Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes<br />

notes on assets<br />

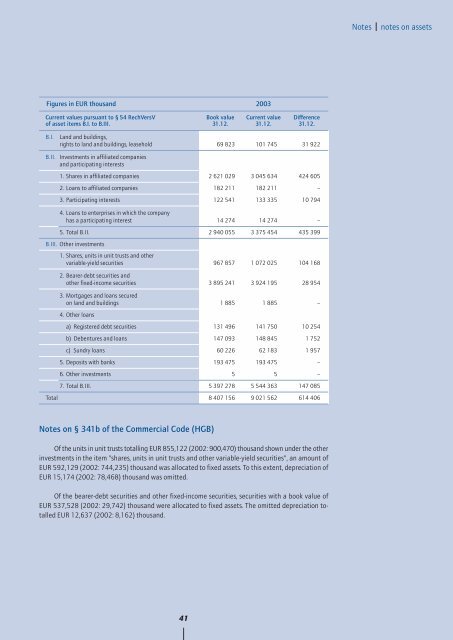

Figures in EUR thousand<br />

<strong>2003</strong><br />

Current values pursuant to § 54 <strong>Re</strong>chVersV<br />

of asset items B.I. to B.III.<br />

Book value<br />

31.12.<br />

Current value<br />

31.12.<br />

Difference<br />

31.12.<br />

B. I. Land and buildings,<br />

rights to land and buildings, leasehold 69 823 101 745 31 922<br />

B. II. Investments in affiliated companies<br />

and participating interests<br />

1. Shares in affiliated companies 2 621 029 3 045 634 424 605<br />

2. Loans to affiliated companies 182 211 182 211 –<br />

3. Participating interests 122 541 133 335 10 794<br />

4. Loans to enterprises in which the company<br />

has a participating interest 14 274 14 274 –<br />

5. Total B. II. 2 940 055 3 375 454 435 399<br />

B. III. Other investments<br />

1. Shares, units in unit trusts and other<br />

variable-yield securities 967 857 1 072 025 104 168<br />

2. Bearer-debt securities and<br />

other fixed-income securities 3 895 241 3 924 195 28 954<br />

3. Mortgages and loans secured<br />

on land and buildings 1 885 1 885 –<br />

4. Other loans<br />

a) <strong>Re</strong>gistered debt securities 131 496 141 750 10 254<br />

b) Debentures and loans 147 093 148 845 1 752<br />

c) Sundry loans 60 226 62 183 1 957<br />

5. Deposits with banks 193 475 193 475 –<br />

6. Other investments 5 5 –<br />

7. Total B. III. 5 397 278 5 544 363 147 085<br />

Total 8 407 156 9 021 562 614 406<br />

Notes on § 341b of the Commercial Code (HGB)<br />

Of the units in unit trusts totalling EUR 855,122 (2002: 900,470) thousand shown under the other<br />

investments in the item "shares, units in unit trusts and other variable-yield securities", an amount of<br />

EUR 592,129 (2002: 744,235) thousand was allocated to fixed assets. To this extent, depreciation of<br />

EUR 15,174 (2002: 78,468) thousand was omitted.<br />

Of the bearer-debt securities and other fixed-income securities, securities with a book value of<br />

EUR 537,528 (2002: 29,742) thousand were allocated to fixed assets. The omitted depreciation totalled<br />

EUR 12,637 (2002: 8,162) thousand.<br />

41