AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

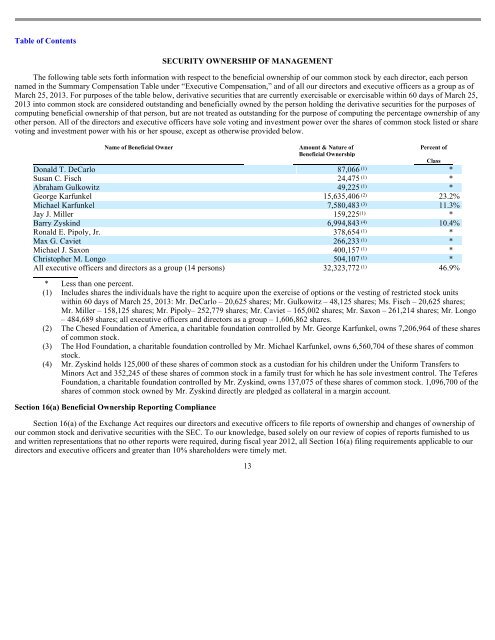

SECURITY OWNERSHIP OF MANAGEMENT<br />

The following table sets forth information with respect to the beneficial ownership of our common stock by each director, each person<br />

named in the Summary Compensation Table under “Executive Compensation,” and of all our directors and executive officers as a group as of<br />

March 25, 2013. For purposes of the table below, derivative securities that are currently exercisable or exercisable within 60 days of March 25,<br />

2013 into common stock are considered outstanding and beneficially owned by the person holding the derivative securities for the purposes of<br />

computing beneficial ownership of that person, but are not treated as outstanding for the purpose of computing the percentage ownership of any<br />

other person. All of the directors and executive officers have sole voting and investment power over the shares of common stock listed or share<br />

voting and investment power with his or her spouse, except as otherwise provided below.<br />

Name of Beneficial Owner<br />

Section 16(a) Beneficial Ownership Reporting Compliance<br />

Section 16(a) of the Exchange Act requires our directors and executive officers to file reports of ownership and changes of ownership of<br />

our common stock and derivative securities with the SEC. To our knowledge, based solely on our review of copies of reports furnished to us<br />

and written representations that no other reports were required, during fiscal year 2012, all Section 16(a) filing requirements applicable to our<br />

directors and executive officers and greater than 10% shareholders were timely met.<br />

13<br />

Amount & Nature of<br />

Beneficial Ownership<br />

Percent of<br />

Donald T. DeCarlo 87,066<br />

(1)<br />

*<br />

Susan C. Fisch 24,475<br />

(1)<br />

*<br />

Abraham Gulkowitz 49,225<br />

(1)<br />

*<br />

George Karfunkel 15,635,406<br />

(2)<br />

23.2 %<br />

Michael Karfunkel 7,580,483<br />

(3)<br />

11.3 %<br />

Jay J. Miller 159,225<br />

(1)<br />

*<br />

Barry Zyskind 6,994,843<br />

(4)<br />

10.4 %<br />

Ronald E. Pipoly, Jr. 378,654<br />

(1)<br />

*<br />

Max G. Caviet 266,233<br />

(1)<br />

*<br />

Michael J. Saxon 400,157<br />

(1)<br />

*<br />

Christopher M. Longo 504,107<br />

(1)<br />

*<br />

All executive officers and directors as a group (14 persons) 32,323,772<br />

(1)<br />

46.9 %<br />

* Less than one percent.<br />

(1) Includes shares the individuals have the right to acquire upon the exercise of options or the vesting of restricted stock units<br />

within 60 days of March 25, 2013: Mr. DeCarlo – 20,625 shares; Mr. Gulkowitz – 48,125 shares; Ms. Fisch – 20,625 shares;<br />

Mr. Miller – 158,125 shares; Mr. Pipoly– 252,779 shares; Mr. Caviet – 165,002 shares; Mr. Saxon – 261,214 shares; Mr. Longo<br />

– 484,689 shares; all executive officers and directors as a group – 1,606,862 shares.<br />

(2) The Chesed Foundation of America, a charitable foundation controlled by Mr. George Karfunkel, owns 7,206,964 of these shares<br />

of common stock.<br />

(3) The Hod Foundation, a charitable foundation controlled by Mr. Michael Karfunkel, owns 6,560,704 of these shares of common<br />

stock.<br />

(4) Mr. Zyskind holds 125,000 of these shares of common stock as a custodian for his children under the Uniform Transfers to<br />

Minors Act and 352,245 of these shares of common stock in a family trust for which he has sole investment control. The Teferes<br />

Foundation, a charitable foundation controlled by Mr. Zyskind, owns 137,075 of these shares of common stock. 1,096,700 of the<br />

shares of common stock owned by Mr. Zyskind directly are pledged as collateral in a margin account.<br />

Class