Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management report<br />

premium development and results<br />

Fire<br />

Fire<br />

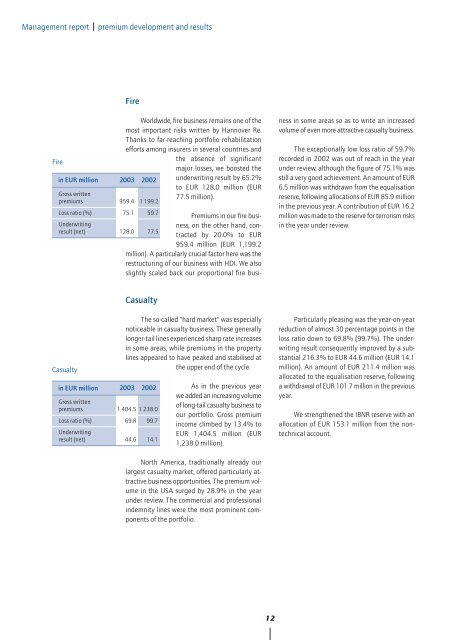

in EUR million<br />

Worldwide, fire business remains one of the<br />

most important risks written by <strong>Hannover</strong> <strong>Re</strong>.<br />

Thanks to far-reaching portfolio rehabilitation<br />

efforts among insurers in several countries and<br />

the absence of significant<br />

major losses, we boosted the<br />

<strong>2003</strong><br />

2002<br />

Gross written<br />

premiums 959.4 1 199.2<br />

underwriting result by 65.2%<br />

to EUR 128.0 million (EUR<br />

77.5 million).<br />

Loss ratio (%)<br />

Underwriting<br />

result (net)<br />

75.1<br />

128.0<br />

59.7<br />

77.5<br />

Premiums in our fire business,<br />

on the other hand, contracted<br />

by 20.0% to EUR<br />

959.4 million (EUR 1,199.2<br />

million). A particularly crucial factor here was the<br />

restructuring of our business with HDI. We also<br />

slightly scaled back our proportional fire busi-<br />

ness in some areas so as to write an increased<br />

volume of even more attractive casualty business.<br />

The exceptionally low loss ratio of 59.7%<br />

recorded in 2002 was out of reach in the year<br />

under review, although the figure of 75.1% was<br />

still a very good achievement. An amount of EUR<br />

6.5 million was withdrawn from the equalisation<br />

reserve, following allocations of EUR 85.9 million<br />

in the previous year. A contribution of EUR 16.2<br />

million was made to the reserve for terrorism risks<br />

in the year under review.<br />

Casualty<br />

Casualty<br />

in EUR million<br />

The so-called "hard market" was especially<br />

noticeable in casualty business. These generally<br />

longer-tail lines experienced sharp rate increases<br />

in some areas, while premiums in the property<br />

lines appeared to have peaked and stabilised at<br />

the upper end of the cycle.<br />

<strong>2003</strong><br />

2002<br />

Gross written<br />

premiums 1 404.5 1 238.0<br />

Loss ratio (%) 69.8 99.7<br />

Underwriting<br />

result (net) 44.6 14.1<br />

As in the previous year<br />

we added an increasing volume<br />

of long-tail casualty business to<br />

our portfolio. Gross premium<br />

income climbed by 13.4% to<br />

EUR 1,404.5 million (EUR<br />

1,238.0 million).<br />

Particularly pleasing was the year-on-year<br />

reduction of almost 30 percentage points in the<br />

loss ratio down to 69.8% (99.7%). The underwriting<br />

result consequently improved by a substantial<br />

216.3% to EUR 44.6 million (EUR 14.1<br />

million). An amount of EUR 211.4 million was<br />

allocated to the equalisation reserve, following<br />

a withdrawal of EUR 101.7 million in the previous<br />

year.<br />

We strengthened the IBNR reserve with an<br />

allocation of EUR 153.1 million from the nontechnical<br />

account.<br />

North America, traditionally already our<br />

largest casualty market, offered particularly attractive<br />

business opportunities. The premium volume<br />

in the USA surged by 28.9% in the year<br />

under review. The commercial and professional<br />

indemnity lines were the most prominent components<br />

of the portfolio.<br />

12