FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

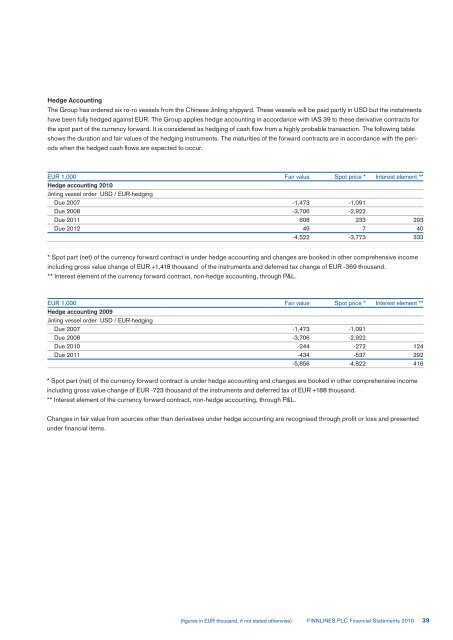

Hedge Accounting<br />

The Group has ordered six ro-ro vessels from the Chinese Jinling shipyard. These vessels will be paid partly in USD but the instalments<br />

have been fully hedged against EUR. The Group applies hedge accounting in accordance with IAS 39 to these derivative contracts for<br />

the spot part of the currency forward. It is considered as hedging of cash flow from a highly probable transaction. The following table<br />

shows the duration and fair values of the hedging instruments. The maturities of the forward contracts are in accordance with the peri-<br />

ods when the hedged cash flows are expected to occur.<br />

EUR 1,000 Fair value Spot price * Interest element **<br />

Hedge accounting <strong>2010</strong><br />

Jinling vessel order USD / EUR-hedging<br />

Due 2007 -1,473 -1,091<br />

Due 2008 -3,706 -2,922<br />

Due 2011 608 233 293<br />

Due 2012 49 7 40<br />

-4,522 -3,773 333<br />

* Spot part (net) of the currency forward contract is under hedge accounting and changes are booked in other comprehensive income<br />

including gross value change of EUR +1,418 thousand of the instruments and deferred tax change of EUR -369 thousand.<br />

** Interest element of the currency forward contract, non-hedge accounting, through P&L.<br />

EUR 1,000 Fair value Spot price * Interest element **<br />

Hedge accounting 2009<br />

Jinling vessel order USD / EUR-hedging<br />

Due 2007 -1,473 -1,091<br />

Due 2008 -3,706 -2,922<br />

Due <strong>2010</strong> -244 -272 124<br />

Due 2011 -434 -537 292<br />

-5,856 -4,822 416<br />

* Spot part (net) of the currency forward contract is under hedge accounting and changes are booked in other comprehensive income<br />

including gross value change of EUR -723 thousand of the instruments and deferred tax of EUR +188 thousand.<br />

** Interest element of the currency forward contract, non-hedge accounting, through P&L.<br />

Changes in fair value from sources other than derivatives under hedge accounting are recognised through profit or loss and presented<br />

under financial items.<br />

(figures in EUR thousand, if not stated otherwise)<br />

FINNLINES PLC Financial Statements <strong>2010</strong><br />

39