Submission to the Review of Indexation Arrangements in Australian ...

Submission to the Review of Indexation Arrangements in Australian ...

Submission to the Review of Indexation Arrangements in Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

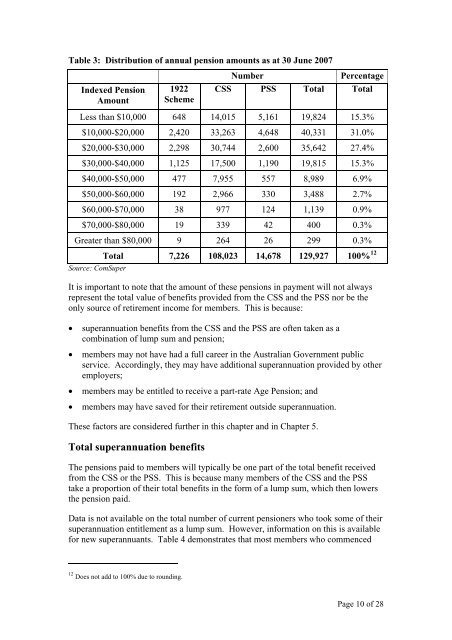

Table 3: Distribution <strong>of</strong> annual pension amounts as at 30 June 2007<br />

Indexed Pension<br />

Amount<br />

1922<br />

Scheme<br />

Number Percentage<br />

CSS PSS Total Total<br />

Less than $10,000 648 14,015 5,161 19,824 15.3%<br />

$10,000-$20,000 2,420 33,263 4,648 40,331 31.0%<br />

$20,000-$30,000 2,298 30,744 2,600 35,642 27.4%<br />

$30,000-$40,000 1,125 17,500 1,190 19,815 15.3%<br />

$40,000-$50,000 477 7,955 557 8,989 6.9%<br />

$50,000-$60,000 192 2,966 330 3,488 2.7%<br />

$60,000-$70,000 38 977 124 1,139 0.9%<br />

$70,000-$80,000 19 339 42 400 0.3%<br />

Greater than $80,000 9 264 26 299 0.3%<br />

Source: ComSuper<br />

Total 7,226 108,023 14,678 129,927<br />

100% 12<br />

It is important <strong>to</strong> note that <strong>the</strong> amount <strong>of</strong> <strong>the</strong>se pensions <strong>in</strong> payment will not always<br />

represent <strong>the</strong> <strong>to</strong>tal value <strong>of</strong> benefits provided from <strong>the</strong> CSS and <strong>the</strong> PSS nor be <strong>the</strong><br />

only source <strong>of</strong> retirement <strong>in</strong>come for members. This is because:<br />

• superannuation benefits from <strong>the</strong> CSS and <strong>the</strong> PSS are <strong>of</strong>ten taken as a<br />

comb<strong>in</strong>ation <strong>of</strong> lump sum and pension;<br />

• members may not have had a full career <strong>in</strong> <strong>the</strong> <strong>Australian</strong> Government public<br />

service. Accord<strong>in</strong>gly, <strong>the</strong>y may have additional superannuation provided by o<strong>the</strong>r<br />

employers;<br />

• members may be entitled <strong>to</strong> receive a part-rate Age Pension; and<br />

• members may have saved for <strong>the</strong>ir retirement outside superannuation.<br />

These fac<strong>to</strong>rs are considered fur<strong>the</strong>r <strong>in</strong> this chapter and <strong>in</strong> Chapter 5.<br />

Total superannuation benefits<br />

The pensions paid <strong>to</strong> members will typically be one part <strong>of</strong> <strong>the</strong> <strong>to</strong>tal benefit received<br />

from <strong>the</strong> CSS or <strong>the</strong> PSS. This is because many members <strong>of</strong> <strong>the</strong> CSS and <strong>the</strong> PSS<br />

take a proportion <strong>of</strong> <strong>the</strong>ir <strong>to</strong>tal benefits <strong>in</strong> <strong>the</strong> form <strong>of</strong> a lump sum, which <strong>the</strong>n lowers<br />

<strong>the</strong> pension paid.<br />

Data is not available on <strong>the</strong> <strong>to</strong>tal number <strong>of</strong> current pensioners who <strong>to</strong>ok some <strong>of</strong> <strong>the</strong>ir<br />

superannuation entitlement as a lump sum. However, <strong>in</strong>formation on this is available<br />

for new superannuants. Table 4 demonstrates that most members who commenced<br />

12 Does not add <strong>to</strong> 100% due <strong>to</strong> round<strong>in</strong>g.<br />

Page 10 <strong>of</strong> 28