South Coast Metropole South Coast Metropole - King Sturge

South Coast Metropole South Coast Metropole - King Sturge

South Coast Metropole South Coast Metropole - King Sturge

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Retail and leisure market review<br />

On a macro level, the retail sector fared extremely<br />

well in 2007. Despite the cumulative effects of<br />

five interest rate rises over a short space of time,<br />

rising energy costs, the wettest summer on record<br />

and the well-documented credit crunch, consumer<br />

confidence remained remarkably robust. Monthly<br />

like-for-like retail sales were ahead of the previous<br />

year for every month during 2007.<br />

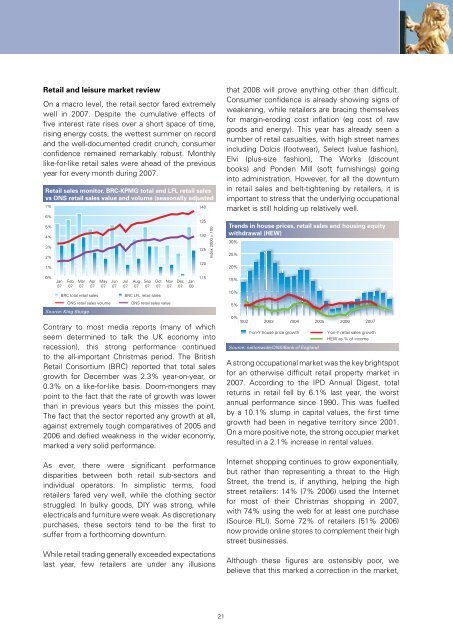

Retail sales monitor. BRC-KPMG total and LFL retail sales<br />

vs ONS retail sales value and volume (seasonally adjusted<br />

7%<br />

6%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

Jan<br />

07<br />

Feb<br />

07<br />

Mar<br />

07<br />

Apr<br />

07<br />

BRC total retail sales<br />

Source: <strong>King</strong> <strong>Sturge</strong><br />

May<br />

07<br />

ONS retail sales volume<br />

Jun<br />

07<br />

Jul<br />

07<br />

Aug<br />

07<br />

Sep<br />

07<br />

Oct<br />

07<br />

BRC LFL retail sales<br />

Nov<br />

07<br />

ONS retail sales value<br />

Contrary to most media reports (many of which<br />

seem determined to talk the UK economy into<br />

recession), this strong performance continued<br />

to the all-important Christmas period. The British<br />

Retail Consortium (BRC) reported that total sales<br />

growth for December was 2.3% year-on-year, or<br />

0.3% on a like-for-like basis. Doom-mongers may<br />

point to the fact that the rate of growth was lower<br />

than in previous years but this misses the point.<br />

The fact that the sector reported any growth at all,<br />

against extremely tough comparatives of 2005 and<br />

2006 and defied weakness in the wider economy,<br />

marked a very solid performance.<br />

As ever, there were significant performance<br />

disparities between both retail sub-sectors and<br />

individual operators. In simplistic terms, food<br />

retailers fared very well, while the clothing sector<br />

struggled. In bulky goods, DIY was strong, while<br />

electricals and furniture were weak. As discretionary<br />

purchases, these sectors tend to be the first to<br />

suffer from a forthcoming downturn.<br />

While retail trading generally exceeded expectations<br />

last year, few retailers are under any illusions<br />

Dec<br />

07<br />

Jan<br />

08<br />

140<br />

135<br />

130<br />

125<br />

120<br />

115<br />

Index 2000 = 100<br />

that 2008 will prove anything other than difficult.<br />

Consumer confidence is already showing signs of<br />

weakening, while retailers are bracing themselves<br />

for margin-eroding cost inflation (eg cost of raw<br />

goods and energy). This year has already seen a<br />

number of retail casualties, with high street names<br />

including Dolcis (footwear), Select (value fashion),<br />

Elvi (plus-size fashion), The Works (discount<br />

books) and Ponden Mill (soft furnishings) going<br />

into administration. However, for all the downturn<br />

in retail sales and belt-tightening by retailers, it is<br />

important to stress that the underlying occupational<br />

market is still holding up relatively well.<br />

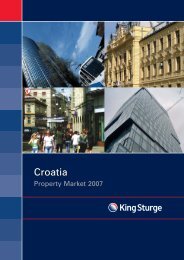

Trends in house prices, retail sales and housing equity<br />

withdrawal (HEW)<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

2002<br />

2003<br />

2004<br />

Y-on-Y house price growth<br />

Source: nationwide/ONS/Bank of England<br />

2005<br />

2006<br />

2007<br />

Y-on-Y retail sales growth<br />

HEW as % of income<br />

A strong occupational market was the key brightspot<br />

for an otherwise difficult retail property market in<br />

2007. According to the IPD Annual Digest, total<br />

returns in retail fell by 6.1% last year, the worst<br />

annual performance since 1990. This was fuelled<br />

by a 10.1% slump in capital values, the first time<br />

growth had been in negative territory since 2001.<br />

On a more positive note, the strong occupier market<br />

resulted in a 2.1% increase in rental values.<br />

Internet shopping continues to grow exponentially,<br />

but rather than representing a threat to the High<br />

Street, the trend is, if anything, helping the high<br />

street retailers: 14% (7% 2006) used the Internet<br />

for most of their Christmas shopping in 2007,<br />

with 74% using the web for at least one purchase<br />

(Source RLI). Some 72% of retailers (51% 2006)<br />

now provide online stores to complement their high<br />

street businesses.<br />

Although these figures are ostensibly poor, we<br />

believe that this marked a correction in the market,<br />

21