Who's Running the Company? - International Center for Journalists

Who's Running the Company? - International Center for Journalists

Who's Running the Company? - International Center for Journalists

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

tors, Grant Thornton and Deloitte Touche Tohmatsu, were<br />

battered by <strong>the</strong>ir failure to detect fraud in <strong>the</strong> dairy company’s<br />

books. They eventually agreed to pay a $15 million<br />

settlement to shareholders.<br />

In fact, all of <strong>the</strong> Big Four accounting firms have featured<br />

in criminal cases involving clients at one time or o<strong>the</strong>r.<br />

Two PricewaterhouseCoopers partners were criminally<br />

charged in connection with <strong>the</strong> Satyam Computer<br />

Systems Ltd. fraud in India. KPMG was charged by <strong>the</strong><br />

SEC with permitting Xerox Corp. to manipulate accounts.<br />

KPMG settled <strong>the</strong> complaint in 2005 without admitting<br />

wrongdoing.<br />

Questions reporters should ask about a company’s<br />

auditors and <strong>the</strong>ir audits include:<br />

n Is <strong>the</strong> external auditor qualified, credible, independent<br />

and free of regulatory or legal problems?<br />

n What are <strong>the</strong> limitations of <strong>the</strong> auditors’ opinion?<br />

n What process was used to verify and audit <strong>the</strong><br />

financial statements?<br />

n What does <strong>the</strong> audit report say about <strong>the</strong><br />

company’s financial statements?<br />

n What kind of business relationship does <strong>the</strong><br />

auditing firm have with <strong>the</strong> company, aside from<br />

its audit services? Any conflicts of interest?<br />

n Is <strong>the</strong> audit team knowledgeable in <strong>the</strong> client’s<br />

business?<br />

n Did management cooperate with <strong>the</strong> auditors?<br />

Corporate scandals often produce tougher regulation<br />

and more rigorous en<strong>for</strong>cement. After <strong>the</strong> Enron and<br />

WorldCom debacles, <strong>the</strong> Sarbanes-Oxley Act of 2002<br />

contained new provisions governing audits, auditing<br />

firms, audit committees and disclosure requirements <strong>for</strong><br />

off-balance-sheet transactions, among many o<strong>the</strong>r new<br />

rules. The new law also held chairmen, CEOs and CFOs<br />

personally accountable <strong>for</strong> <strong>the</strong> financial reports, compelling<br />

<strong>the</strong>m to be more diligent in <strong>the</strong>ir oversight of <strong>the</strong><br />

auditor’s work.<br />

5. Develop multiple sources in <strong>the</strong><br />

financial world<br />

Hedge-fund managers, short sellers, analysts and<br />

researchers can be valuable sources <strong>for</strong> journalists<br />

because <strong>the</strong>y delve deeply into <strong>the</strong> company financial<br />

and non-financial in<strong>for</strong>mation and per<strong>for</strong>m extensive due<br />

diligence <strong>for</strong> <strong>the</strong>ir clients.<br />

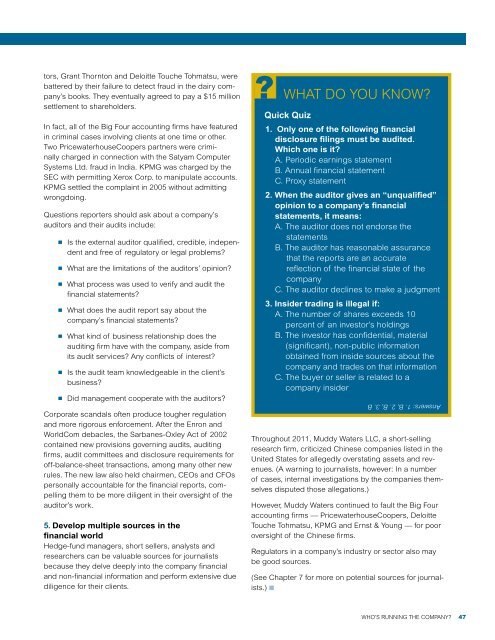

?<br />

WHAT DO YOU KNOW?<br />

Quick Quiz<br />

1. Only one of <strong>the</strong> following financial<br />

disclosure filings must be audited.<br />

Which one is it?<br />

A. Periodic earnings statement<br />

B. Annual financial statement<br />

C. Proxy statement<br />

2. When <strong>the</strong> auditor gives an “unqualified”<br />

opinion to a company’s financial<br />

statements, it means:<br />

A. The auditor does not endorse <strong>the</strong><br />

statements<br />

B. The auditor has reasonable assurance<br />

that <strong>the</strong> reports are an accurate<br />

reflection of <strong>the</strong> financial state of <strong>the</strong><br />

company<br />

C. The auditor declines to make a judgment<br />

3. Insider trading is illegal if:<br />

A. The number of shares exceeds 10<br />

percent of an investor’s holdings<br />

B. The investor has confidential, material<br />

(significant), non-public in<strong>for</strong>mation<br />

obtained from inside sources about <strong>the</strong><br />

company and trades on that in<strong>for</strong>mation<br />

C. The buyer or seller is related to a<br />

company insider<br />

Answers: 1. B, 2. B, 3. B<br />

Throughout 2011, Muddy Waters LLC, a short-selling<br />

research firm, criticized Chinese companies listed in <strong>the</strong><br />

United States <strong>for</strong> allegedly overstating assets and revenues.<br />

(A warning to journalists, however: In a number<br />

of cases, internal investigations by <strong>the</strong> companies <strong>the</strong>mselves<br />

disputed those allegations.)<br />

However, Muddy Waters continued to fault <strong>the</strong> Big Four<br />

accounting firms — PricewaterhouseCoopers, Deloitte<br />

Touche Tohmatsu, KPMG and Ernst & Young — <strong>for</strong> poor<br />

oversight of <strong>the</strong> Chinese firms.<br />

Regulators in a company’s industry or sector also may<br />

be good sources.<br />

(See Chapter 7 <strong>for</strong> more on potential sources <strong>for</strong> journalists.)<br />

n<br />

WHO’S RUNNING THE COMPANY?<br />

47