Volume 2 - IFC

Volume 2 - IFC

Volume 2 - IFC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MANAGING TROUBLED ASSETS<br />

<strong>IFC</strong> is working to create a private sector program to address the issue of<br />

rising nonperforming loans in banking systems of developing countries.<br />

OTHER<br />

In addition, <strong>IFC</strong> is involved in targeted regional crisis response initiatives<br />

in Central and Eastern Europe, Latin America and the Caribbean<br />

and Africa.<br />

INVESTMENT PROGRAM SUMMARY<br />

COMMITMENTS<br />

In FY09, <strong>IFC</strong> entered into new commitments totaling $10.5 billion, compared<br />

with $11.4 billion for FY08. In addition, <strong>IFC</strong> mobilized resources<br />

totaling $4.0 billion, compared with $4.8 billion in FY08. FY09 and FY08<br />

commitments and resources mobilized (as described in more detail in<br />

“Investment Products”) comprised the following:<br />

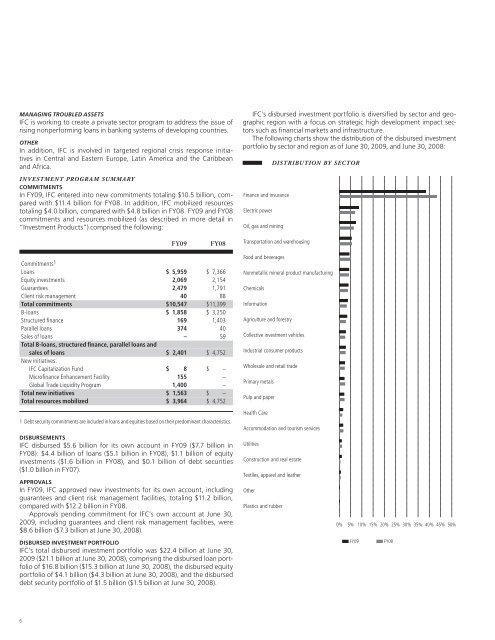

<strong>IFC</strong>’s disbursed investment portfolio is diversified by sector and geographic<br />

region with a focus on strategic high development impact sectors<br />

such as financial markets and infrastructure.<br />

The following charts show the distribution of the disbursed investment<br />

portfolio by sector and region as of June 30, 2009, and June 30, 2008:<br />

Finance and insurance<br />

Electric power<br />

Oil, gas and mining<br />

DISTRIBUTION BY SECTOR<br />

FY09<br />

FY08<br />

Transportation and warehousing<br />

Commitments 1<br />

Loans $ 5,959 $ 7,366<br />

Equity investments 2,069 2,154<br />

Guarantees 2,479 1,791<br />

Client risk management 40 88<br />

Total commitments $10,547 $11,399<br />

B-loans $ 1,858 $ 3,250<br />

Structured fi nance 169 1,403<br />

Parallel loans 374 40<br />

Sales of loans – 59<br />

Total B-loans, structured finance, parallel loans and<br />

sales of loans $ 2,401 $ 4,752<br />

New initiatives:<br />

<strong>IFC</strong> Capitalization Fund $ 8 $ –<br />

Microfi nance Enhancement Facility 155 –<br />

Global Trade Liquidity Program 1,400 –<br />

Total new initiatives $ 1,563 $ –<br />

Total resources mobilized $ 3,964 $ 4,752<br />

1 Debt security commitments are included in loans and equities based on their predominant characteristics.<br />

DISBURSEMENTS<br />

<strong>IFC</strong> disbursed $5.6 billion for its own account in FY09 ($7.7 billion in<br />

FY08): $4.4 billion of loans ($5.1 billion in FY08), $1.1 billion of equity<br />

investments ($1.6 billion in FY08), and $0.1 billion of debt securities<br />

($1.0 billion in FY07).<br />

APPROVALS<br />

In FY09, <strong>IFC</strong> approved new investments for its own account, including<br />

guarantees and client risk management facilities, totaling $11.2 billion,<br />

compared with $12.2 billion in FY08.<br />

Approvals pending commitment for <strong>IFC</strong>’s own account at June 30,<br />

2009, including guarantees and client risk management facilities, were<br />

$8.6 billion ($7.3 billion at June 30, 2008).<br />

DISBURSED INVESTMENT PORTFOLIO<br />

<strong>IFC</strong>’s total disbursed investment portfolio was $22.4 billion at June 30,<br />

2009 ($21.1 billion at June 30, 2008), comprising the disbursed loan portfolio<br />

of $16.8 billion ($15.3 billion at June 30, 2008), the disbursed equity<br />

portfolio of $4.1 billion ($4.3 billion at June 30, 2008), and the disbursed<br />

debt security portfolio of $1.5 billion ($1.5 billion at June 30, 2008).<br />

Food and beverages<br />

Nonmetallic mineral product manufacturing<br />

Chemicals<br />

Information<br />

Agriculture and forestry<br />

Collective investment vehicles<br />

Industrial consumer products<br />

Wholesale and retail trade<br />

Primary metals<br />

Pulp and paper<br />

Health Care<br />

Accommodation and tourism services<br />

Utilities<br />

Construction and real estate<br />

Textiles, apparel and leather<br />

Other<br />

Plastics and rubber<br />

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50%<br />

FY09<br />

FY08<br />

6