Annual Report 2006 - Boehringer Ingelheim

Annual Report 2006 - Boehringer Ingelheim

Annual Report 2006 - Boehringer Ingelheim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Pension provisions<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong>’s pension schemes are based on various defined contribution plans as well as<br />

defined benefit plans.<br />

Pension obligations arising from direct or indirect defined benefit plans are determined on the basis of<br />

the projected unit credit method, taking future salary and pension increases into consideration.<br />

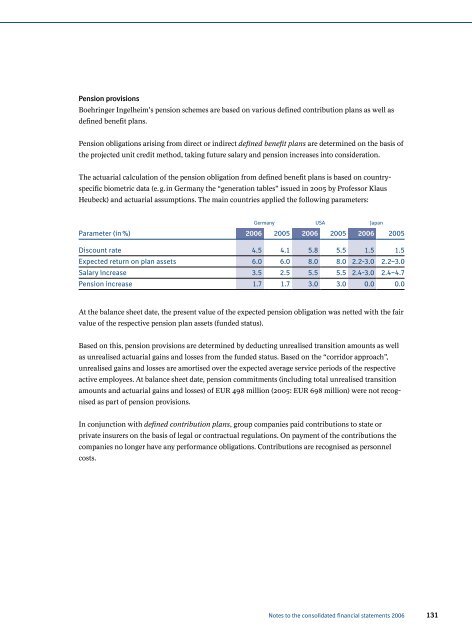

The actuarial calculation of the pension obligation from defined benefit plans is based on country-<br />

specific biometric data (e. g. in Germany the “generation tables” issued in 2005 by Professor Klaus<br />

Heubeck) and actuarial assumptions. The main countries applied the following parameters:<br />

Germany USA Japan<br />

Parameter (in %) <strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Discount rate 4.5 4.1 5.8 5.5 1.5 1.5<br />

Expected return on plan assets 6.0 6.0 8.0 8.0 2.2-3.0 2.2–3.0<br />

Salary increase 3.5 2.5 5.5 5.5 2.4-3.0 2.4–4.7<br />

Pension increase 1.7 1.7 3.0 3.0 0.0 0.0<br />

At the balance sheet date, the present value of the expected pension obligation was netted with the fair<br />

value of the respective pension plan assets (funded status).<br />

Based on this, pension provisions are determined by deducting unrealised transition amounts as well<br />

as unrealised actuarial gains and losses from the funded status. Based on the “corridor approach”,<br />

unrealised gains and losses are amortised over the expected average service periods of the respective<br />

active employees. At balance sheet date, pension commitments (including total unrealised transition<br />

amounts and actuarial gains and losses) of EUR 498 million (2005: EUR 698 million) were not recognised<br />

as part of pension provisions.<br />

In conjunction with defined contribution plans, group companies paid contributions to state or<br />

private insurers on the basis of legal or contractual regulations. On payment of the contributions the<br />

companies no longer have any performance obligations. Contributions are recognised as personnel<br />

costs.<br />

Notes to the consolidated financial statements <strong>2006</strong> 131