AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table of Contents<br />

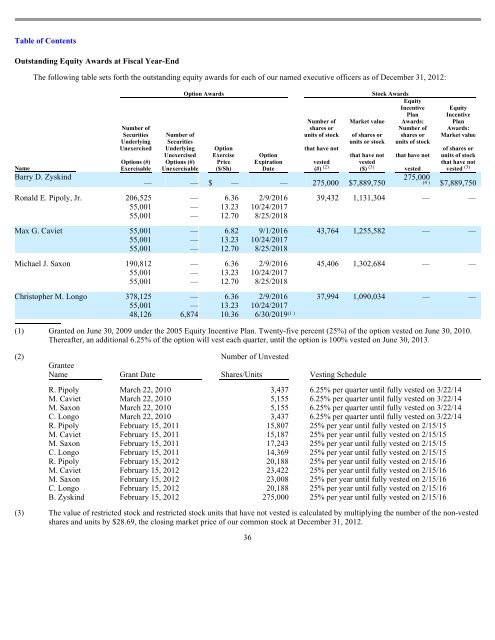

Outstanding Equity Awards at Fiscal Year-End<br />

Name<br />

The following table sets forth the outstanding equity awards for each of our named executive officers as of December 31, 2012:<br />

Barry D. Zyskind<br />

Number of<br />

Securities<br />

Underlying<br />

Unexercised<br />

Options (#)<br />

Exercisable<br />

Number of<br />

Securities<br />

Underlying<br />

Unexercised<br />

Options (#)<br />

Unexercisable<br />

Option Awards<br />

Option<br />

Exercise<br />

Price<br />

($/Sh)<br />

Option<br />

Expiration<br />

Date<br />

Number of<br />

shares or<br />

units of stock<br />

Market value<br />

— — $ — — 275,000 $ 7,889,750<br />

Stock Awards<br />

Equity<br />

Incentive<br />

Plan<br />

Awards:<br />

Number of<br />

shares or<br />

units of stock<br />

Equity<br />

Incentive<br />

Plan<br />

Awards:<br />

Market value<br />

of shares or<br />

units or stock<br />

that have not<br />

of shares or<br />

that have not that have not units of stock<br />

vested<br />

(#) (2)<br />

vested<br />

($) (3) vested<br />

that have not<br />

vested (3)<br />

275,000<br />

$ 7,889,750<br />

Ronald E. Pipoly, Jr. 206,525 — 6.36 2/9/2016 39,432 1,131,304 — —<br />

55,001 — 13.23 10/24/2017<br />

55,001 — 12.70 8/25/2018<br />

Max G. Caviet 55,001 — 6.82 9/1/2016 43,764 1,255,582 — —<br />

55,001 — 13.23 10/24/2017<br />

55,001 — 12.70 8/25/2018<br />

Michael J. Saxon 190,812 — 6.36 2/9/2016 45,406 1,302,684 — —<br />

55,001 — 13.23 10/24/2017<br />

55,001 — 12.70 8/25/2018<br />

Christopher M. Longo 378,125 — 6.36 2/9/2016 37,994 1,090,034 — —<br />

55,001 — 13.23 10/24/2017<br />

48,126 6,874 10.36 6/30/2019<br />

(1 )<br />

(1) Granted on June 30, 2009 under the 2005 Equity Incentive Plan. Twenty-five percent (25%) of the option vested on June 30, 2010.<br />

Thereafter, an additional 6.25% of the option will vest each quarter, until the option is 100% vested on June 30, 2013.<br />

(4 )<br />

(2)<br />

Grantee<br />

Name<br />

Grant Date<br />

Number of Unvested<br />

Shares/Units<br />

Vesting Schedule<br />

R. Pipoly March 22, 2010 3,437 6.25% per quarter until fully vested on 3/22/14<br />

M. Caviet March 22, 2010 5,155 6.25% per quarter until fully vested on 3/22/14<br />

M. Saxon March 22, 2010 5,155 6.25% per quarter until fully vested on 3/22/14<br />

C. Longo March 22, 2010 3,437 6.25% per quarter until fully vested on 3/22/14<br />

R. Pipoly February 15, 2011 15,807 25% per year until fully vested on 2/15/15<br />

M. Caviet February 15, 2011 15,187 25% per year until fully vested on 2/15/15<br />

M. Saxon February 15, 2011 17,243 25% per year until fully vested on 2/15/15<br />

C. Longo February 15, 2011 14,369 25% per year until fully vested on 2/15/15<br />

R. Pipoly February 15, 2012 20,188 25% per year until fully vested on 2/15/16<br />

M. Caviet February 15, 2012 23,422 25% per year until fully vested on 2/15/16<br />

M. Saxon February 15, 2012 23,008 25% per year until fully vested on 2/15/16<br />

C. Longo February 15, 2012 20,188 25% per year until fully vested on 2/15/16<br />

B. Zyskind February 15, 2012 275,000 25% per year until fully vested on 2/15/16<br />

(3) The value of restricted stock and restricted stock units that have not vested is calculated by multiplying the number of the non-vested<br />

shares and units by $28.69, the closing market price of our common stock at December 31, 2012.<br />

36