Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes<br />

notes on liabilities<br />

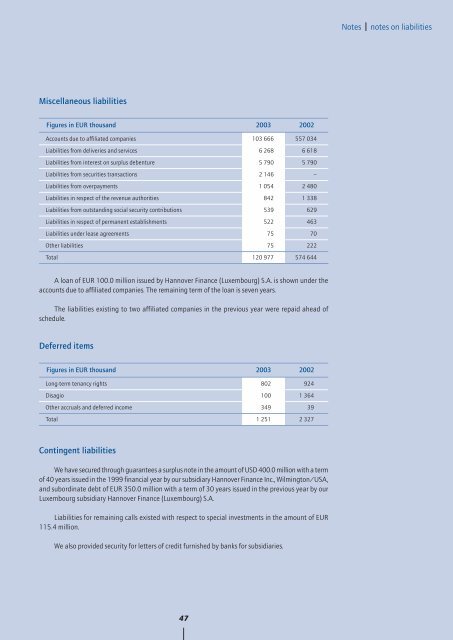

Miscellaneous liabilities<br />

Figures in EUR thousand<br />

<strong>2003</strong> 2002<br />

Accounts due to affiliated companies 103 666 557 034<br />

Liabilities from deliveries and services 6 268 6 618<br />

Liabilities from interest on surplus debenture 5 790 5 790<br />

Liabilities from securities transactions 2 146 –<br />

Liabilities from overpayments 1 054 2 480<br />

Liabilities in respect of the revenue authorities 842 1 338<br />

Liabilities from outstanding social security contributions 539 629<br />

Liabilities in respect of permanent establishments 522 463<br />

Liabilities under lease agreements 75 70<br />

Other liabilities 75 222<br />

Total 120 977 574 644<br />

A loan of EUR 100.0 million issued by <strong>Hannover</strong> Finance (Luxembourg) S.A. is shown under the<br />

accounts due to affiliated companies. The remaining term of the loan is seven years.<br />

The liabilities existing to two affiliated companies in the previous year were repaid ahead of<br />

schedule.<br />

Deferred items<br />

Figures in EUR thousand<br />

<strong>2003</strong> 2002<br />

Long-term tenancy rights 802 924<br />

Disagio 100 1 364<br />

Other accruals and deferred income 349 39<br />

Total 1 251 2 327<br />

Contingent liabilities<br />

We have secured through guarantees a surplus note in the amount of USD 400.0 million with a term<br />

of 40 years issued in the 1999 financial year by our subsidiary <strong>Hannover</strong> Finance Inc., Wilmington/USA,<br />

and subordinate debt of EUR 350.0 million with a term of 30 years issued in the previous year by our<br />

Luxembourg subsidiary <strong>Hannover</strong> Finance (Luxembourg) S.A.<br />

Liabilities for remaining calls existed with respect to special investments in the amount of EUR<br />

115.4 million.<br />

We also provided security for letters of credit furnished by banks for subsidiaries.<br />

47