Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes<br />

notes on assets<br />

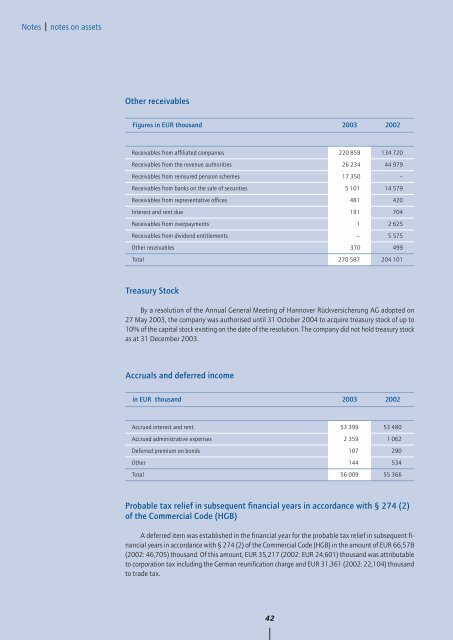

Other receivables<br />

Figures in EUR thousand<br />

<strong>2003</strong> 2002<br />

<strong>Re</strong>ceivables from affiliated companies 220 859 134 720<br />

<strong>Re</strong>ceivables from the revenue authorities 26 234 44 979<br />

<strong>Re</strong>ceivables from reinsured pension schemes 17 350 –<br />

<strong>Re</strong>ceivables from banks on the sale of securities 5 101 14 579<br />

<strong>Re</strong>ceivables from representative offices 481 420<br />

Interest and rent due 191 704<br />

<strong>Re</strong>ceivables from overpayments 1 2 625<br />

<strong>Re</strong>ceivables from dividend entitlements – 5 575<br />

Other receivables 370 499<br />

Total 270 587 204 101<br />

Treasury Stock<br />

By a resolution of the <strong>Annual</strong> General Meeting of <strong>Hannover</strong> Rückversicherung AG adopted on<br />

27 May <strong>2003</strong>, the company was authorised until 31 October 2004 to acquire treasury stock of up to<br />

10% of the capital stock existing on the date of the resolution. The company did not hold treasury stock<br />

as at 31 December <strong>2003</strong>.<br />

Accruals and deferred income<br />

in EUR thousand<br />

<strong>2003</strong> 2002<br />

Accrued interest and rent 53 399 53 480<br />

Accrued administrative expenses 2 359 1 062<br />

Deferred premium on bonds 107 290<br />

Other 144 534<br />

Total 56 009 55 366<br />

Probable tax relief in subsequent financial years in accordance with § 274 (2)<br />

of the Commercial Code (HGB)<br />

A deferred item was established in the financial year for the probable tax relief in subsequent financial<br />

years in accordance with § 274 (2) of the Commercial Code (HGB) in the amount of EUR 66,578<br />

(2002: 46,705) thousand. Of this amount, EUR 35,217 (2002: EUR 24,601) thousand was attributable<br />

to corporation tax including the German reunification charge and EUR 31,361 (2002: 22,104) thousand<br />

to trade tax.<br />

42