AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

AMTRUST FINANCIAL SERVICES, INC. - Corporate Solutions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

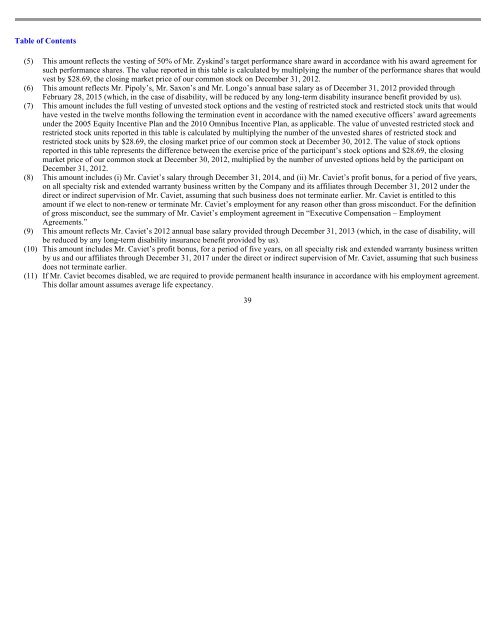

(5) This amount reflects the vesting of 50% of Mr. Zyskind’s target performance share award in accordance with his award agreement for<br />

such performance shares. The value reported in this table is calculated by multiplying the number of the performance shares that would<br />

vest by $28.69, the closing market price of our common stock on December 31, 2012.<br />

(6) This amount reflects Mr. Pipoly’s, Mr. Saxon’s and Mr. Longo’s annual base salary as of December 31, 2012 provided through<br />

February 28, 2015 (which, in the case of disability, will be reduced by any long-term disability insurance benefit provided by us).<br />

(7) This amount includes the full vesting of unvested stock options and the vesting of restricted stock and restricted stock units that would<br />

have vested in the twelve months following the termination event in accordance with the named executive officers’ award agreements<br />

under the 2005 Equity Incentive Plan and the 2010 Omnibus Incentive Plan, as applicable. The value of unvested restricted stock and<br />

restricted stock units reported in this table is calculated by multiplying the number of the unvested shares of restricted stock and<br />

restricted stock units by $28.69, the closing market price of our common stock at December 30, 2012. The value of stock options<br />

reported in this table represents the difference between the exercise price of the participant’s stock options and $28.69, the closing<br />

market price of our common stock at December 30, 2012, multiplied by the number of unvested options held by the participant on<br />

December 31, 2012.<br />

(8) This amount includes (i) Mr. Caviet’s salary through December 31, 2014, and (ii) Mr. Caviet’s profit bonus, for a period of five years,<br />

on all specialty risk and extended warranty business written by the Company and its affiliates through December 31, 2012 under the<br />

direct or indirect supervision of Mr. Caviet, assuming that such business does not terminate earlier. Mr. Caviet is entitled to this<br />

amount if we elect to non-renew or terminate Mr. Caviet’s employment for any reason other than gross misconduct. For the definition<br />

of gross misconduct, see the summary of Mr. Caviet’s employment agreement in “Executive Compensation – Employment<br />

Agreements.”<br />

(9) This amount reflects Mr. Caviet’s 2012 annual base salary provided through December 31, 2013 (which, in the case of disability, will<br />

be reduced by any long-term disability insurance benefit provided by us).<br />

(10) This amount includes Mr. Caviet’s profit bonus, for a period of five years, on all specialty risk and extended warranty business written<br />

by us and our affiliates through December 31, 2017 under the direct or indirect supervision of Mr. Caviet, assuming that such business<br />

does not terminate earlier.<br />

(11) If Mr. Caviet becomes disabled, we are required to provide permanent health insurance in accordance with his employment agreement.<br />

This dollar amount assumes average life expectancy.<br />

39