GMR Infrastructure Limited - BSE

GMR Infrastructure Limited - BSE

GMR Infrastructure Limited - BSE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

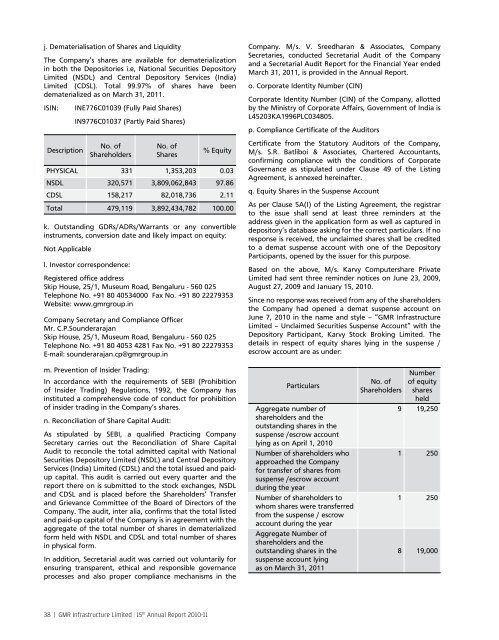

j. Dematerialisation of Shares and Liquidity<br />

The Company’s shares are available for dematerialization<br />

in both the Depositories i.e, National Securities Depository<br />

<strong>Limited</strong> (NSDL) and Central Depository Services (India)<br />

<strong>Limited</strong> (CDSL). Total 99.97% of shares have been<br />

dematerialized as on March 31, 2011.<br />

ISIN: INE776C01039 (Fully Paid Shares)<br />

IN9776C01037 (Partly Paid Shares)<br />

Description<br />

No. of<br />

Shareholders<br />

No. of<br />

Shares<br />

% Equity<br />

PHYSICAL 331 1,353,203 0.03<br />

NSDL 320,571 3,809,062,843 97.86<br />

CDSL 158,217 82,018,736 2.11<br />

Total 479,119 3,892,434,782 100.00<br />

k. Outstanding GDRs/ADRs/Warrants or any convertible<br />

instruments, conversion date and likely impact on equity:<br />

Not Applicable<br />

l. Investor correspondence:<br />

Registered office address<br />

Skip House, 25/1, Museum Road, Bengaluru - 560 025<br />

Telephone No. +91 80 40534000 Fax No. +91 80 22279353<br />

Website: www.gmrgroup.in<br />

Company Secretary and Compliance Officer<br />

Mr. C.P.Sounderarajan<br />

Skip House, 25/1, Museum Road, Bengaluru - 560 025<br />

Telephone No. +91 80 4053 4281 Fax No. +91 80 22279353<br />

E-mail: sounderarajan.cp@gmrgroup.in<br />

m. Prevention of Insider Trading:<br />

In accordance with the requirements of SEBI (Prohibition<br />

of Insider Trading) Regulations, 1992, the Company has<br />

instituted a comprehensive code of conduct for prohibition<br />

of insider trading in the Company’s shares.<br />

n. Reconciliation of Share Capital Audit:<br />

As stipulated by SEBI, a qualified Practicing Company<br />

Secretary carries out the Reconciliation of Share Capital<br />

Audit to reconcile the total admitted capital with National<br />

Securities Depository <strong>Limited</strong> (NSDL) and Central Depository<br />

Services (India) <strong>Limited</strong> (CDSL) and the total issued and paidup<br />

capital. This audit is carried out every quarter and the<br />

report there on is submitted to the stock exchanges, NSDL<br />

and CDSL and is placed before the Shareholders’ Transfer<br />

and Grievance Committee of the Board of Directors of the<br />

Company. The audit, inter alia, confirms that the total listed<br />

and paid-up capital of the Company is in agreement with the<br />

aggregate of the total number of shares in dematerialized<br />

form held with NSDL and CDSL and total number of shares<br />

in physical form.<br />

In addition, Secretarial audit was carried out voluntarily for<br />

ensuring transparent, ethical and responsible governance<br />

processes and also proper compliance mechanisms in the<br />

Company. M/s. V. Sreedharan & Associates, Company<br />

Secretaries, conducted Secretarial Audit of the Company<br />

and a Secretarial Audit Report for the Financial Year ended<br />

March 31, 2011, is provided in the Annual Report.<br />

o. Corporate Identity Number (CIN)<br />

Corporate Identity Number (CIN) of the Company, allotted<br />

by the Ministry of Corporate Affairs, Government of India is<br />

L45203KA1996PLC034805.<br />

p. Compliance Certificate of the Auditors<br />

Certificate from the Statutory Auditors of the Company,<br />

M/s. S.R. Batliboi & Associates, Chartered Accountants,<br />

confirming compliance with the conditions of Corporate<br />

Governance as stipulated under Clause 49 of the Listing<br />

Agreement, is annexed hereinafter.<br />

q. Equity Shares in the Suspense Account<br />

As per Clause 5A(I) of the Listing Agreement, the registrar<br />

to the issue shall send at least three reminders at the<br />

address given in the application form as well as captured in<br />

depository’s database asking for the correct particulars. If no<br />

response is received, the unclaimed shares shall be credited<br />

to a demat suspense account with one of the Depository<br />

Participants, opened by the issuer for this purpose.<br />

Based on the above, M/s. Karvy Computershare Private<br />

<strong>Limited</strong> had sent three reminder notices on June 23, 2009,<br />

August 27, 2009 and January 15, 2010.<br />

Since no response was received from any of the shareholders<br />

the Company had opened a demat suspense account on<br />

June 7, 2010 in the name and style – “<strong>GMR</strong> <strong>Infrastructure</strong><br />

<strong>Limited</strong> – Unclaimed Securities Suspense Account” with the<br />

Depository Participant, Karvy Stock Broking <strong>Limited</strong>. The<br />

details in respect of equity shares lying in the suspense /<br />

escrow account are as under:<br />

Particulars<br />

Aggregate number of<br />

shareholders and the<br />

outstanding shares in the<br />

suspense /escrow account<br />

lying as on April 1, 2010<br />

Number of shareholders who<br />

approached the Company<br />

for transfer of shares from<br />

suspense /escrow account<br />

during the year<br />

Number of shareholders to<br />

whom shares were transferred<br />

from the suspense / escrow<br />

account during the year<br />

Aggregate Number of<br />

shareholders and the<br />

outstanding shares in the<br />

suspense account lying<br />

as on March 31, 2011<br />

No. of<br />

Shareholders<br />

Number<br />

of equity<br />

shares<br />

held<br />

9 19,250<br />

1 250<br />

1 250<br />

8 19,000<br />

38 | <strong>GMR</strong> <strong>Infrastructure</strong> <strong>Limited</strong> | 15 th Annual Report 2010-11