Annual Report and Financial Statements 2007 - Finnlines

Annual Report and Financial Statements 2007 - Finnlines

Annual Report and Financial Statements 2007 - Finnlines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

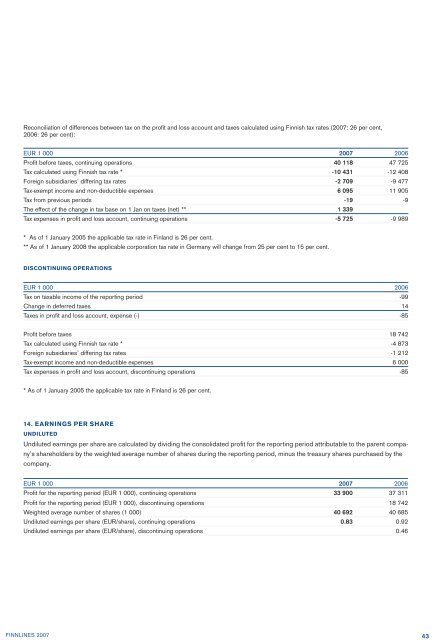

Reconciliation of differences between tax on the profi t <strong>and</strong> loss account <strong>and</strong> taxes calculated using Finnish tax rates (<strong>2007</strong>: 26 per cent,<br />

2006: 26 per cent):<br />

EUR 1 000 <strong>2007</strong> 2006<br />

Profi t before taxes, continuing operations 40 118 47 725<br />

Tax calculated using Finnish tax rate * -10 431 -12 408<br />

Foreign subsidiaries’ differing tax rates -2 709 -9 477<br />

Tax-exempt income <strong>and</strong> non-deductible expenses 6 095 11 905<br />

Tax from previous periods -19 -9<br />

The effect of the change in tax base on 1 Jan on taxes (net) ** 1 339<br />

Tax expenses in profi t <strong>and</strong> loss account, continuing operations -5 725 -9 989<br />

* As of 1 January 2005 the applicable tax rate in Finl<strong>and</strong> is 26 per cent.<br />

** As of 1 January 2008 the applicable corporation tax rate in Germany will change from 25 per cent to 15 per cent.<br />

DISCONTINUING OPERATIONS<br />

EUR 1 000 2006<br />

Tax on taxable income of the reporting period -99<br />

Change in deferred taxes 14<br />

Taxes in profi t <strong>and</strong> loss account, expense (-) -85<br />

Profi t before taxes 18 742<br />

Tax calculated using Finnish tax rate * -4 873<br />

Foreign subsidiaries’ differing tax rates -1 212<br />

Tax-exempt income <strong>and</strong> non-deductible expenses 6 000<br />

Tax expenses in profi t <strong>and</strong> loss account, discontinuing operations -85<br />

* As of 1 January 2005 the applicable tax rate in Finl<strong>and</strong> is 26 per cent.<br />

14. EARNINGS PER SHARE<br />

UNDILUTED<br />

Undiluted earnings per share are calculated by dividing the consolidated profi t for the reporting period attributable to the parent company’s<br />

shareholders by the weighted average number of shares during the reporting period, minus the treasury shares purchased by the<br />

company.<br />

EUR 1 000 <strong>2007</strong> 2006<br />

Profi t for the reporting period (EUR 1 000), continuing operations 33 900 37 311<br />

Profi t for the reporting period (EUR 1 000), discontinuing operations 18 742<br />

Weighted average number of shares (1 000) 40 692 40 685<br />

Undiluted earnings per share (EUR/share), continuing operations 0.83 0.92<br />

Undiluted earnings per share (EUR/share), discontinuing operations 0.46<br />

FINNLINES <strong>2007</strong><br />

43