. Retail originations during the quarter <strong>of</strong> 1–4 family residential mortgage loans <strong>for</strong><br />

sale<br />

Bil Mil Thou<br />

F066<br />

F067<br />

F670<br />

F671<br />

F068<br />

F069<br />

F672<br />

F673<br />

F070<br />

F071<br />

F674<br />

F675<br />

F072<br />

F073<br />

F676<br />

F677<br />

RIAD<br />

F184<br />

F560<br />

RCON<br />

F678<br />

F679<br />

F680<br />

F681<br />

2:<br />

a. Closed-end fi rst liens ..................................................................................................................... 1.a.<br />

b. Closed-end junior liens ..................................................................................................................<br />

c. Open-end loans extended under lines <strong>of</strong> credit:<br />

1.b.<br />

(1) Total commitment under the lines <strong>of</strong> credit ............................................................................. 1.c.(1)<br />

(2) Principal amount funded under the lines <strong>of</strong> credit ...................................................................<br />

2. Wholesale originations <strong>and</strong> purchases during the quarter <strong>of</strong> 1–4 family residential<br />

mortgage loans <strong>for</strong> sale:<br />

1.c.(2)<br />

2<br />

a. Closed-end fi rst liens ..................................................................................................................... 2.a.<br />

b. Closed-end junior liens ..................................................................................................................<br />

c. Open-end loans extended under lines <strong>of</strong> credit:<br />

2.b.<br />

(1) Total commitment under the lines <strong>of</strong> credit ............................................................................. 2.c.(1)<br />

(2) Principal amount funded under the lines <strong>of</strong> credit ...................................................................<br />

3. 1–4 family residential mortgage loans sold during the quarter:<br />

2.c.(2)<br />

a. Closed-end fi rst liens ..................................................................................................................... 3.a.<br />

b. Closed-end junior liens ..................................................................................................................<br />

c. Open-end loans extended under lines <strong>of</strong> credit:<br />

3.b.<br />

(1) Total commitment under the lines <strong>of</strong> credit ............................................................................. 3.c.(1)<br />

(2) Principal amount funded under the lines <strong>of</strong> credit ...................................................................<br />

4. 1–4 family residential mortgage loans held <strong>for</strong> sale or trading at quarter-end (included in<br />

Schedule RC, items 4.a <strong>and</strong> 5):<br />

3.c.(2)<br />

a. Closed-end fi rst liens ..................................................................................................................... 4.a.<br />

b. Closed-end junior liens ..................................................................................................................<br />

c. Open-end loans extended under lines <strong>of</strong> credit:<br />

4.b.<br />

(1) Total commitment under the lines <strong>of</strong> credit ............................................................................. 4.c.(1)<br />

(2) Principal amount funded under the lines <strong>of</strong> credit ...................................................................<br />

5. Noninterest income <strong>for</strong> the quarter from the sale, securitization, <strong>and</strong> servicing <strong>of</strong> 1–4 family<br />

4.c.(2)<br />

residential mortgage loans (included in Schedule RI, items 5.c, 5.f, 5.g, <strong>and</strong> 5.i):<br />

a. Closed-end 1–4 family residential mortgage loans ....................................................................... 5.a.<br />

b. Open-end 1–4 family residential mortgage loans extended under lines <strong>of</strong> credit .........................<br />

6. Repurchases <strong>and</strong> indemnifi cations <strong>of</strong> 1–4 family residential mortgage loans during the<br />

5.b.<br />

quarter:<br />

a. Closed-end fi rst liens ..................................................................................................................... 6.a.<br />

b. Closed-end junior liens ..................................................................................................................<br />

c. Open-end loans extended under lines <strong>of</strong> credit:<br />

6.b.<br />

(1) Total commitment under the lines <strong>of</strong> credit ............................................................................. 6.c.(1)<br />

(2) Principal amount funded under the lines <strong>of</strong> credit ................................................................... 6.c.(2)<br />

1 The $1 billion asset size test is generally based on the total assets reported on the June 30, 2010, Report <strong>of</strong> <strong>Condition</strong>.<br />

2 Exclude originations <strong>and</strong> purchases <strong>of</strong> 1–4 family residential mortgage loans that are held <strong>for</strong> investment.<br />

52