Interim Report 2/2010 - Hannover Re

Interim Report 2/2010 - Hannover Re

Interim Report 2/2010 - Hannover Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

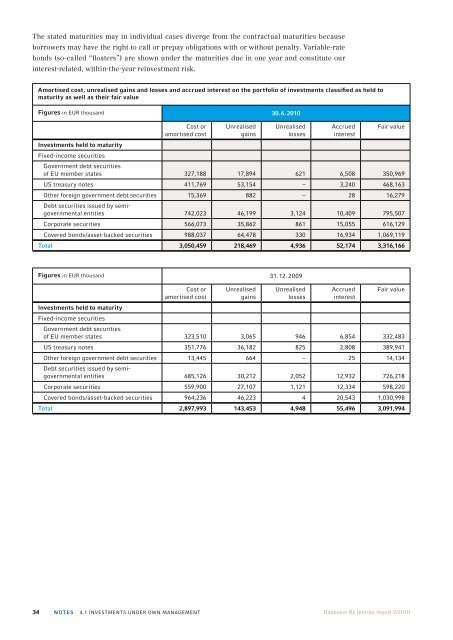

The stated maturities may in individual cases diverge from the contractual maturities because<br />

borrowers may have the right to call or prepay obligations with or without penalty. Variable-rate<br />

bonds (so-called “floaters”) are shown under the maturities due in one year and constitute our<br />

interest-related, within-the-year reinvestment risk.<br />

Amortised cost, unrealised gains and losses and accrued interest on the portfolio of investments classified as held to<br />

maturity as well as their fair value<br />

Figures in EUR thousand 30. 6. <strong>2010</strong><br />

Cost or<br />

amortised cost<br />

Unrealised<br />

gains<br />

Unrealised<br />

losses<br />

Accrued<br />

interest<br />

Fair value<br />

Investments held to maturity<br />

Fixed-income securities<br />

Government debt securities<br />

of EU member states 327,188 17,894 621 6,508 350,969<br />

US treasury notes 411,769 53,154 – 3,240 468,163<br />

Other foreign government debt securities 15,369 882 – 28 16,279<br />

Debt securities issued by semigovernmental<br />

entities 742,023 46,199 3,124 10,409 795,507<br />

Corporate securities 566,073 35,862 861 15,055 616,129<br />

Covered bonds/asset-backed securities 988,037 64,478 330 16,934 1,069,119<br />

Total 3,050,459 218,469 4,936 52,174 3,316,166<br />

Figures in EUR thousand 31. 12. 2009<br />

Cost or<br />

amortised cost<br />

Unrealised<br />

gains<br />

Unrealised<br />

losses<br />

Accrued<br />

interest<br />

Fair value<br />

Investments held to maturity<br />

Fixed-income securities<br />

Government debt securities<br />

of EU member states 323,510 3,065 946 6,854 332,483<br />

US treasury notes 351,776 36,182 825 2,808 389,941<br />

Other foreign government debt securities 13,445 664 – 25 14,134<br />

Debt securities issued by semigovernmental<br />

entities 685,126 30,212 2,052 12,932 726,218<br />

Corporate securities 559,900 27,107 1,121 12,334 598,220<br />

Covered bonds/asset-backed securities 964,236 46,223 4 20,543 1,030,998<br />

Total 2,897,993 143,453 4,948 55,496 3,091,994<br />

34 NOTES 4.1 Investments under own management<br />

<strong>Hannover</strong> <strong>Re</strong> interim report 2/<strong>2010</strong>