Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management report<br />

affiliated companies<br />

The anticipated positive underwriting cash<br />

flow should further boost the volume of assets.<br />

With interest rates remaining more or less unchanged<br />

and at least neutral extraordinary income,<br />

we expect an investment result roughly<br />

on a par with the <strong>2003</strong> financial year. Building<br />

upon the year under review, it is probable that<br />

we shall again cautiously increase our equity<br />

allocation. In the area of fixed-income securities<br />

we continue to set great store by the quality of<br />

our portfolio, and we are prepared to err on the<br />

side of caution and sacrifice one or two percentage<br />

points of yield to the benefit of flexibility<br />

and quality. We expect yields at the long end of<br />

the market to increase somewhat in the course<br />

of the year, and it is therefore likely that we shall<br />

again slightly extend the duration of our bond<br />

portfolio.<br />

In view of the expected development of our<br />

business groups and the economic environment,<br />

we should again be able in 2004 to significantly<br />

boost the profit for the year. As always, this is subject<br />

to the proviso that the burden of losses remains<br />

within the normal bounds of the multi-year<br />

average and that there are no unexpectedly adverse<br />

movements on capital markets.<br />

Affiliated companies<br />

We received an adequate consideration for<br />

all transactions with affiliated companies according<br />

to the circumstances of which we were<br />

aware at the time when the transactions were<br />

effected. We incurred no losses requiring compensation<br />

as defined by § 311 (1) of the Stock<br />

Corporation Act (AktG).<br />

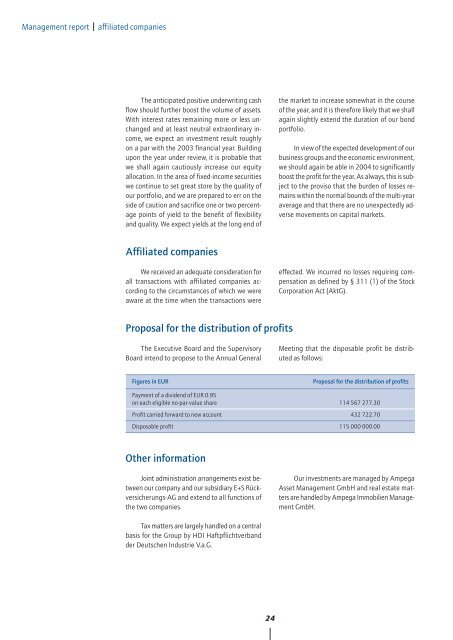

Proposal for the distribution of profits<br />

The Executive Board and the Supervisory<br />

Board intend to propose to the <strong>Annual</strong> General<br />

Meeting that the disposable profit be distributed<br />

as follows:<br />

Figures in EUR<br />

Proposal for the distribution of profits<br />

Payment of a dividend of EUR 0.95<br />

on each eligible no-par-value share 114 567 277.30<br />

Profit carried forward to new account 432 722.70<br />

Disposable profit 115 000 000.00<br />

Other information<br />

Joint administration arrangements exist between<br />

our company and our subsidiary E+S Rückversicherungs-AG<br />

and extend to all functions of<br />

the two companies.<br />

Our investments are managed by Ampega<br />

Asset Management GmbH and real estate matters<br />

are handled by Ampega Immobilien Management<br />

GmbH.<br />

Tax matters are largely handled on a central<br />

basis for the Group by HDI Haftpflichtverband<br />

der Deutschen Industrie V.a.G.<br />

24