Interim Report 2/2010 - Hannover Re

Interim Report 2/2010 - Hannover Re

Interim Report 2/2010 - Hannover Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

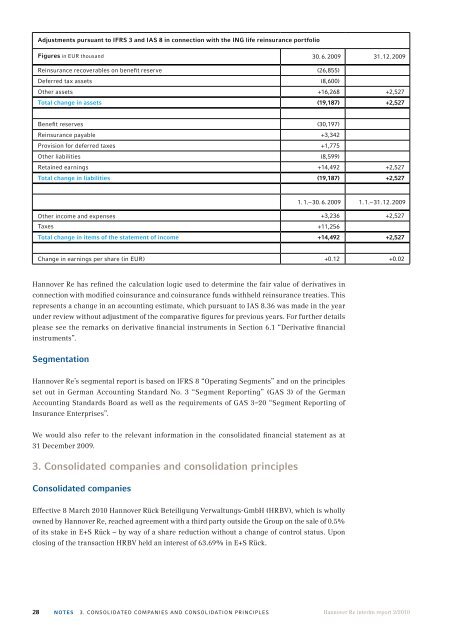

Adjustments pursuant to IFRS 3 and IAS 8 in connection with the ING life reinsurance portfolio<br />

Figures in EUR thousand 30. 6. 2009 31. 12. 2009<br />

<strong>Re</strong>insurance recoverables on benefit reserve (26,855)<br />

Deferred tax assets (8,600)<br />

Other assets +16,268 +2,527<br />

Total change in assets (19,187) +2,527<br />

Benefit reserves (30,197)<br />

<strong>Re</strong>insurance payable +3,342<br />

Provision for deferred taxes +1,775<br />

Other liabilities (8,599)<br />

<strong>Re</strong>tained earnings +14,492 +2,527<br />

Total change in liabilities (19,187) +2,527<br />

1. 1.– 30. 6. 2009 1. 1.– 31. 12. 2009<br />

Other income and expenses +3,236 +2,527<br />

Taxes +11,256<br />

Total change in items of the statement of income +14,492 +2,527<br />

Change in earnings per share (in EUR) +0.12 +0.02<br />

<strong>Hannover</strong> <strong>Re</strong> has refined the calculation logic used to determine the fair value of derivatives in<br />

connection with modified coinsurance and coinsurance funds withheld reinsurance treaties. This<br />

represents a change in an accounting estimate, which pursuant to IAS 8.36 was made in the year<br />

under review without adjustment of the comparative figures for previous years. For further details<br />

please see the remarks on derivative financial instruments in Section 6.1 “Derivative financial<br />

instruments”.<br />

Segmentation<br />

<strong>Hannover</strong> <strong>Re</strong>’s segmental report is based on IFRS 8 “Operating Segments” and on the principles<br />

set out in German Accounting Standard No. 3 “Segment <strong><strong>Re</strong>port</strong>ing” (GAS 3) of the German<br />

Accounting Standards Board as well as the requirements of GAS 3–20 “Segment <strong><strong>Re</strong>port</strong>ing of<br />

Insurance Enterprises”.<br />

We would also refer to the relevant information in the consolidated financial statement as at<br />

31 December 2009.<br />

3. Consolidated companies and consolidation principles<br />

Consolidated companies<br />

Effective 8 March <strong>2010</strong> <strong>Hannover</strong> Rück Beteiligung Verwaltungs-GmbH (HRBV), which is wholly<br />

owned by <strong>Hannover</strong> <strong>Re</strong>, reached agreement with a third party outside the Group on the sale of 0.5%<br />

of its stake in E+S Rück – by way of a share reduction without a change of control status. Upon<br />

closing of the transaction HRBV held an interest of 63.69% in E+S Rück.<br />

28 NOTES 3. Consolidated companies and consolidation principles<br />

<strong>Hannover</strong> <strong>Re</strong> interim report 2/<strong>2010</strong>