Volume 2 - IFC

Volume 2 - IFC

Volume 2 - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INTERNATIONAL FINANCE CORPORATION<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

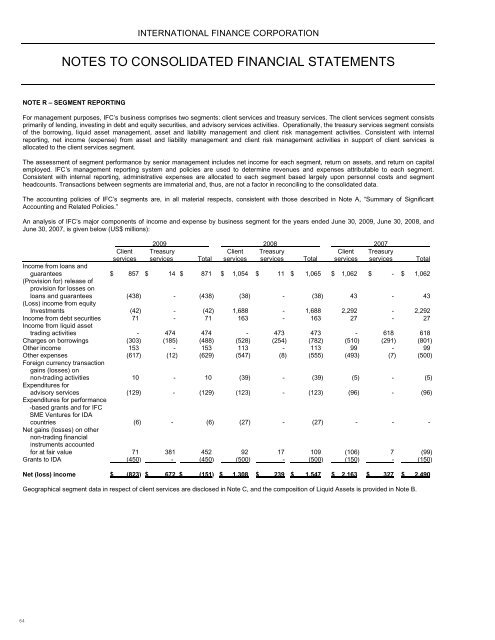

NOTE R – SEGMENT REPORTING<br />

For management purposes, <strong>IFC</strong>’s business comprises two segments: client services and treasury services. The client services segment consists<br />

primarily of lending, investing in debt and equity securities, and advisory services activities. Operationally, the treasury services segment consists<br />

of the borrowing, liquid asset management, asset and liability management and client risk management activities. Consistent with internal<br />

reporting, net income (expense) from asset and liability management and client risk management activities in support of client services is<br />

allocated to the client services segment.<br />

The assessment of segment performance by senior management includes net income for each segment, return on assets, and return on capital<br />

employed. <strong>IFC</strong>’s management reporting system and policies are used to determine revenues and expenses attributable to each segment.<br />

Consistent with internal reporting, administrative expenses are allocated to each segment based largely upon personnel costs and segment<br />

headcounts. Transactions between segments are immaterial and, thus, are not a factor in reconciling to the consolidated data.<br />

The accounting policies of <strong>IFC</strong>’s segments are, in all material respects, consistent with those described in Note A, “Summary of Significant<br />

Accounting and Related Policies.”<br />

An analysis of <strong>IFC</strong>’s major components of income and expense by business segment for the years ended June 30, 2009, June 30, 2008, and<br />

June 30, 2007, is given below (US$ millions):<br />

2009 2008 2007<br />

Client Treasury Client Treasury Client Treasury<br />

services services Total services services Total services services Total<br />

Income from loans and<br />

guarantees $ 857 $ 14 $ 871 $ 1,054 $ 11 $ 1,065 $ 1,062 $ - $ 1,062<br />

(Provision for) release of<br />

provision for losses on<br />

loans and guarantees (438) - (438) (38) - (38) 43 - 43<br />

(Loss) income from equity<br />

Investments (42) - (42) 1,688 - 1,688 2,292 - 2,292<br />

Income from debt securities 71 - 71 163 - 163 27 - 27<br />

Income from liquid asset<br />

trading activities - 474 474 - 473 473 - 618 618<br />

Charges on borrowings (303) (185) (488) (528) (254) (782) (510) (291) (801)<br />

Other income 153 - 153 113 - 113 99 - 99<br />

Other expenses (617) (12) (629) (547) (8) (555) (493) (7) (500)<br />

Foreign currency transaction<br />

gains (losses) on<br />

non-trading activities 10 - 10 (39) - (39) (5) - (5)<br />

Expenditures for<br />

advisory services (129) - (129) (123) - (123) (96) - (96)<br />

Expenditures for performance<br />

-based grants and for <strong>IFC</strong><br />

SME Ventures for IDA<br />

countries (6) - (6) (27) - (27) - - -<br />

Net gains (losses) on other<br />

non-trading financial<br />

instruments accounted<br />

for at fair value 71 381 452 92 17 109 (106) 7 (99)<br />

Grants to IDA (450) - (450) (500) - (500) (150) - (150)<br />

Net (loss) income $ (823) $ 672 $ (151) $ 1,308 $ 239 $ 1,547 $ 2,163 $ 327 $ 2,490<br />

Geographical segment data in respect of client services are disclosed in Note C, and the composition of Liquid Assets is provided in Note B.<br />

64