ETFR's - IndexUniverse.com

ETFR's - IndexUniverse.com

ETFR's - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ETFR<br />

4 Natural gas ETF<br />

in the works<br />

Victoria Bay Asset Management, the<br />

folks that brought the $900 million US<br />

Oil Fund (AMEX: USO) to market, has<br />

filed papers with the SEC for an ETF tied<br />

to the price of natural gas. The US<br />

Natural Gas will, like other <strong>com</strong>modity<br />

ETFs, buy natural gas futures contracts<br />

on the New York Mercantile Exchange<br />

and roll them one month to the next,<br />

while investing collateral cash in<br />

Treasuries. Victoria Bay’s isn’t the first<br />

natural gas ETF in development.<br />

Barclays Global Investors is also planning<br />

such a fund.<br />

Claymore adds three<br />

quirky and four style ETFs<br />

In early April, Claymore Securities<br />

added seven ETFs to its ever-expanding<br />

lineup. As usual with this ETF provider,<br />

three of the products are quirky, four<br />

are domestic style boxes.<br />

The style ETFs include: BIR Leaders<br />

Mid-Cap Value (AMEX: BMV); BIR<br />

Leaders Small-Cap Core (AMEX: BES),<br />

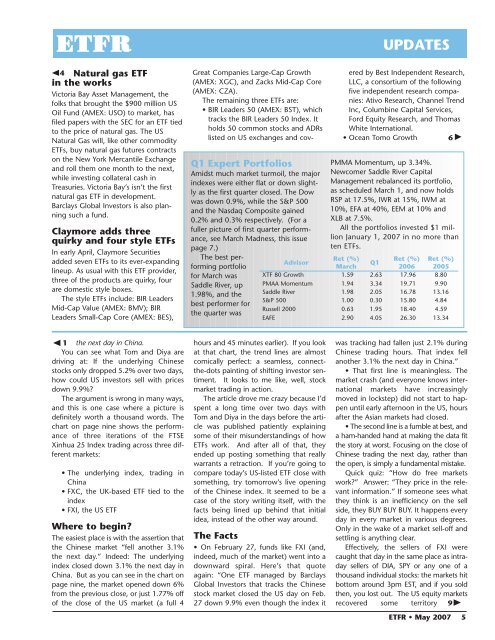

Q1 Expert Portfolios<br />

Amidst much market turmoil, the major<br />

indexes were either flat or down slightly<br />

as the first quarter closed. The Dow<br />

was down 0.9%, while the S&P 500<br />

and the Nasdaq Composite gained<br />

0.2% and 0.3% respectively. (For a<br />

fuller picture of first quarter performance,<br />

see March Madness, this issue<br />

page 7.)<br />

The best performing<br />

portfolio<br />

for March was<br />

Saddle River, up<br />

1.98%, and the<br />

best performer for<br />

the quarter was<br />

UPDATES<br />

Great Companies Large-Cap Growth<br />

(AMEX: XGC), and Zacks Mid-Cap Core<br />

(AMEX: CZA).<br />

The remaining three ETFs are:<br />

• BIR Leaders 50 (AMEX: BST), which<br />

tracks the BIR Leaders 50 Index. It<br />

holds 50 <strong>com</strong>mon stocks and ADRs<br />

listed on US exchanges and covered<br />

by Best Independent Research,<br />

LLC, a consortium of the following<br />

five independent research <strong>com</strong>panies:<br />

Ativo Research, Channel Trend<br />

Inc, Columbine Capital Services,<br />

Ford Equity Research, and Thomas<br />

White International.<br />

• Ocean Tomo Growth 6<br />

PMMA Momentum, up 3.34%.<br />

New<strong>com</strong>er Saddle River Capital<br />

Management rebalanced its portfolio,<br />

as scheduled March 1, and now holds<br />

RSP at 17.5%, IWR at 15%, IWM at<br />

10%, EFA at 40%, EEM at 10% and<br />

XLB at 7.5%.<br />

All the portfolios invested $1 million<br />

January 1, 2007 in no more than<br />

ten ETFs.<br />

Advisor<br />

Ret (%)<br />

Ret (%) Ret (%)<br />

Q1<br />

March<br />

2006 2005<br />

XTF 80 Growth 1.59 2.63 17.96 8.80<br />

PMAA Momentum 1.94 3.34 19.71 9.90<br />

Saddle River 1.98 2.05 16.78 13.16<br />

S&P 500 1.00 0.30 15.80 4.84<br />

Russell 2000 0.63 1.95 18.40 4.59<br />

EAFE 2.90 4.05 26.30 13.34<br />

1 the next day in China.<br />

You can see what Tom and Diya are<br />

driving at: If the underlying Chinese<br />

stocks only dropped 5.2% over two days,<br />

how could US investors sell with prices<br />

down 9.9%?<br />

The argument is wrong in many ways,<br />

and this is one case where a picture is<br />

definitely worth a thousand words. The<br />

chart on page nine shows the performance<br />

of three iterations of the FTSE<br />

Xinhua 25 Index trading across three different<br />

markets:<br />

• The underlying index, trading in<br />

China<br />

• FXC, the UK-based ETF tied to the<br />

index<br />

• FXI, the US ETF<br />

Where to begin?<br />

The easiest place is with the assertion that<br />

the Chinese market “fell another 3.1%<br />

the next day.” Indeed: The underlying<br />

index closed down 3.1% the next day in<br />

China. But as you can see in the chart on<br />

page nine, the market opened down 6%<br />

from the previous close, or just 1.77% off<br />

of the close of the US market (a full 4<br />

hours and 45 minutes earlier). If you look<br />

at that chart, the trend lines are almost<br />

<strong>com</strong>ically perfect: a seamless, connectthe-dots<br />

painting of shifting investor sentiment.<br />

It looks to me like, well, stock<br />

market trading in action.<br />

The article drove me crazy because I’d<br />

spent a long time over two days with<br />

Tom and Diya in the days before the article<br />

was published patiently explaining<br />

some of their misunderstandings of how<br />

ETFs work. And after all of that, they<br />

ended up posting something that really<br />

warrants a retraction. If you’re going to<br />

<strong>com</strong>pare today’s US-listed ETF close with<br />

something, try tomorrow’s live opening<br />

of the Chinese index. It seemed to be a<br />

case of the story writing itself, with the<br />

facts being lined up behind that initial<br />

idea, instead of the other way around.<br />

The Facts<br />

• On February 27, funds like FXI (and,<br />

indeed, much of the market) went into a<br />

downward spiral. Here’s that quote<br />

again: “One ETF managed by Barclays<br />

Global Investors that tracks the Chinese<br />

stock market closed the US day on Feb.<br />

27 down 9.9% even though the index it<br />

was tracking had fallen just 2.1% during<br />

Chinese trading hours. That index fell<br />

another 3.1% the next day in China.”<br />

• That first line is meaningless. The<br />

market crash (and everyone knows international<br />

markets have increasingly<br />

moved in lockstep) did not start to happen<br />

until early afternoon in the US, hours<br />

after the Asian markets had closed.<br />

• The second line is a fumble at best, and<br />

a ham-handed hand at making the data fit<br />

the story at worst. Focusing on the close of<br />

Chinese trading the next day, rather than<br />

the open, is simply a fundamental mistake.<br />

Quick quiz: “How do free markets<br />

work?” Answer: “They price in the relevant<br />

information.” If someone sees what<br />

they think is an inefficiency on the sell<br />

side, they BUY BUY BUY. It happens every<br />

day in every market in various degrees.<br />

Only in the wake of a market sell-off and<br />

settling is anything clear.<br />

Effectively, the sellers of FXI were<br />

caught that day in the same place as intraday<br />

sellers of DIA, SPY or any one of a<br />

thousand individual stocks: the markets hit<br />

bottom around 3pm EST, and if you sold<br />

then, you lost out. The US equity markets<br />

recovered some territory 9<br />

ETFR • May 2007 5