AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table of Contents<br />

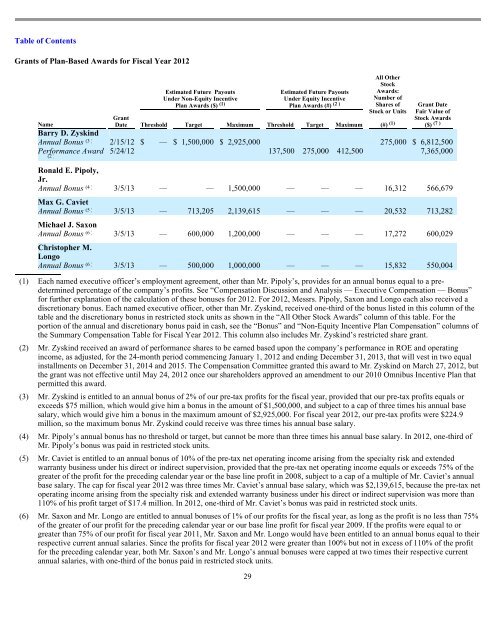

Grants of Plan-Based Awards for Fiscal Year 2012<br />

Name<br />

Grant<br />

Date<br />

Estimated Future Payouts<br />

Estimated Future Payouts<br />

Under Non-Equity Incentive<br />

Under Equity Incentive<br />

Plan Awards ($) (1) Plan Awards (#) (2 )<br />

Threshold Target Maximum Threshold Target Maximum<br />

29<br />

All Other<br />

Stock<br />

Awards:<br />

Number of<br />

Shares of Grant Date<br />

Stock or Units Fair Value of<br />

Stock Awards<br />

(#) (1) ($) (7 )<br />

Barry D. Zyskind<br />

Annual Bonus<br />

(3 )<br />

2/15/12 $ — $ 1,500,000 $ 2,925,000 275,000 $ 6,812,500<br />

Performance Award 5/24/12 137,500 275,000 412,500 7,365,000<br />

(2 )<br />

Ronald E. Pipoly,<br />

Jr.<br />

Annual Bonus<br />

(4 )<br />

3/5/13 — — 1,500,000 — — — 16,312 566,679<br />

Max G. Caviet<br />

Annual Bonus<br />

(5 )<br />

3/5/13 — 713,205 2,139,615 — — — 20,532 713,282<br />

Michael J. Saxon<br />

Annual Bonus<br />

(6 )<br />

3/5/13 — 600,000 1,200,000 — — — 17,272 600,029<br />

Christopher M.<br />

Longo<br />

Annual Bonus<br />

(6 )<br />

3/5/13 — 500,000 1,000,000 — — — 15,832 550,004<br />

(1) Each named executive officer’s employment agreement, other than Mr. Pipoly’s, provides for an annual bonus equal to a predetermined<br />

percentage of the company’s profits. See “Compensation Discussion and Analysis — Executive Compensation — Bonus”<br />

for further explanation of the calculation of these bonuses for 2012. For 2012, Messrs. Pipoly, Saxon and Longo each also received a<br />

discretionary bonus. Each named executive officer, other than Mr. Zyskind, received one-third of the bonus listed in this column of the<br />

table and the discretionary bonus in restricted stock units as shown in the “All Other Stock Awards” column of this table. For the<br />

portion of the annual and discretionary bonus paid in cash, see the “Bonus” and “Non-Equity Incentive Plan Compensation” columns of<br />

the Summary Compensation Table for Fiscal Year 2012. This column also includes Mr. Zyskind’s restricted share grant.<br />

(2) Mr. Zyskind received an award of performance shares to be earned based upon the company’s performance in ROE and operating<br />

income, as adjusted, for the 24-month period commencing January 1, 2012 and ending December 31, 2013, that will vest in two equal<br />

installments on December 31, 2014 and 2015. The Compensation Committee granted this award to Mr. Zyskind on March 27, 2012, but<br />

the grant was not effective until May 24, 2012 once our shareholders approved an amendment to our 2010 Omnibus Incentive Plan that<br />

permitted this award.<br />

(3) Mr. Zyskind is entitled to an annual bonus of 2% of our pre-tax profits for the fiscal year, provided that our pre-tax profits equals or<br />

exceeds $75 million, which would give him a bonus in the amount of $1,500,000, and subject to a cap of three times his annual base<br />

salary, which would give him a bonus in the maximum amount of $2,925,000. For fiscal year 2012, our pre-tax profits were $224.9<br />

million, so the maximum bonus Mr. Zyskind could receive was three times his annual base salary.<br />

(4) Mr. Pipoly’s annual bonus has no threshold or target, but cannot be more than three times his annual base salary. In 2012, one-third of<br />

Mr. Pipoly’s bonus was paid in restricted stock units.<br />

(5) Mr. Caviet is entitled to an annual bonus of 10% of the pre-tax net operating income arising from the specialty risk and extended<br />

warranty business under his direct or indirect supervision, provided that the pre-tax net operating income equals or exceeds 75% of the<br />

greater of the profit for the preceding calendar year or the base line profit in 2008, subject to a cap of a multiple of Mr. Caviet’s annual<br />

base salary. The cap for fiscal year 2012 was three times Mr. Caviet’s annual base salary, which was $2,139,615, because the pre-tax net<br />

operating income arising from the specialty risk and extended warranty business under his direct or indirect supervision was more than<br />

110% of his profit target of $17.4 million. In 2012, one-third of Mr. Caviet’s bonus was paid in restricted stock units.<br />

(6) Mr. Saxon and Mr. Longo are entitled to annual bonuses of 1% of our profits for the fiscal year, as long as the profit is no less than 75%<br />

of the greater of our profit for the preceding calendar year or our base line profit for fiscal year 2009. If the profits were equal to or<br />

greater than 75% of our profit for fiscal year 2011, Mr. Saxon and Mr. Longo would have been entitled to an annual bonus equal to their<br />

respective current annual salaries. Since the profits for fiscal year 2012 were greater than 100% but not in excess of 110% of the profit<br />

for the preceding calendar year, both Mr. Saxon’s and Mr. Longo’s annual bonuses were capped at two times their respective current<br />

annual salaries, with one-third of the bonus paid in restricted stock units.