Volume 2 - IFC

Volume 2 - IFC

Volume 2 - IFC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INTERNATIONAL FINANCE CORPORATION<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

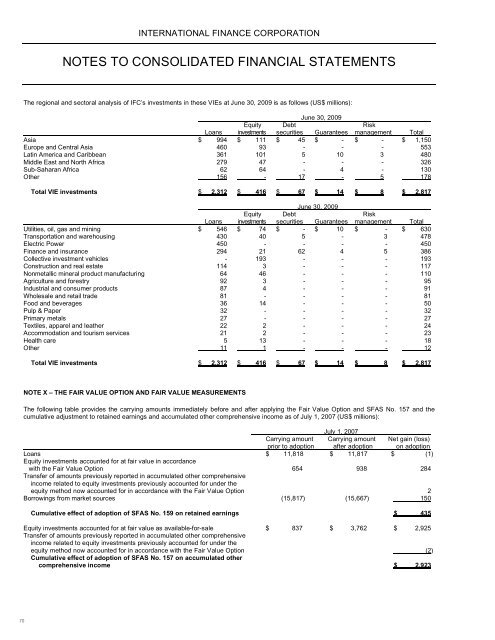

The regional and sectoral analysis of <strong>IFC</strong>’s investments in these VIEs at June 30, 2009 is as follows (US$ millions):<br />

June 30, 2009<br />

Equity Debt Risk<br />

Loans investments securities Guarantees management Total<br />

Asia $ 994 $ 111 $ 45 $ - $ - $ 1,150<br />

Europe and Central Asia 460 93 - - - 553<br />

Latin America and Caribbean 361 101 5 10 3 480<br />

Middle East and North Africa 279 47 - - - 326<br />

Sub-Saharan Africa 62 64 - 4 - 130<br />

Other 156 - 17 - 5 178<br />

Total VIE investments $ 2,312 $ 416 $ 67 $ 14 $ 8 $ 2,817<br />

June 30, 2009<br />

Equity Debt Risk<br />

Loans investments securities Guarantees management Total<br />

Utilities, oil, gas and mining $ 546 $ 74 $ - $ 10 $ - $ 630<br />

Transportation and warehousing 430 40 5 - 3 478<br />

Electric Power 450 - - - - 450<br />

Finance and insurance 294 21 62 4 5 386<br />

Collective investment vehicles - 193 - - - 193<br />

Construction and real estate 114 3 - - - 117<br />

Nonmetallic mineral product manufacturing 64 46 - - - 110<br />

Agriculture and forestry 92 3 - - - 95<br />

Industrial and consumer products 87 4 - - - 91<br />

Wholesale and retail trade 81 - - - - 81<br />

Food and beverages 36 14 - - - 50<br />

Pulp & Paper 32 - - - - 32<br />

Primary metals 27 - - - - 27<br />

Textiles, apparel and leather 22 2 - - - 24<br />

Accommodation and tourism services 21 2 - - - 23<br />

Health care 5 13 - - - 18<br />

Other 11 1 - - - 12<br />

Total VIE investments $ 2,312 $ 416 $ 67 $ 14 $ 8 $ 2,817<br />

NOTE X – THE FAIR VALUE OPTION AND FAIR VALUE MEASUREMENTS<br />

The following table provides the carrying amounts immediately before and after applying the Fair Value Option and SFAS No. 157 and the<br />

cumulative adjustment to retained earnings and accumulated other comprehensive income as of July 1, 2007 (US$ millions):<br />

July 1, 2007<br />

Carrying amount Carrying amount Net gain (loss)<br />

prior to adoption after adoption on adoption<br />

Loans $ 11,818 $ 11,817 $ (1)<br />

Equity investments accounted for at fair value in accordance<br />

with the Fair Value Option 654 938 284<br />

Transfer of amounts previously reported in accumulated other comprehensive<br />

income related to equity investments previously accounted for under the<br />

equity method now accounted for in accordance with the Fair Value Option 2<br />

Borrowings from market sources (15,817) (15,667) 150<br />

Cumulative effect of adoption of SFAS No. 159 on retained earnings $ 435<br />

Equity investments accounted for at fair value as available-for-sale $ 837 $ 3,762 $ 2,925<br />

Transfer of amounts previously reported in accumulated other comprehensive<br />

income related to equity investments previously accounted for under the<br />

equity method now accounted for in accordance with the Fair Value Option (2)<br />

Cumulative effect of adoption of SFAS No. 157 on accumulated other<br />

comprehensive income $ 2,923<br />

70