Interim Report 2/2010 - Hannover Re

Interim Report 2/2010 - Hannover Re

Interim Report 2/2010 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

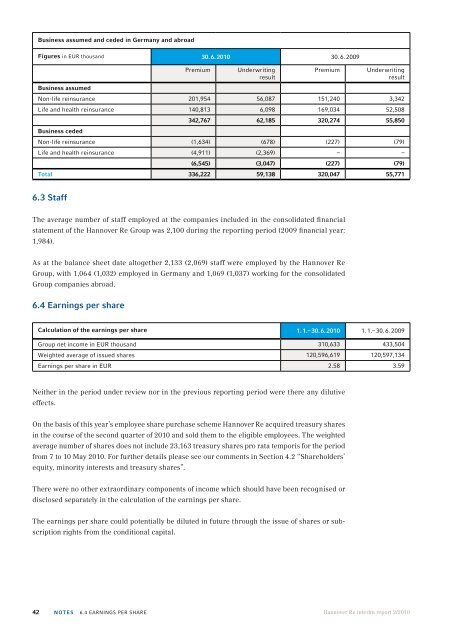

Business assumed and ceded in Germany and abroad<br />

Figures in EUR thousand 30. 6. <strong>2010</strong> 30. 6. 2009<br />

Premium<br />

Underwriting<br />

result<br />

Premium<br />

Underwriting<br />

result<br />

Business assumed<br />

Non-life reinsurance 201,954 56,087 151,240 3,342<br />

Life and health reinsurance 140,813 6,098 169,034 52,508<br />

342,767 62,185 320,274 55,850<br />

Business ceded<br />

Non-life reinsurance (1,634) (678) (227) (79)<br />

Life and health reinsurance (4,911) (2,369) – –<br />

(6,545) (3,047) (227) (79)<br />

Total 336,222 59,138 320,047 55,771<br />

6.3 Staff<br />

The average number of staff employed at the companies included in the consolidated financial<br />

statement of the <strong>Hannover</strong> <strong>Re</strong> Group was 2,100 during the reporting period (2009 financial year:<br />

1,984).<br />

As at the balance sheet date altogether 2,133 (2,069) staff were employed by the <strong>Hannover</strong> <strong>Re</strong><br />

Group, with 1,064 (1,032) employed in Germany and 1,069 (1,037) working for the consolidated<br />

Group companies abroad.<br />

6.4 Earnings per share<br />

Calculation of the earnings per share 1. 1.– 30. 6. <strong>2010</strong> 1. 1.– 30. 6. 2009<br />

Group net income in EUR thousand 310,633 433,504<br />

Weighted average of issued shares 120,596,619 120,597,134<br />

Earnings per share in EUR 2.58 3.59<br />

Neither in the period under review nor in the previous reporting period were there any dilutive<br />

effects.<br />

On the basis of this year’s employee share purchase scheme <strong>Hannover</strong> <strong>Re</strong> acquired treasury shares<br />

in the course of the second quarter of <strong>2010</strong> and sold them to the eligible employees. The weighted<br />

average number of shares does not include 23,163 treasury shares pro rata temporis for the period<br />

from 7 to 10 May <strong>2010</strong>. For further details please see our comments in Section 4.2 “Shareholders’<br />

equity, minority interests and treasury shares”.<br />

There were no other extraordinary components of income which should have been recognised or<br />

disclosed separately in the calculation of the earnings per share.<br />

The earnings per share could potentially be diluted in future through the issue of shares or subscription<br />

rights from the conditional capital.<br />

42 NOTES 6.4 EARNINGS PER SHARE<br />

<strong>Hannover</strong> <strong>Re</strong> interim report 2/<strong>2010</strong>