Volume 2 - IFC

Volume 2 - IFC

Volume 2 - IFC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHAPTER MANAGEMENT’S FOUR: SIGNIFICANT DISCUSSION AND IMPACT ANALYSIS<br />

— V. BY ENTERPRISE REGION RISK MANAGEMENT<br />

<strong>IFC</strong> does not recognize income on loans where collectibility is in doubt<br />

or payments of interest or principal are past due more than 60 days<br />

unless management anticipates that collection of interest is expected in<br />

the near future.<br />

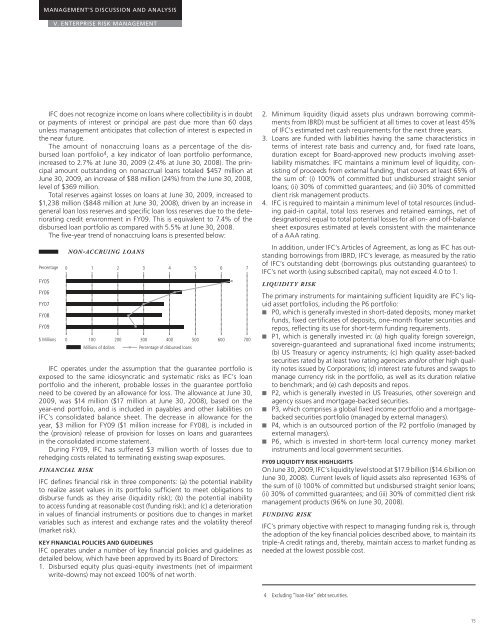

The amount of nonaccruing loans as a percentage of the disbursed<br />

loan portfolio 4 , a key indicator of loan portfolio performance,<br />

increased to 2.7% at June 30, 2009 (2.4% at June 30, 2008). The principal<br />

amount outstanding on nonaccrual loans totaled $457 million at<br />

June 30, 2009, an increase of $88 million (24%) from the June 30, 2008,<br />

level of $369 million.<br />

Total reserves against losses on loans at June 30, 2009, increased to<br />

$1,238 million ($848 million at June 30, 2008), driven by an increase in<br />

general loan loss reserves and specific loan loss reserves due to the deteriorating<br />

credit environment in FY09. This is equivalent to 7.4% of the<br />

disbursed loan portfolio as compared with 5.5% at June 30, 2008.<br />

The five-year trend of nonaccruing loans is presented below:<br />

Percentage<br />

FY05<br />

FY06<br />

FY07<br />

FY08<br />

FY09<br />

$ Millions<br />

NON-ACCRUING LOANS<br />

0 1 2 3 4 5 6 7<br />

0 100 200 300 400 500 600 700<br />

Millions of dollars<br />

Percentage of disbursed loans<br />

<strong>IFC</strong> operates under the assumption that the guarantee portfolio is<br />

exposed to the same idiosyncratic and systematic risks as <strong>IFC</strong>’s loan<br />

portfolio and the inherent, probable losses in the guarantee portfolio<br />

need to be covered by an allowance for loss. The allowance at June 30,<br />

2009, was $14 million ($17 million at June 30, 2008), based on the<br />

year-end port folio, and is included in payables and other liabilities on<br />

<strong>IFC</strong>’s consolidated balance sheet. The decrease in allowance for the<br />

year, $3 million for FY09 ($1 million increase for FY08), is included in<br />

the (provision) release of provision for losses on loans and guarantees<br />

in the consolidated income statement.<br />

During FY09, <strong>IFC</strong> has suffered $3 million worth of losses due to<br />

rehedging costs related to terminating existing swap exposures.<br />

FINANCIAL RISK<br />

<strong>IFC</strong> defines financial risk in three components: (a) the potential inability<br />

to realize asset values in its portfolio sufficient to meet obligations to<br />

disburse funds as they arise (liquidity risk); (b) the potential inability<br />

to access funding at reasonable cost (funding risk); and (c) a deterioration<br />

in values of financial instruments or positions due to changes in market<br />

variables such as interest and exchange rates and the volatility thereof<br />

(market risk).<br />

KEY FINANCIAL POLICIES AND GUIDELINES<br />

<strong>IFC</strong> operates under a number of key financial policies and guidelines as<br />

detailed below, which have been approved by its Board of Directors:<br />

1. Disbursed equity plus quasi-equity investments (net of impairment<br />

write-downs) may not exceed 100% of net worth.<br />

2. Minimum liquidity (liquid assets plus undrawn borrowing commitments<br />

from IBRD) must be sufficient at all times to cover at least 45%<br />

of <strong>IFC</strong>’s estimated net cash requirements for the next three years.<br />

3. Loans are funded with liabilities having the same characteristics in<br />

terms of interest rate basis and currency and, for fixed rate loans,<br />

duration except for Board-approved new products involving assetliability<br />

mismatches. <strong>IFC</strong> maintains a minimum level of liquidity, consisting<br />

of proceeds from external funding, that covers at least 65% of<br />

the sum of: (i) 100% of committed but undisbursed straight senior<br />

loans; (ii) 30% of committed guarantees; and (iii) 30% of committed<br />

client risk management products.<br />

4. <strong>IFC</strong> is required to maintain a minimum level of total resources (including<br />

paid-in capital, total loss reserves and retained earnings, net of<br />

designations) equal to total potential losses for all on- and off-balance<br />

sheet exposures estimated at levels consistent with the maintenance<br />

of a AAA rating.<br />

In addition, under <strong>IFC</strong>’s Articles of Agreement, as long as <strong>IFC</strong> has outstanding<br />

borrowings from IBRD, <strong>IFC</strong>’s leverage, as measured by the ratio<br />

of <strong>IFC</strong>’s outstanding debt (borrowings plus outstanding guarantees) to<br />

<strong>IFC</strong>’s net worth (using subscribed capital), may not exceed 4.0 to 1.<br />

LIQUIDITY RISK<br />

The primary instruments for maintaining sufficient liquidity are <strong>IFC</strong>’s liquid<br />

asset portfolios, including the P6 portfolio:<br />

■ P0, which is generally invested in short-dated deposits, money market<br />

funds, fixed certificates of deposits, one-month floater securities and<br />

repos, reflecting its use for short-term funding requirements.<br />

■ P1, which is generally invested in: (a) high quality foreign sovereign,<br />

sovereign-guaranteed and supranational fixed income instruments;<br />

(b) US Treasury or agency instruments; (c) high quality asset-backed<br />

securities rated by at least two rating agencies and/or other high quality<br />

notes issued by Corporations; (d) interest rate futures and swaps to<br />

manage currency risk in the portfolio, as well as its duration relative<br />

to benchmark; and (e) cash deposits and repos.<br />

■ P2, which is generally invested in US Treasuries, other sovereign and<br />

agency issues and mortgage-backed securities.<br />

■ P3, which comprises a global fixed income portfolio and a mortgagebacked<br />

securities portfolio (managed by external managers).<br />

■ P4, which is an outsourced portion of the P2 portfolio (managed by<br />

external managers).<br />

■ P6, which is invested in short-term local currency money market<br />

instruments and local government securities.<br />

FY09 LIQUIDITY RISK HIGHLIGHTS<br />

On June 30, 2009, <strong>IFC</strong>’s liquidity level stood at $17.9 billion ($14.6 billion on<br />

June 30, 2008). Current levels of liquid assets also represented 163% of<br />

the sum of (i) 100% of committed but undisbursed straight senior loans;<br />

(ii) 30% of committed guarantees; and (iii) 30% of committed client risk<br />

management products (96% on June 30, 2008).<br />

FUNDING RISK<br />

<strong>IFC</strong>’s primary objective with respect to managing funding risk is, through<br />

the adoption of the key financial policies described above, to maintain its<br />

triple-A credit ratings and, thereby, maintain access to market funding as<br />

needed at the lowest possible cost.<br />

4 Excluding “loan-like” debt securities.<br />

15