Volume 2 - IFC

Volume 2 - IFC

Volume 2 - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INTERNATIONAL FINANCE CORPORATION<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

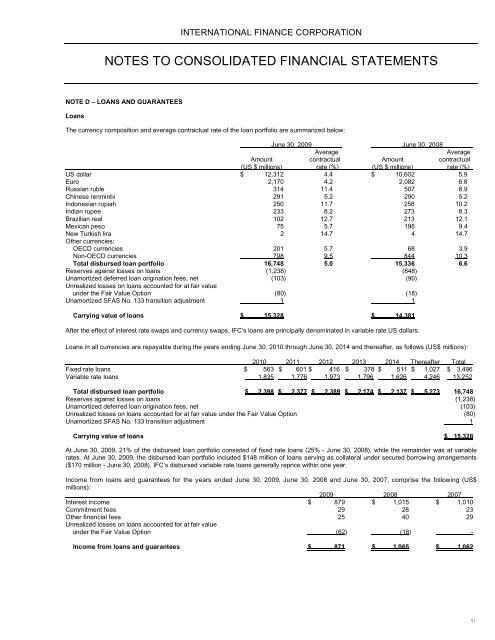

NOTE D – LOANS AND GUARANTEES<br />

Loans<br />

The currency composition and average contractual rate of the loan portfolio are summarized below:<br />

June 30, 2009 June 30, 2008<br />

Average<br />

Average<br />

Amount contractual Amount contractual<br />

(US $ millions) rate (%) (US $ millions) rate (%)<br />

US dollar $ 12,312 4.4 $ 10,602 5.9<br />

Euro 2,170 4.2 2,082 6.8<br />

Russian ruble 314 11.4 507 8.9<br />

Chinese renminbi 291 5.2 290 5.2<br />

Indonesian rupiah 250 11.7 258 10.2<br />

Indian rupee 233 8.2 273 8.3<br />

Brazilian real 102 12.7 213 12.1<br />

Mexican peso 75 5.7 195 9.4<br />

New Turkish lira 2 14.7 4 14.7<br />

Other currencies:<br />

OECD currencies 201 5.7 68 3.9<br />

Non-OECD currencies 798 9.5 844 10.3<br />

Total disbursed loan portfolio 16,748 5.0 15,336 6.6<br />

Reserves against losses on loans (1,238) (848)<br />

Unamortized deferred loan origination fees, net (103) (90)<br />

Unrealized losses on loans accounted for at fair value<br />

under the Fair Value Option (80) (18)<br />

Unamortized SFAS No. 133 transition adjustment 1 1<br />

Carrying value of loans $ 15,328 $ 14,381<br />

After the effect of interest rate swaps and currency swaps, <strong>IFC</strong>’s loans are principally denominated in variable rate US dollars.<br />

Loans in all currencies are repayable during the years ending June 30, 2010 through June 30, 2014 and thereafter, as follows (US$ millions):<br />

2010 2011 2012 2013 2014 Thereafter Total<br />

Fixed rate loans $ 563 $ 601 $ 416 $ 378 $ 511 $ 1,027 $ 3,496<br />

Variable rate loans 1,835 1,776 1,973 1,796 1,626 4,246 13,252<br />

Total disbursed loan portfolio $ 2,398 $ 2,377 $ 2,389 $ 2,174 $ 2,137 $ 5,273 16,748<br />

Reserves against losses on loans (1,238)<br />

Unamortized deferred loan origination fees, net (103)<br />

Unrealized losses on loans accounted for at fair value under the Fair Value Option (80)<br />

Unamortized SFAS No. 133 transition adjustment 1<br />

Carrying value of loans $ 15,328<br />

At June 30, 2009, 21% of the disbursed loan portfolio consisted of fixed rate loans (25% - June 30, 2008), while the remainder was at variable<br />

rates. At June 30, 2009, the disbursed loan portfolio included $148 million of loans serving as collateral under secured borrowing arrangements<br />

($170 million - June 30, 2008). <strong>IFC</strong>’s disbursed variable rate loans generally reprice within one year.<br />

Income from loans and guarantees for the years ended June 30, 2009, June 30, 2008 and June 30, 2007, comprise the following (US$<br />

millions):<br />

2009 2008 2007<br />

Interest income $ 879 $ 1,015 $ 1,010<br />

Commitment fees 29 28 23<br />

Other financial fees 25 40 29<br />

Unrealized losses on loans accounted for at fair value<br />

under the Fair Value Option (62) (18) -<br />

Income from loans and guarantees $ 871 $ 1,065 $ 1,062<br />

51