Who's Running the Company? - International Center for Journalists

Who's Running the Company? - International Center for Journalists

Who's Running the Company? - International Center for Journalists

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

qualifications of executives and board members, and<br />

whe<strong>the</strong>r banks and o<strong>the</strong>r financial institutions have policies<br />

and systems to protect against unauthorized trades.<br />

Though many of <strong>the</strong> corporate scandals of recent years<br />

were engineered by top executives, some shady dealings<br />

were <strong>the</strong> work of rogue employees who managed to hide<br />

<strong>the</strong>ir activities from <strong>the</strong>ir superiors until it was too late.<br />

At U.K.’s Barings Bank plc, futures trader Nick Leeson<br />

was a star in <strong>the</strong> early 1990s, responsible in one early<br />

high-flying year <strong>for</strong> 10 percent of <strong>the</strong> bank’s entire annual<br />

profits. But <strong>the</strong>n <strong>the</strong> Asian financial crisis began to unfold,<br />

and losses piled up. Leeson managed to hide more than<br />

£800 million in losses in an obscure account.<br />

His bosses began to uncover <strong>the</strong> dealings with a spot audit<br />

in 1995, but by that time, all of <strong>the</strong> bank’s assets and<br />

its very future were on <strong>the</strong> line. Eventually, heads rolled,<br />

Leeson went to prison and Barings was sold.<br />

Despite investigations and lessons learned from <strong>the</strong><br />

Leeson case, ano<strong>the</strong>r rogue trader caused similar problems<br />

<strong>for</strong> French banking giant Societe Generale many<br />

years later, in 2008. The tab <strong>for</strong> Jerome Keviel’s rogue<br />

trades was £7 billion.<br />

That same year, Kweku Adoboli, a trader <strong>for</strong> Switzerland’s<br />

UBS AG’s investment bank, was starting to hide his trading<br />

losses, which ultimately caused a $2 billion loss <strong>for</strong><br />

UBS, discovered in 2011.<br />

Adoboli was charged with fraud and false accounting,<br />

and governance experts immediately began questioning<br />

<strong>the</strong> banks’ risk management and oversight. USB chief<br />

executive Oswald Gruebel at first said that USB had “one<br />

of <strong>the</strong> best” risk-management units in <strong>the</strong> industry. But he<br />

soon resigned, saying he was shocked that a trader was<br />

able to inflict multibillion-dollar losses through unauthorized<br />

trades.<br />

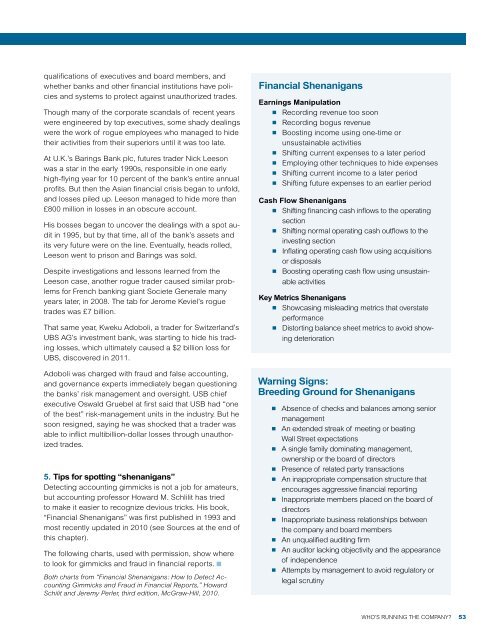

5. Tips <strong>for</strong> spotting “shenanigans”<br />

Detecting accounting gimmicks is not a job <strong>for</strong> amateurs,<br />

but accounting professor Howard M. Schlilit has tried<br />

to make it easier to recognize devious tricks. His book,<br />

“Financial Shenanigans” was first published in 1993 and<br />

most recently updated in 2010 (see Sources at <strong>the</strong> end of<br />

this chapter).<br />

The following charts, used with permission, show where<br />

to look <strong>for</strong> gimmicks and fraud in financial reports. n<br />

Both charts from “Financial Shenanigans: How to Detect Accounting<br />

Gimmicks and Fraud in Financial Reports,” Howard<br />

Schilit and Jeremy Perler, third edition, McGraw-Hill, 2010.<br />

Financial Shenanigans<br />

Earnings Manipulation<br />

n Recording revenue too soon<br />

n Recording bogus revenue<br />

n Boosting income using one-time or<br />

unsustainable activities<br />

n Shifting current expenses to a later period<br />

n Employing o<strong>the</strong>r techniques to hide expenses<br />

n Shifting current income to a later period<br />

n Shifting future expenses to an earlier period<br />

Cash Flow Shenanigans<br />

n Shifting financing cash inflows to <strong>the</strong> operating<br />

section<br />

n Shifting normal operating cash outflows to <strong>the</strong><br />

investing section<br />

n Inflating operating cash flow using acquisitions<br />

or disposals<br />

n Boosting operating cash flow using unsustainable<br />

activities<br />

Key Metrics Shenanigans<br />

n Showcasing misleading metrics that overstate<br />

per<strong>for</strong>mance<br />

n Distorting balance sheet metrics to avoid showing<br />

deterioration<br />

Warning Signs:<br />

Breeding Ground <strong>for</strong> Shenanigans<br />

n Absence of checks and balances among senior<br />

management<br />

n An extended streak of meeting or beating<br />

Wall Street expectations<br />

n A single family dominating management,<br />

ownership or <strong>the</strong> board of directors<br />

n Presence of related party transactions<br />

n An inappropriate compensation structure that<br />

encourages aggressive financial reporting<br />

n Inappropriate members placed on <strong>the</strong> board of<br />

directors<br />

n Inappropriate business relationships between<br />

<strong>the</strong> company and board members<br />

n An unqualified auditing firm<br />

n An auditor lacking objectivity and <strong>the</strong> appearance<br />

of independence<br />

n Attempts by management to avoid regulatory or<br />

legal scrutiny<br />

WHO’S RUNNING THE COMPANY?<br />

53