GMR Infrastructure Limited - BSE

GMR Infrastructure Limited - BSE

GMR Infrastructure Limited - BSE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

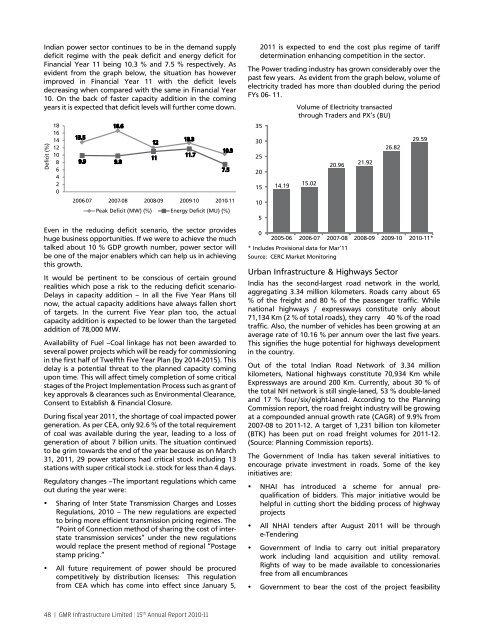

Indian power sector continues to be in the demand supply<br />

deficit regime with the peak deficit and energy deficit for<br />

Financial Year 11 being 10.3 % and 7.5 % respectively. As<br />

evident from the graph below, the situation has however<br />

improved in Financial Year 11 with the deficit levels<br />

decreasing when compared with the same in Financial Year<br />

10. On the back of faster capacity addition in the coming<br />

years it is expected that deficit levels will further come down.<br />

Deficit (%)<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

13.5<br />

16.6<br />

9.9 9.8<br />

12<br />

11<br />

13.3<br />

11.7<br />

10.3<br />

2006-07 2007-08 2008-09 2009-10 2010-11<br />

7.5<br />

Peak Deficit (MW) (%) Energy Deficit (MU) (%)<br />

Even in the reducing deficit scenario, the sector provides<br />

huge business opportunities. If we were to achieve the much<br />

talked about 10 % GDP growth number, power sector will<br />

be one of the major enablers which can help us in achieving<br />

this growth.<br />

It would be pertinent to be conscious of certain ground<br />

realities which pose a risk to the reducing deficit scenario-<br />

Delays in capacity addition – In all the Five Year Plans till<br />

now, the actual capacity additions have always fallen short<br />

of targets. In the current Five Year plan too, the actual<br />

capacity addition is expected to be lower than the targeted<br />

addition of 78,000 MW.<br />

Availability of Fuel –Coal linkage has not been awarded to<br />

several power projects which will be ready for commissioning<br />

in the first half of Twelfth Five Year Plan (by 2014-2015). This<br />

delay is a potential threat to the planned capacity coming<br />

upon time. This will affect timely completion of some critical<br />

stages of the Project Implementation Process such as grant of<br />

key approvals & clearances such as Environmental Clearance,<br />

Consent to Establish & Financial Closure.<br />

During fiscal year 2011, the shortage of coal impacted power<br />

generation. As per CEA, only 92.6 % of the total requirement<br />

of coal was available during the year, leading to a loss of<br />

generation of about 7 billion units. The situation continued<br />

to be grim towards the end of the year because as on March<br />

31, 2011, 29 power stations had critical stock including 13<br />

stations with super critical stock i.e. stock for less than 4 days.<br />

Regulatory changes –The important regulations which came<br />

out during the year were:<br />

• y Sharing of Inter State Transmission Charges and Losses<br />

Regulations, 2010 – The new regulations are expected<br />

to bring more efficient transmission pricing regimes. The<br />

“Point of Connection method of sharing the cost of interstate<br />

transmission services” under the new regulations<br />

would replace the present method of regional “Postage<br />

stamp pricing.”<br />

• y All future requirement of power should be procured<br />

competitively by distribution licenses: This regulation<br />

from CEA which has come into effect since January 5,<br />

2011 is expected to end the cost plus regime of tariff<br />

determination enhancing competition in the sector.<br />

The Power trading industry has grown considerably over the<br />

past few years. As evident from the graph below, volume of<br />

electricity traded has more than doubled during the period<br />

FYs 06- 11.<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

14.19 15.02<br />

2005-06<br />

Volume of Electricity transacted<br />

through Traders and PX’s (BU)<br />

20.96<br />

* Includes Provisional data for Mar’11<br />

Source: CERC Market Monitoring<br />

21.92<br />

26.82<br />

29.59<br />

2006-07 2007-08 2008-09 2009-10 2010-11*<br />

Urban <strong>Infrastructure</strong> & Highways Sector<br />

India has the second-largest road network in the world,<br />

aggregating 3.34 million kilometers. Roads carry about 65<br />

% of the freight and 80 % of the passenger traffic. While<br />

national highways / expressways constitute only about<br />

71,134 Km (2 % of total roads), they carry 40 % of the road<br />

traffic. Also, the number of vehicles has been growing at an<br />

average rate of 10.16 % per annum over the last five years.<br />

This signifies the huge potential for highways development<br />

in the country.<br />

Out of the total Indian Road Network of 3.34 million<br />

kilometers, National highways constitute 70,934 Km while<br />

Expressways are around 200 Km. Currently, about 30 % of<br />

the total NH network is still single-laned, 53 % double-laned<br />

and 17 % four/six/eight-laned. According to the Planning<br />

Commission report, the road freight industry will be growing<br />

at a compounded annual growth rate (CAGR) of 9.9% from<br />

2007-08 to 2011-12. A target of 1,231 billion ton kilometer<br />

(BTK) has been put on road freight volumes for 2011-12.<br />

(Source: Planning Commission reports).<br />

The Government of India has taken several initiatives to<br />

encourage private investment in roads. Some of the key<br />

initiatives are:<br />

• y NHAI has introduced a scheme for annual prequalification<br />

of bidders. This major initiative would be<br />

helpful in cutting short the bidding process of highway<br />

projects<br />

• y All NHAI tenders after August 2011 will be through<br />

e-Tendering<br />

• y Government of India to carry out initial preparatory<br />

work including land acquisition and utility removal.<br />

Rights of way to be made available to concessionaries<br />

free from all encumbrances<br />

• y Government to bear the cost of the project feasibility<br />

48 | <strong>GMR</strong> <strong>Infrastructure</strong> <strong>Limited</strong> | 15 th Annual Report 2010-11