Interim Report 2/2010 - Hannover Re

Interim Report 2/2010 - Hannover Re

Interim Report 2/2010 - Hannover Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

IAS 1 requires separate disclosure of treasury shares in shareholders’ equity. As part of this year’s<br />

employee share purchase scheme <strong>Hannover</strong> <strong>Re</strong> acquired altogether 23,163 treasury shares during<br />

the second quarter of <strong>2010</strong> and delivered them to eligible employees at preferential conditions.<br />

These shares are blocked until 31 May 2014. This transaction reduced retained earnings by an<br />

amount of EUR 0.3 million. The company was no longer in possession of treasury shares as at the<br />

balance sheet date.<br />

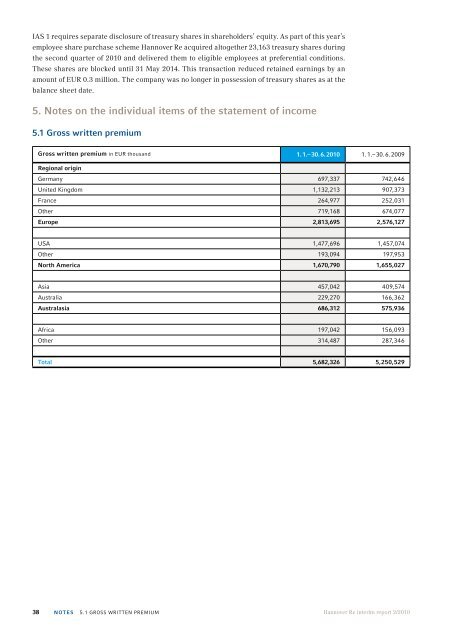

5. Notes on the individual items of the statement of income<br />

5.1 Gross written premium<br />

Gross written premium in EUR thousand 1. 1.– 30. 6. <strong>2010</strong> 1. 1.– 30. 6. 2009<br />

<strong>Re</strong>gional origin<br />

Germany 697,337 742,646<br />

United Kingdom 1,132,213 907,373<br />

France 264,977 252,031<br />

Other 719,168 674,077<br />

Europe 2,813,695 2,576,127<br />

USA 1,477,696 1,457,074<br />

Other 193,094 197,953<br />

North America 1,670,790 1,655,027<br />

Asia 457,042 409,574<br />

Australia 229,270 166,362<br />

Australasia 686,312 575,936<br />

Africa 197,042 156,093<br />

Other 314,487 287,346<br />

Total 5,682,326 5,250,529<br />

38 NOTES 5.1 Gross written premium<br />

<strong>Hannover</strong> <strong>Re</strong> interim report 2/<strong>2010</strong>