Anil Bhandari

Anil Bhandari

Anil Bhandari

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

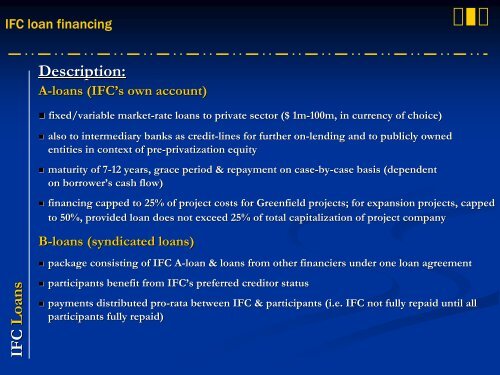

IFC loan financing<br />

Description:<br />

A-loans (IFC(<br />

IFC’s own account)<br />

• fixed/variable market-rate rate loans to private sector ($ 1m-100m, 100m, in currency of choice)<br />

IFC Loans<br />

• also to intermediary banks as credit-lines for further on-lending and to publicly owned<br />

entities in context of pre-privatization privatization equity<br />

• maturity of 7-127<br />

years, grace period & repayment on case-by<br />

by-case basis (dependent<br />

on borrower’s s cash flow)<br />

• financing capped to 25% of project costs for Greenfield projects; ; for expansion projects, capped<br />

to 50%, provided loan does not exceed 25% of total capitalization n of project company<br />

B-loans (syndicated loans)<br />

• package consisting of IFC A-loan A<br />

& loans from other financiers under one loan agreement<br />

• participants benefit from IFC’s preferred creditor status<br />

• payments distributed pro-rata rata between IFC & participants (i.e. IFC not fully repaid until all<br />

participants fully repaid)