Annual Report and Financial Statements 2007 - Finnlines

Annual Report and Financial Statements 2007 - Finnlines

Annual Report and Financial Statements 2007 - Finnlines

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

60<br />

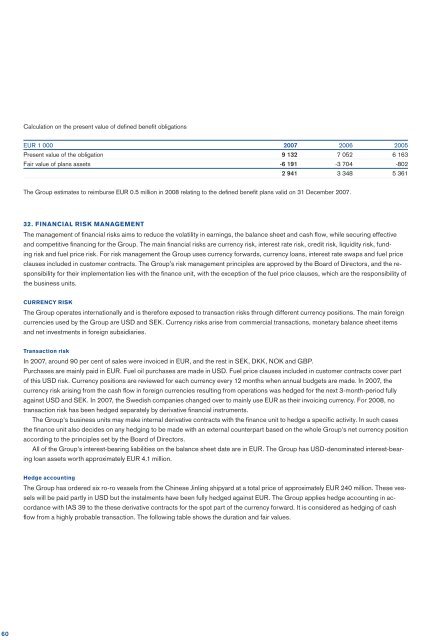

Calculation on the present value of defi ned benefi t obligations<br />

EUR 1 000 <strong>2007</strong> 2006 2005<br />

Present value of the obligation 9 132 7 052 6 163<br />

Fair value of plans assets -6 191 -3 704 -802<br />

2 941 3 348 5 361<br />

The Group estimates to reimburse EUR 0.5 million in 2008 relating to the defi ned benefi t plans valid on 31 December <strong>2007</strong>.<br />

32. FINANCIAL RISK MANAGEMENT<br />

The management of fi nancial risks aims to reduce the volatility in earnings, the balance sheet <strong>and</strong> cash fl ow, while securing effective<br />

<strong>and</strong> competitive fi nancing for the Group. The main fi nancial risks are currency risk, interest rate risk, credit risk, liquidity risk, fund-<br />

ing risk <strong>and</strong> fuel price risk. For risk management the Group uses currency forwards, currency loans, interest rate swaps <strong>and</strong> fuel price<br />

clauses included in customer contracts. The Group’s risk management principles are approved by the Board of Directors, <strong>and</strong> the re-<br />

sponsibility for their implementation lies with the fi nance unit, with the exception of the fuel price clauses, which are the responsibility of<br />

the business units.<br />

CURRENCY RISK<br />

The Group operates internationally <strong>and</strong> is therefore exposed to transaction risks through different currency positions. The main foreign<br />

currencies used by the Group are USD <strong>and</strong> SEK. Currency risks arise from commercial transactions, monetary balance sheet items<br />

<strong>and</strong> net investments in foreign subsidiaries.<br />

Transaction risk<br />

In <strong>2007</strong>, around 90 per cent of sales were invoiced in EUR, <strong>and</strong> the rest in SEK, DKK, NOK <strong>and</strong> GBP.<br />

Purchases are mainly paid in EUR. Fuel oil purchases are made in USD. Fuel price clauses included in customer contracts cover part<br />

of this USD risk. Currency positions are reviewed for each currency every 12 months when annual budgets are made. In <strong>2007</strong>, the<br />

currency risk arising from the cash fl ow in foreign currencies resulting from operations was hedged for the next 3-month-period fully<br />

against USD <strong>and</strong> SEK. In <strong>2007</strong>, the Swedish companies changed over to mainly use EUR as their invoicing currency. For 2008, no<br />

transaction risk has been hedged separately by derivative fi nancial instruments.<br />

The Group's business units may make internal derivative contracts with the fi nance unit to hedge a specifi c activity. In such cases<br />

the fi nance unit also decides on any hedging to be made with an external counterpart based on the whole Group's net currency position<br />

according to the principles set by the Board of Directors.<br />

All of the Group's interest-bearing liabilities on the balance sheet date are in EUR. The Group has USD-denominated interest-bearing<br />

loan assets worth approximately EUR 4.1 million.<br />

Hedge accounting<br />

The Group has ordered six ro-ro vessels from the Chinese Jinling shipyard at a total price of approximately EUR 240 million. These vessels<br />

will be paid partly in USD but the instalments have been fully hedged against EUR. The Group applies hedge accounting in accordance<br />

with IAS 39 to the these derivative contracts for the spot part of the currency forward. It is considered as hedging of cash<br />

fl ow from a highly probable transaction. The following table shows the duration <strong>and</strong> fair values.