Do labor market institutions matter for business cycles?∗ - European ...

Do labor market institutions matter for business cycles?∗ - European ...

Do labor market institutions matter for business cycles?∗ - European ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

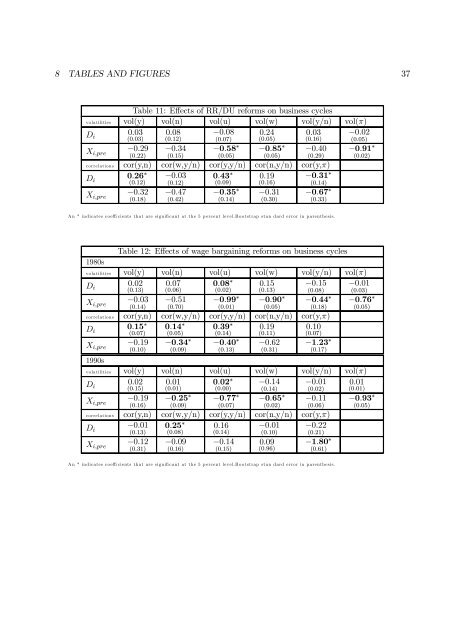

8 TABLES AND FIGURES 37<br />

Table 11: Effects of RR/DU re<strong>for</strong>ms on <strong>business</strong> <strong>cycles</strong><br />

volatilities vol(y) vol(n) vol(u) vol(w) vol(y/n) vol(π)<br />

D i<br />

0.03 0.08<br />

0.24 0.03<br />

(0.03) (0.12)<br />

(0.05) (0.16)<br />

X i,pre<br />

−0.29<br />

(0.22)<br />

−0.34<br />

(0.15)<br />

−0.08<br />

(0.07)<br />

−0.58 <strong>∗</strong><br />

(0.05)<br />

−0.85 <strong>∗</strong><br />

(0.05)<br />

−0.40<br />

(0.29)<br />

correlation s cor(y,n) cor(w,y/n) cor(y,y/n) cor(n,y/n) cor(y,π)<br />

D i<br />

0.26 <strong>∗</strong><br />

(0.12)<br />

X i,pre<br />

−0.32<br />

(0.18)<br />

−0.03<br />

(0.12)<br />

−0.47<br />

(0.42)<br />

0.43 <strong>∗</strong><br />

(0.09)<br />

−0.35 <strong>∗</strong><br />

(0.14)<br />

0.19<br />

(0.16)<br />

−0.31<br />

(0.30)<br />

−0.31 <strong>∗</strong><br />

(0.14)<br />

−0.67 <strong>∗</strong><br />

(0.33)<br />

−0.02<br />

(0.05)<br />

−0.91 <strong>∗</strong><br />

(0.02)<br />

A n * in dicates co effi cients that are sign ifi cant at th e 5 p ercent level.B o otstrap stan d ard error in parenth esis.<br />

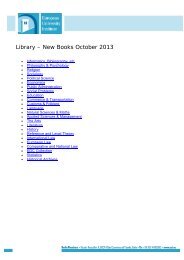

1980s<br />

Table 12: Effects of wage bargaining re<strong>for</strong>ms on <strong>business</strong> <strong>cycles</strong><br />

volatilities vol(y) vol(n) vol(u) vol(w) vol(y/n) vol(π)<br />

D i<br />

0.02 0.07 0.08 <strong>∗</strong> 0.15<br />

(0.13) (0.06)<br />

(0.02) (0.13)<br />

X i,pre<br />

−0.03<br />

(0.14)<br />

−0.51<br />

(0.70)<br />

−0.99 <strong>∗</strong><br />

(0.01)<br />

−0.90 <strong>∗</strong><br />

(0.05)<br />

−0.15<br />

(0.08)<br />

−0.44 <strong>∗</strong><br />

(0.18)<br />

correlation s cor(y,n) cor(w,y/n) cor(y,y/n) cor(n,y/n) cor(y,π)<br />

D i<br />

0.15 <strong>∗</strong><br />

(0.07)<br />

X i,pre<br />

−0.19<br />

(0.10)<br />

1990s<br />

0.14 <strong>∗</strong><br />

(0.05)<br />

−0.34 <strong>∗</strong><br />

(0.09)<br />

0.39 <strong>∗</strong><br />

(0.14)<br />

−0.40 <strong>∗</strong><br />

(0.13)<br />

0.19<br />

(0.11)<br />

−0.62<br />

(0.31)<br />

0.10<br />

(0.07)<br />

−1.23 <strong>∗</strong><br />

(0.17)<br />

−0.01<br />

(0.03)<br />

−0.76 <strong>∗</strong><br />

(0.05)<br />

volatilities vol(y) vol(n) vol(u) vol(w) vol(y/n) vol(π)<br />

D i<br />

0.02 0.01 0.02 <strong>∗</strong><br />

0.01<br />

(0.15) (0.01)<br />

(0.00)<br />

(0.01)<br />

X i,pre<br />

−0.19<br />

(0.16)<br />

−0.25 <strong>∗</strong><br />

(0.09)<br />

−0.77 <strong>∗</strong><br />

(0.07)<br />

−0.14<br />

(0.14)<br />

−0.65 <strong>∗</strong><br />

(0.02)<br />

−0.01<br />

(0.02)<br />

−0.11<br />

(0.06)<br />

correlation s cor(y,n) cor(w,y/n) cor(y,y/n) cor(n,y/n) cor(y,π)<br />

D −0.01<br />

i<br />

0.25 <strong>∗</strong> 0.16 −0.01 −0.22<br />

(0.13) (0.08) (0.14)<br />

(0.10) (0.21)<br />

X i,pre<br />

−0.12<br />

(0.31)<br />

−0.09<br />

(0.16)<br />

−0.14<br />

(0.15)<br />

0.09<br />

(0.96)<br />

−1.80 <strong>∗</strong><br />

(0.61)<br />

−0.93 <strong>∗</strong><br />

(0.05)<br />

A n * in dicates co effi cients that are sign ifi cant at th e 5 p ercent level.B o otstrap stan d ard error in parenth esis.