- Page 1 and 2:

The Annual CONDITION OF EDUCATION R

- Page 3 and 4:

State Board of Education State of I

- Page 5 and 6:

To the Citizens of Iowa Our 14 th A

- Page 7 and 8:

Contents BACKGROUND DEMOGRAPHICS ..

- Page 9 and 10:

Contents STUDENT PERFORMANCE2......

- Page 12 and 13:

BACKGROUND DEMOGRAPHICS Introductio

- Page 14 and 15:

Population and Demographics Populat

- Page 16 and 17:

Population and Demographics Iowa Po

- Page 18 and 19:

Population and Demographics Birth R

- Page 20 and 21:

Population and Demographics Househo

- Page 22 and 23:

Population and Demographics Migrati

- Page 24 and 25:

Economics Average Weekly Wage FIGUR

- Page 26 and 27:

Social Children Poverty - States FI

- Page 28 and 29:

Social Educational Attainment TABLE

- Page 30 and 31:

Social Educational Attainment FIGUR

- Page 32 and 33:

Social Educational Attainment TABLE

- Page 34 and 35:

Social Eligible for Free or Reduced

- Page 36 and 37:

Social Most Livable States TABLE 5B

- Page 38 and 39:

Social Working Parents FIGURE 20B

- Page 40 and 41:

INTRODUCTION TO GRADES PK-12 Inform

- Page 42 and 43:

ENROLLMENT Enrollment information p

- Page 44 and 45:

Table 2 presents information pertai

- Page 46 and 47:

Among states in the region, Illinoi

- Page 48 and 49:

Historical and projected Iowa publi

- Page 50 and 51:

Enrollment Changes for the Nation I

- Page 52 and 53:

Figure 6 Number of School Districts

- Page 54 and 55:

Table 11 Source: IOWA NONPUBLIC SCH

- Page 56 and 57:

Enrollment Distribution by Area Edu

- Page 58 and 59:

Table 15 IOWA PUBLIC SCHOOL CERTIFI

- Page 60 and 61:

Table 16 IOWA PUBLIC SCHOOL PK-12 E

- Page 62 and 63:

Weighted English Language Learners

- Page 64 and 65:

Table 20 % of Total ELL Language 19

- Page 66 and 67:

Figure 11 Number of Students 30,000

- Page 68:

Figure 12 SPECIAL EDUCATION ENROLLM

- Page 71 and 72:

Table 24 CHARACTERISTICS OF IOWA FU

- Page 73 and 74:

Figure 13 IOWA FULL-TIME PUBLIC SCH

- Page 76 and 77:

Beginning Full-time Public School T

- Page 78 and 79:

Minority Teacher Characteristics Mi

- Page 80 and 81:

Tables 35 through 37 present public

- Page 82 and 83:

Average Regular Salary vs. Average

- Page 84 and 85:

Teacher Salaries by Area Education

- Page 86 and 87:

Teacher Salary Comparisons with Oth

- Page 88 and 89:

Beginning Teacher Salary Comparison

- Page 90 and 91:

Characteristics of Principals Chara

- Page 92 and 93:

Table 47 COMBINED AGE AND EXPERIENC

- Page 94 and 95:

Characteristics of Superintendents

- Page 96 and 97:

Figure 20 COMBINED AGE AND EXPERIEN

- Page 98 and 99:

Average salaries by enrollment cate

- Page 100 and 101:

Table 55 Source: Note: GENDER COMPA

- Page 102 and 103:

The distribution of Iowa public sch

- Page 104 and 105:

Pupil-Teacher Ratios Figures 23 and

- Page 106:

Table 60 K-12 PUPIL-TEACHER RATIOS

- Page 109 and 110:

Table 62 ORGANIZATIONAL STRUCTURES

- Page 111 and 112:

Table 64 presents average curriculu

- Page 113 and 114:

Foreign Language Enrollments Total

- Page 115 and 116:

Higher Level Science Enrollments Ta

- Page 117 and 118:

Computer-Related Course Enrollments

- Page 119 and 120:

The frequency distribution of mathe

- Page 121 and 122:

Findings A comparison of average cl

- Page 123 and 124:

The variation in change to average

- Page 125 and 126:

Although the percentage of classroo

- Page 127 and 128:

Figure 26 DISTRIBUTIONS OF IOWA PUB

- Page 129 and 130:

Figure 27 DISTRIBUTIONS OF IOWA PUB

- Page 131 and 132:

Figure 28 DISTRIBUTIONS OF IOWA PUB

- Page 133 and 134:

Figure 29 DISTRIBUTIONS OF IOWA PUB

- Page 135 and 136:

Class Size Expenditures Over 97 per

- Page 137 and 138:

Public school expenditures for comp

- Page 139 and 140:

Table 92 NUMBER OF COMPUTERS IN IOW

- Page 141 and 142:

Table 93 2000-2001 NUMBER OF COMPUT

- Page 143 and 144:

Project EASIER (Electronic Access S

- Page 145 and 146:

Table 97 shows the number of public

- Page 147 and 148:

In 2002-2003, all-day, everyday two

- Page 149 and 150:

138

- Page 151 and 152:

For many years, statewide achieveme

- Page 153 and 154:

Subgroup Iowa Student Counts for IT

- Page 155 and 156:

Table 104 APPROXIMATE AVERAGE NUMBE

- Page 157 and 158:

Figure 38A PERCENT OF IOWA FOURTH G

- Page 159 and 160:

Figure 40A PERCENT OF IOWA FOURTH G

- Page 161 and 162:

Figure 42A PERCENT OF IOWA FOURTH G

- Page 163 and 164:

Figure 44A PERCENT OF IOWA EIGHTH G

- Page 165 and 166:

Figure 46A PERCENT OF IOWA EIGHTH G

- Page 167 and 168:

Figure 48A PERCENT OF IOWA EIGHTH G

- Page 169 and 170:

Figure 50 PERCENT OF IOWA ELEVENTH

- Page 171 and 172:

Figure 52A PERCENT OF IOWA ELEVENTH

- Page 173 and 174:

Figure 54A PERCENT OF IOWA ELEVENTH

- Page 175 and 176:

Figure 56A PERCENT OF IOWA ELEVENTH

- Page 177 and 178:

Figure 58A PERCENT OF IOWA FOURTH G

- Page 179 and 180:

Figure 60A PERCENT OF IOWA FOURTH G

- Page 181 and 182:

Figure 62A PERCENT OF IOWA FOURTH G

- Page 183 and 184:

Figure 64 PERCENT OF IOWA EIGHTH GR

- Page 185 and 186:

Figure 66A PERCENT OF IOWA EIGHTH G

- Page 187 and 188:

Figure 68A PERCENT OF IOWA EIGHTH G

- Page 189 and 190:

Figure 70A PERCENT OF IOWA EIGHTH G

- Page 191 and 192:

Figure 72A PERCENT OF IOWA ELEVENTH

- Page 193 and 194:

Figure 74A PERCENT OF IOWA ELEVENTH

- Page 195 and 196:

Figure 76A PERCENT OF IOWA ELEVENTH

- Page 197 and 198:

Science Indicator: Percentage of al

- Page 199 and 200:

Figure 82 PERCENT OF IOWA EIGHTH GR

- Page 201 and 202:

Figure 86 PERCENT OF IOWA ELEVENTH

- Page 203 and 204:

Dropouts Indicator: Percentage of s

- Page 205 and 206:

High School Graduation Rates Indica

- Page 207 and 208:

Postsecondary Education/Training In

- Page 209 and 210:

Iowa Testing Programs Iowa Testing

- Page 211 and 212:

Average ITBS Reading Comprehension

- Page 213 and 214:

Iowa Tests of Educational Developme

- Page 215 and 216:

Average ITED Mathematics scores for

- Page 217 and 218:

Table 105 shows how 2001-2002 Iowa

- Page 219 and 220:

Figure 108 COMPARISON OF THE PERCEN

- Page 221 and 222:

There was about a four percentage p

- Page 223 and 224:

Achievement Levels for Mathematics

- Page 225 and 226:

Figure 115 ITED MATHEMATICS - GRADE

- Page 227 and 228:

Figure 117 ITED SCIENCE - GRADE 11

- Page 229 and 230:

The percentage of Iowa graduates th

- Page 231 and 232: Figure 119 ores 36 31 IOWA AND NATI

- Page 233 and 234: Figure 122 AVERAGE ACT READING SCOR

- Page 235 and 236: Figure 124 PERCENT OF ACT PARTICIPA

- Page 237 and 238: Figure 126 DISTRIBUTION OF IOWA ACT

- Page 239 and 240: ACT Scores by Gender Figure 128 com

- Page 241 and 242: The average ACT composite scores by

- Page 243 and 244: Iowa Student Satisfaction with Sele

- Page 245 and 246: Figure 130 TRENDS OF AVERAGE SAT SC

- Page 247 and 248: Advanced Placement (AP) The Advance

- Page 249 and 250: Table 128 ADVANCED PLACEMENT EXAM S

- Page 251 and 252: Table 131 shows the AP school parti

- Page 253 and 254: National Assessment of Educational

- Page 255 and 256: Pursuit of Postsecondary Education/

- Page 257 and 258: The percent of high school graduate

- Page 259 and 260: Table 138 IOWA POSTSECONDARY ENROLL

- Page 261 and 262: Although the total number of course

- Page 263 and 264: Table 141 TOTAL IOWA PUBLIC SCHOOL

- Page 265 and 266: Figure 140 COMPARISON OF THE PERCEN

- Page 267 and 268: High School Graduation Rates The De

- Page 269 and 270: Graduation data by race/ethnicity a

- Page 271 and 272: Table 150 displays data from the Na

- Page 273 and 274: Highly Qualified Teacher Comparison

- Page 275 and 276: 264

- Page 277 and 278: Table 155 provides function categor

- Page 279 and 280: Table 158 REVENUES BY SOURCE AS A P

- Page 281: Figure 143 PERCENT OF TOTAL GENERAL

- Page 285 and 286: Figure 145 IOWA AND MIDWEST STATES

- Page 287 and 288: Property Taxes Table 165 displays t

- Page 289 and 290: Table 167 provides total property t

- Page 291 and 292: Total taxes for the regular and vot

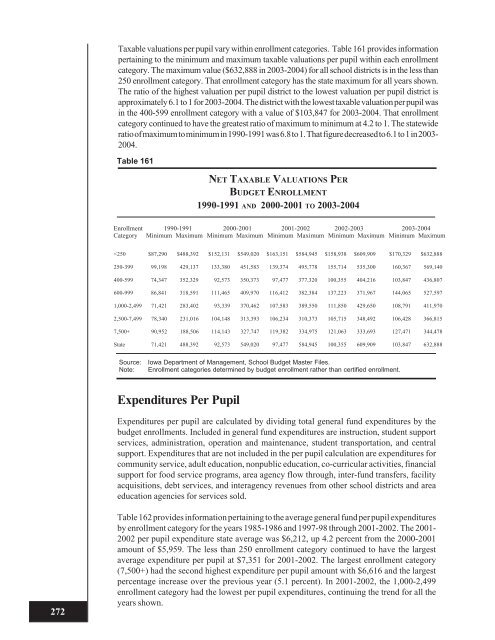

- Page 293 and 294: through 2003-2004, two enrollment c

- Page 295 and 296: Figure 146 INSTRUCTIONAL SUPPORT PR

- Page 297 and 298: Table 174 INSTRUCTIONAL SUPPORT PRO

- Page 299 and 300: Figure 148 NUMBER AND PERCENT OF IO

- Page 301 and 302: Bond Elections The number of distri

- Page 303 and 304: Table 178 LOCAL OPTION SALES AND SE