Submission to the Review of Indexation Arrangements in Australian ...

Submission to the Review of Indexation Arrangements in Australian ...

Submission to the Review of Indexation Arrangements in Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

salary. From 1 July 2008, a member can elect <strong>to</strong> make no member contributions.<br />

Member contributions are paid <strong>in</strong><strong>to</strong> <strong>the</strong> PSS Fund and accumulate with fund earn<strong>in</strong>gs.<br />

Employer productivity contributions <strong>of</strong> around 3% <strong>of</strong> superannuation salary are paid<br />

<strong>in</strong><strong>to</strong> <strong>the</strong> PSS Fund and accumulate with fund earn<strong>in</strong>gs. The balance <strong>of</strong> <strong>the</strong> member’s<br />

employer f<strong>in</strong>anced benefit is unfunded; that is, it is not funded until <strong>the</strong> member’s<br />

benefit becomes payable.<br />

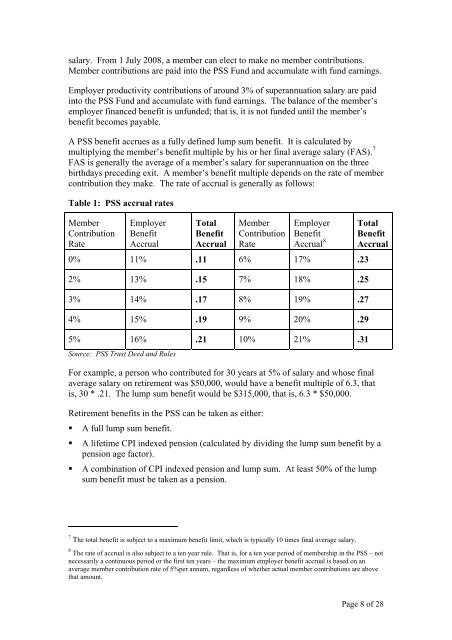

A PSS benefit accrues as a fully def<strong>in</strong>ed lump sum benefit. It is calculated by<br />

multiply<strong>in</strong>g <strong>the</strong> member’s benefit multiple by his or her f<strong>in</strong>al average salary (FAS). 7<br />

FAS is generally <strong>the</strong> average <strong>of</strong> a member’s salary for superannuation on <strong>the</strong> three<br />

birthdays preced<strong>in</strong>g exit. A member’s benefit multiple depends on <strong>the</strong> rate <strong>of</strong> member<br />

contribution <strong>the</strong>y make. The rate <strong>of</strong> accrual is generally as follows:<br />

Table 1: PSS accrual rates<br />

Member<br />

Contribution<br />

Rate<br />

Employer<br />

Benefit<br />

Accrual<br />

Total<br />

Benefit<br />

Accrual<br />

Member<br />

Contribution<br />

Rate<br />

Employer<br />

Benefit<br />

Accrual 8<br />

0% 11% .11 6% 17% .23<br />

2% 13% .15 7% 18% .25<br />

3% 14% .17 8% 19% .27<br />

4% 15% .19 9% 20% .29<br />

5% 16% .21 10% 21% .31<br />

Source: PSS Trust Deed and Rules<br />

Total<br />

Benefit<br />

Accrual<br />

For example, a person who contributed for 30 years at 5% <strong>of</strong> salary and whose f<strong>in</strong>al<br />

average salary on retirement was $50,000, would have a benefit multiple <strong>of</strong> 6.3, that<br />

is, 30 * .21. The lump sum benefit would be $315,000, that is, 6.3 * $50,000.<br />

Retirement benefits <strong>in</strong> <strong>the</strong> PSS can be taken as ei<strong>the</strong>r:<br />

A full lump sum benefit.<br />

A lifetime CPI <strong>in</strong>dexed pension (calculated by divid<strong>in</strong>g <strong>the</strong> lump sum benefit by a<br />

pension age fac<strong>to</strong>r).<br />

A comb<strong>in</strong>ation <strong>of</strong> CPI <strong>in</strong>dexed pension and lump sum. At least 50% <strong>of</strong> <strong>the</strong> lump<br />

sum benefit must be taken as a pension.<br />

7 The <strong>to</strong>tal benefit is subject <strong>to</strong> a maximum benefit limit, which is typically 10 times f<strong>in</strong>al average salary.<br />

8 The rate <strong>of</strong> accrual is also subject <strong>to</strong> a ten year rule. That is, for a ten year period <strong>of</strong> membership <strong>in</strong> <strong>the</strong> PSS – not<br />

necessarily a cont<strong>in</strong>uous period or <strong>the</strong> first ten years – <strong>the</strong> maximum employer benefit accrual is based on an<br />

average member contribution rate <strong>of</strong> 5%per annum, regardless <strong>of</strong> whe<strong>the</strong>r actual member contributions are above<br />

that amount.<br />

Page 8 <strong>of</strong> 28