Who's Running the Company? - International Center for Journalists

Who's Running the Company? - International Center for Journalists

Who's Running the Company? - International Center for Journalists

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHAPTER 4<br />

Inside family-owned and state-owned enterprises<br />

n Succession issues. According to economist<br />

Dr. Joseph Fan’s research of <strong>the</strong> Asian market:<br />

“In <strong>the</strong> five years after <strong>the</strong> company founder turns<br />

over <strong>the</strong> reins to <strong>the</strong> next generation, companies<br />

in <strong>the</strong> sample declined in value by an average of<br />

nearly 60 percent.” Given <strong>the</strong> importance of family<br />

businesses <strong>for</strong> emerging markets, this issue poses<br />

major challenges <strong>for</strong> economic development.<br />

Many family businesses appoint a family council to coordinate<br />

<strong>the</strong>ir interests and serve as <strong>the</strong> primary link between<br />

<strong>the</strong> family, <strong>the</strong> board and senior management. The<br />

council also suggests candidates <strong>for</strong> board membership<br />

and drafts policies on such items as family employment,<br />

compensation and shareholding.<br />

Cultivating sources within <strong>the</strong> family council is key <strong>for</strong><br />

journalists who want to stay on top of developments.<br />

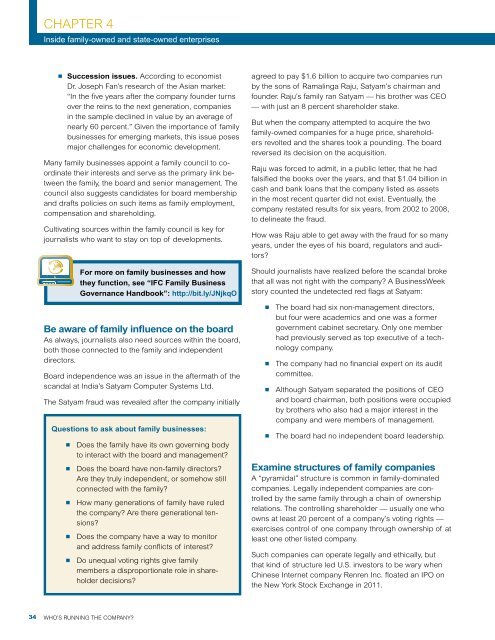

For more on family businesses and how<br />

<strong>the</strong>y function, see “IFC Family Business<br />

Governance Handbook”: http://bit.ly/JNjkqO<br />

Be aware of family influence on <strong>the</strong> board<br />

As always, journalists also need sources within <strong>the</strong> board,<br />

both those connected to <strong>the</strong> family and independent<br />

directors.<br />

Board independence was an issue in <strong>the</strong> aftermath of <strong>the</strong><br />

scandal at India’s Satyam Computer Systems Ltd.<br />

The Satyam fraud was revealed after <strong>the</strong> company initially<br />

Questions to ask about family businesses:<br />

n Does <strong>the</strong> family have its own governing body<br />

to interact with <strong>the</strong> board and management?<br />

n Does <strong>the</strong> board have non-family directors?<br />

Are <strong>the</strong>y truly independent, or somehow still<br />

connected with <strong>the</strong> family?<br />

n How many generations of family have ruled<br />

<strong>the</strong> company? Are <strong>the</strong>re generational tensions?<br />

n Does <strong>the</strong> company have a way to monitor<br />

and address family conflicts of interest?<br />

n Do unequal voting rights give family<br />

members a disproportionate role in shareholder<br />

decisions?<br />

agreed to pay $1.6 billion to acquire two companies run<br />

by <strong>the</strong> sons of Ramalinga Raju, Satyam’s chairman and<br />

founder. Raju’s family ran Satyam — his bro<strong>the</strong>r was CEO<br />

— with just an 8 percent shareholder stake.<br />

But when <strong>the</strong> company attempted to acquire <strong>the</strong> two<br />

family-owned companies <strong>for</strong> a huge price, shareholders<br />

revolted and <strong>the</strong> shares took a pounding. The board<br />

reversed its decision on <strong>the</strong> acquisition.<br />

Raju was <strong>for</strong>ced to admit, in a public letter, that he had<br />

falsified <strong>the</strong> books over <strong>the</strong> years, and that $1.04 billion in<br />

cash and bank loans that <strong>the</strong> company listed as assets<br />

in <strong>the</strong> most recent quarter did not exist. Eventually, <strong>the</strong><br />

company restated results <strong>for</strong> six years, from 2002 to 2008,<br />

to delineate <strong>the</strong> fraud.<br />

How was Raju able to get away with <strong>the</strong> fraud <strong>for</strong> so many<br />

years, under <strong>the</strong> eyes of his board, regulators and auditors?<br />

Should journalists have realized be<strong>for</strong>e <strong>the</strong> scandal broke<br />

that all was not right with <strong>the</strong> company? A BusinessWeek<br />

story counted <strong>the</strong> undetected red flags at Satyam:<br />

n The board had six non-management directors,<br />

but four were academics and one was a <strong>for</strong>mer<br />

government cabinet secretary. Only one member<br />

had previously served as top executive of a technology<br />

company.<br />

n The company had no financial expert on its audit<br />

committee.<br />

n Although Satyam separated <strong>the</strong> positions of CEO<br />

and board chairman, both positions were occupied<br />

by bro<strong>the</strong>rs who also had a major interest in <strong>the</strong><br />

company and were members of management.<br />

n The board had no independent board leadership.<br />

Examine structures of family companies<br />

A “pyramidal” structure is common in family-dominated<br />

companies. Legally independent companies are controlled<br />

by <strong>the</strong> same family through a chain of ownership<br />

relations. The controlling shareholder — usually one who<br />

owns at least 20 percent of a company’s voting rights —<br />

exercises control of one company through ownership of at<br />

least one o<strong>the</strong>r listed company.<br />

Such companies can operate legally and ethically, but<br />

that kind of structure led U.S. investors to be wary when<br />

Chinese Internet company Renren Inc. floated an IPO on<br />

<strong>the</strong> New York Stock Exchange in 2011.<br />

34<br />

WHO’S RUNNING THE COMPANY?